Homebuilder sentiment upbeat for first time in almost a year

25% of builders reduced home prices to bolster sales in June: NAHB

Biggest competitor to homebuilders is existing home sales: Pulte

Pulte Capital CEO Bill Pulte discusses the state of the housing market as the U.S. nears debt default on 'Cavuto: Coast to Coast.'

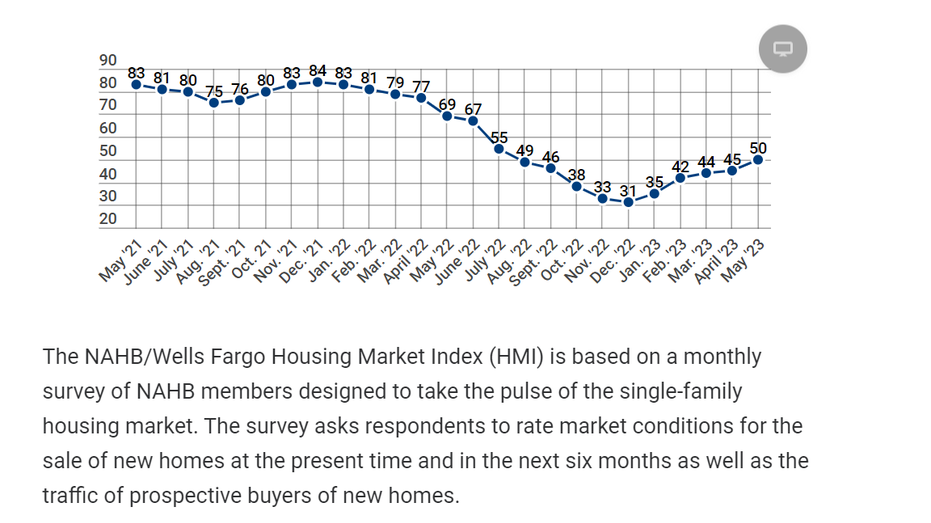

Builder confidence is up for the first time in 11 months, according to data compiled by the National Association of Home Builders (NAHB).

The Wells Fargo housing market index reading went up five points in May, rising to 55 from 50, while notching the sixth consecutive month that sentiment improved and the first time it surpassed the midpoint of 50 since July last year.

Builder confidence is up for the first time in 11 months, according to data compiled by the National Association of Home Builders (NAHB). (NAHB/Wells Fargo Housing Market )

FED PAUSES INTEREST RATE HIKES, BUT HIGH MORTGAGE RATES COULD BE HERE TO STAY

"Builders are feeling cautiously optimistic about market conditions given low levels of existing home inventory and ongoing gradual improvements for supply chains" said NAHB Chairman Alicia Huey in a statement.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TOL | TOLL BROTHERS INC. | 153.23 | +2.67 | +1.77% |

| LEN | LENNAR CORP. | 114.04 | -1.35 | -1.17% |

| DHI | D.R. HORTON INC. | 156.27 | -1.86 | -1.18% |

| MTG | MGIC INVESTMENT CORP. | 27.32 | +0.05 | +0.18% |

"However, access for builder and developer loans has become more difficult to obtain over the last year, which will ultimately result in lower lot supplies as the industry tries to expand off cycle lows," she added.

Construction workers build new homes in Philadelphia, April 5, 2022. (AP Photo/Matt Rourke)

According to the NAHB, the uptick in home builder sentiment reflects growing foot traffic from homebuyers, light competition from resale and a better supply chain.

TAMPA, FLORIDA RESIDENTS MAY NEED AT LEAST $85K TO AFFORD RENT, STUDY FINDS

Meanwhile, project financing remains an industry issue in 2023.

In June, 25% of builders reduced home prices to bolster sales, after a 27% builder reduction in May and a 30% reduction in April. Home sales have declined steadily since peaking at 36% in November 2022, with the average price reduction being 7% in June, below the 8% rate in December 2022.

Also in June, 56% of builders offered incentives to buyers, slightly more than the 54% in May, but fewer than the 62% in December 2022.

MORTGAGE DEMAND PLUMMETS AS INTEREST RATES SOAR NEAR 7-MONTH HIGH

NAHB chief economist Robert Dietz said June "marks the first time in a year that both the current and future sales components of the HMI have exceeded 60, as some buyers adjust to a new normal in terms of interest rates."

Federal Reserve Chair Jerome Powell arrives for testimony before the Senate Banking Committee March 7, 2023, in Washington, D.C. (Win McNamee / Getty Images)

"The Federal Reserve nearing the end of its tightening cycle is also good news for future market conditions in terms of mortgage rates and the cost of financing for builder and developer loans," he said. The Fed and Washington policymakers must factor into consideration how the state of home building is critical for the inflation outlook and the future of monetary policy.