Here's How Intel Corporation Could Refresh Server Chips in 2018

In the middle of 2017, Intel (NASDAQ: INTC) is expected to launch its next-generation processor family targeted at the server market, based on its Skylake server architecture. These chips promise to deliver significant improvements in both processor performance and efficiency while also delivering a lot of new platform-level features as well.

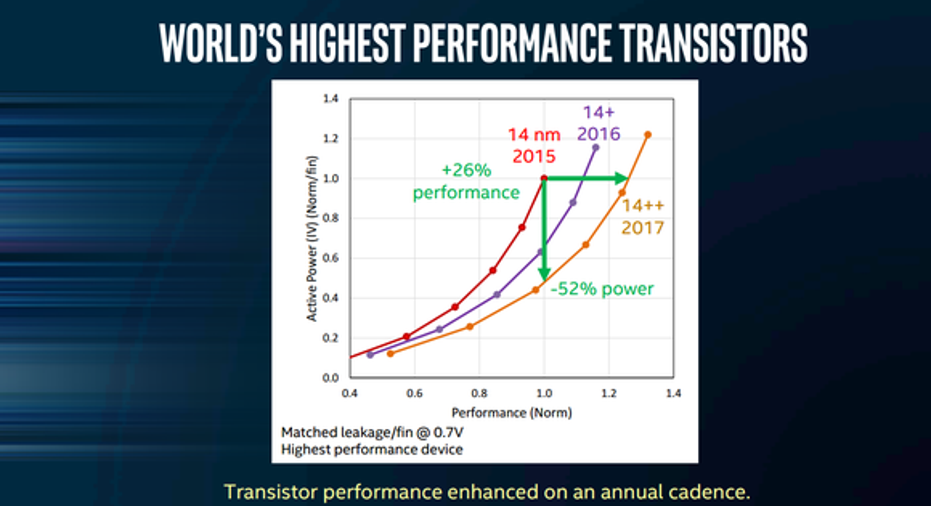

These new chips, per website ServeTheHome, will be manufactured using Intel's 14-nanometer+ manufacturing technology. This technology, Intel has said, delivers a 12% performance boost relative to the company's first-generation 14-nanometer technology that's used to manufacture its current generation Broadwell-based server processors.

Image source: Intel.

That process technology enhancement, coupled with the significant architectural/design improvements that Intel plans to bring with the new Skylake Server chips, should make for a compelling improvement to the chipmaker's data center processor product line.

What's interesting, though, is that at the company's Technology and Manufacturing Day hosted on March 28, Intel executive Murthy Renduchintala said that the company intends to update all its product lines at an annual cadence. Presumably, this includes Intel's data center processor lineup.

Here's how I expect Intel to refresh this product line next year.

What comes after 14-nanometer+?

At the Technology and Manufacturing Day, Intel said that it plans to go into production on a new variant of its 14-nanometer technology, known as 14-nanometer++, later this year. This technology will first be used to build the company's eighth-generation Core processors for personal computers later this year, and it promises to deliver roughly a 12.5% performance enhancement over the company's 14-nanometer+ technology.

Image source: Intel.

Since it is unlikely that Intel's 10-nanometer or 10-nanometer+ technologies will be in good enough shape to build enormous server processors next year -- and considering that Intel has publicly said that its 10-nanometer and 10-nanometer+ technologies will offer lower performance than its 14-nanometer++ technology -- Intel is more likely to update its server processor product line by migrating it to the 14-nanometer++ technology.

Bigger, but better, chips

Intel has said that the transistor gate pitch of its 14-nanometer++ technology is 84-nanometers, up quite a bit from the 70-nanometers of its 14-nanometer and 14-nanometer+ technologies. In a nutshell, this means that Intel not only won't see an area reduction in moving from 14-nanometer+ to 14-nanometer++, but it could see chip area grow somewhat.

That said, data center customers aren't buying chip area, they're buying performance and power efficiency. Ideally for said customers, Intel would be able to offer the better-performing (and slightly larger) chips for the same prices as the prior-generation products; in that case, the slight chip size increase would be completely irrelevant to Intel's customers (though this could potentially mean slight margin erosion for Intel).

However, even if the chip size increase drives up prices a smidgen -- perhaps commensurate with any cost structure increase Intel would incur from the larger chip sizes -- data center customers might not care too much if the performance increase is compelling enough.

Better than nothing

The bottom line is this: Even if Intel delivers "just" a manufacturing technology improvement to its data center product line in 2018 without any significant changes in the architecture, core count, and so on, then that's still better than delivering nothing at all.

What will be interesting to see, then, is what Intel brings to this market in the 2019 time frame and beyond.

10 stocks we like better than IntelWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Intel wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017

Ashraf Eassa owns shares of Intel. The Motley Fool recommends Intel. The Motley Fool has a disclosure policy.