Home Depot customers go big on smaller projects

Home Depot authorizes $15 billion stock buyback plan

Former Home Depot CEO blasts Biden for cost increases hammering retail industry

Former Home Depot CEO Bob Nardelli gives his market outlook and how inflation is affecting the retail industry on 'Maria Bartiromo's Wall Street.'

Home Depot customers are still shopping — they're just shifting their priorities on improvement projects.

"Our customers and our contractors tell us that there is some stance of deferral when it comes to large projects. Customers are opting for smaller versus larger," Home Depot CFO Richard McPhail said during Tuesday’s earnings call.

"We are also seeing the impact of softness in certain large ticket discretionary item purchases like patio and appliances," he added.

Still, the retailer reported second quarter earnings slightly ahead of Wall Street’s predictions, despite the retail giant posting a drop in sales amid slowing demand for larger item purchases and building projects.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| HD | THE HOME DEPOT INC. | 385.25 | +3.34 | +0.87% |

| LOW | LOWE'S COMPANIES INC. | 278.38 | +3.49 | +1.27% |

The home improvement store generated $42.9 billion in sales for the second quarter of fiscal 2023, marking a 2% drop from the same period last year. Comparable sales in the U.S. also slipped 2%.

TYRESE GIBSON SUES HOME DEPOT FOR $1M, CITES VIOLATION OF CIVIL RIGHTS ACT

Curbed consumer spending comes as inflation remains high impacting consumer spending patterns. The annual inflation rate for the U.S. rose 3.2% in July but has come down from the peak 9.1% hit in June 2022.

CONNECTICUT MAN ALLEGEDLY CHEATED HOME DEPOT WITH $300,000 DOOR-RETURN SCAM

The U.S. Federal Reserve, last month, announced its second consecutive 0.75 percentage point interest rate hike, increasing the federal funds rate to a target range of 2.25 to 2.50%.

(Matt Stone/MediaNews Group/Boston Herald)

THE FOUR US CITIES FACING THE BIGGEST HOUSING SHORTAGES

With more interest rate hikes looming and residual fears of an impending recession, Home Depot reaffirmed its subdued 2023 guidance, including a sales and comparable sales drop between 2% and 5% compared to fiscal 2022, and diluted earnings-per-share-percent-decline between 7% and 13% compared to last year.

Home Depot

"We’ve looked at 2023 as a year of moderation after the explosive growth we had the prior few years, and consumers would be shifting their spending from goods to services," said Home Depot CEO Ted Decker.

MORTGAGE RATES TEETER TOWARD 7% WITH NO RELIEF IN SIGHT: FREDDIE MAC

"Uncertainties remain for us," he continued. "We don’t know where spending in home improvement will ultimately settle and we don’t know how the monetary policy actions, which are specifically intended to dampen consumer demand, will impact consumer sentiment in the overall economy."

A customer shops for lumber at a Home Depot store on in San Rafael, California. (Photo by Justin Sullivan/Getty Images)

Meanwhile, the retailer posted net earnings for the second quarter of fiscal 2023 of $4.7 billion, or $4.65 per diluted share, compared with net earnings of $5.2 billion, or $5.05 per diluted share, in the same period of fiscal 2022.

"Consumers don’t want to add more high-interest credit card debt with slowing housing prices," Global Director of Research at M Science John Tomlinson told FOX Business.

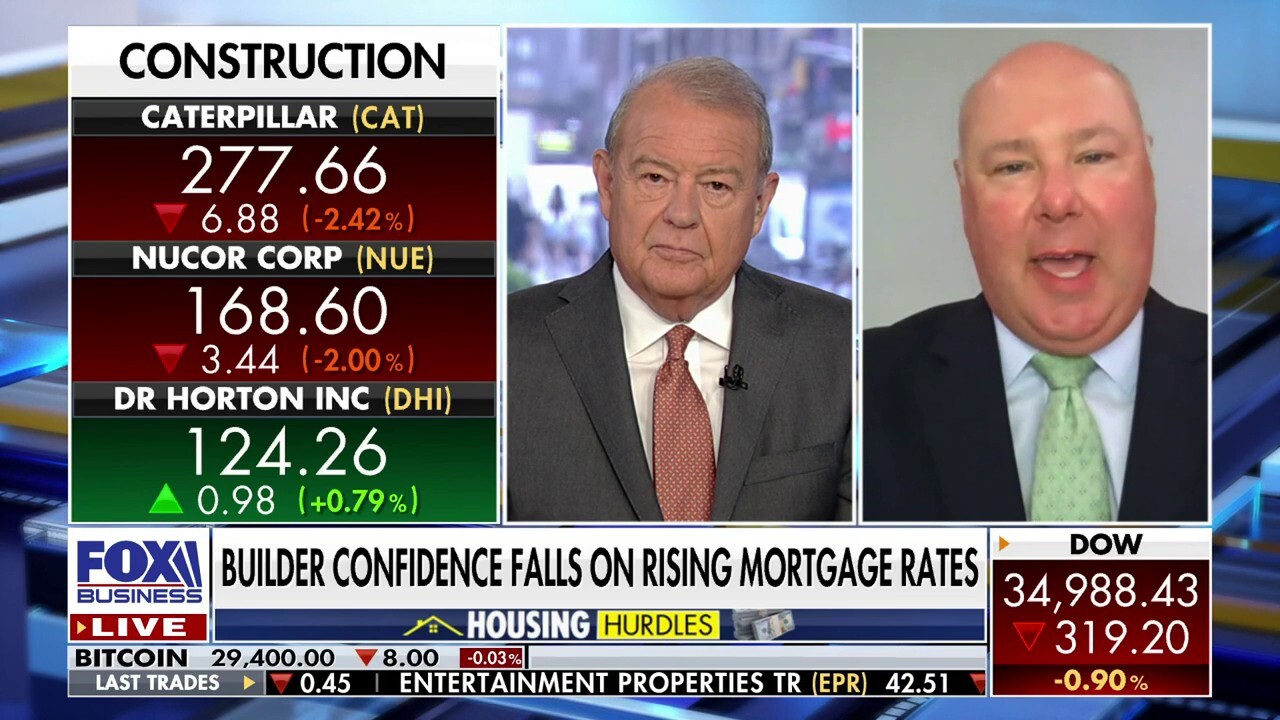

US housing needs more 'yes in my backyards' policy: Jim Tobin

National Association of Home Builders CEO Jim Tobin explains how local governments have tied up housing construction projects.

"We believe that home improvement spending may not have found its bottom in the short-term, but we continue to have a favorable long-term view on the industry, the company and the housing market," he continued.

Additionally, Home Depot said the board of directors authorized a new $15 billion share repurchase program effective Aug. 15, 2023, replacing its previous authorization.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business' Danielle Wallace contributed to this report.