Hong Kong protests could impact trade talks

Negotiators from the U.S. and China are set to resume trade discussions next week in Washington, and they could be forced to broach a touchy subject when the talks resume – the pro-democracy protests in Hong Kong.

The protests, which have stretched into their 17th week, reached a new level of chaos on Tuesday, when an officer shot a demonstrator in the chest at close range, leaving him in critical condition. It was the first shooting to occur during the protests.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

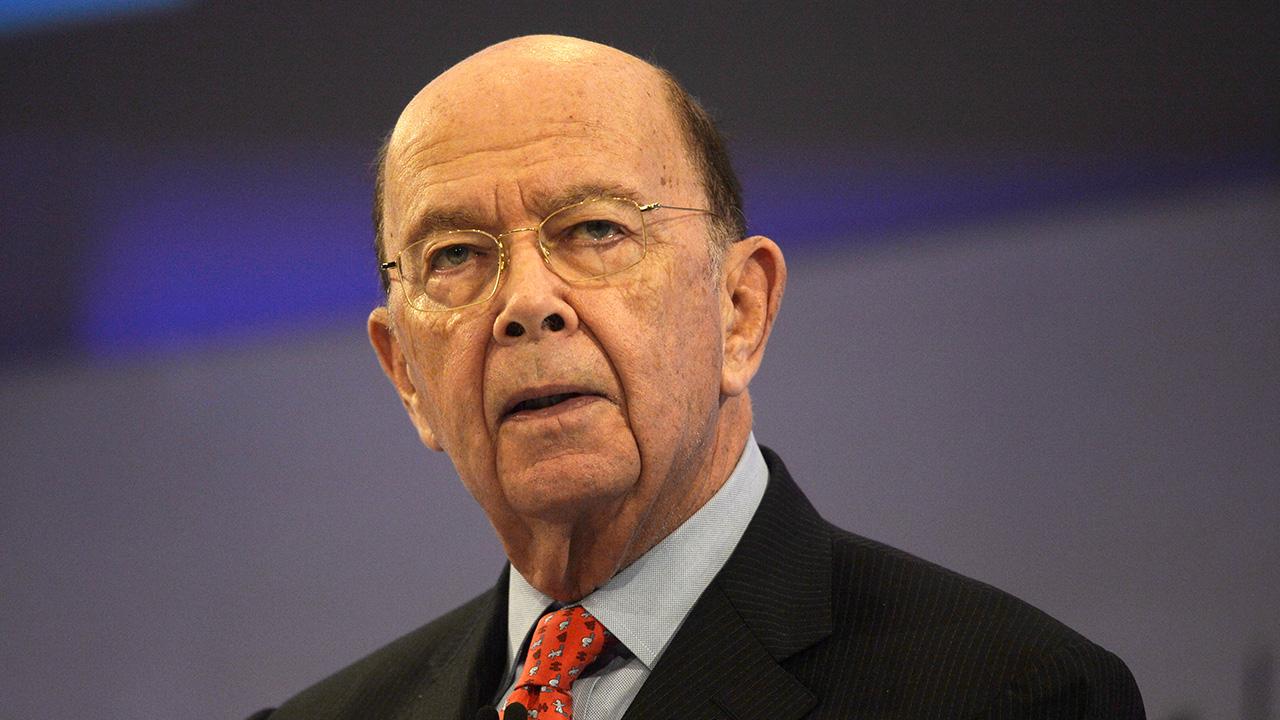

“It probably will have some impact on the Chinese side, even despite whatever it has on ours, because this is a sign of domestic dissent within their community and Hong Kong is quite important for the international trading activities of China,” said Commerce Secretary Wilbur Ross when discussing the protests on "Varney & Co."

Trade discussions are set to resume shortly after China’s Golden Week holiday, which runs through Oct. 7, when Chinese Vice Premier Liu He is scheduled to travel to Washington.

There has been a recent de-escalation of the trade war, but a deal has remained elusive.

Last month, the U.S. said it was postponing raising the tariffs on Chinese goods to Oct.15 out of respect for China’s holiday. Beijing responded by exempting U.S. pork and soybeans from additional tariffs.

Still, the trade war looks likely to intensify in the near term, according to Torsten Slok, chief economist at Deutsche Bank Securities.

"At least for now, more tariffs are coming on the 15th of October and again in December, and some of the talk about the delisting of Chinese companies and less U.S. investment into China, that if anything, suggests to us that if the trade war is doing anything at the moment it is going to escalate rather than deescalate," he told FOX Business.

On Sunday, Reuters reported Nasdaq Inc. could crack down on Chinese companies listing on its exchange by tightening restrictions and slowing down on their approvals. It is unclear if such action would be a trade-war weapon or more to protect investors from the low liquidity of those shares.

“The president has indicated he wants a complete deal,” Ross said.

CLICK HERE FOR THE ALL-NEW FOXBUSINESS.COM

“If all we wanted was to sell just a few more products to them, we could’ve had that deal two and a half years ago. The president wants that, but he most importantly wants to resolve the structural issues. The issues of forced intellectual property transfers, the issue of subsidy of SOEs, the disrespect for intellectual property, the whole panoply of equal market access complaints that we’ve had over the years. Without those, it isn’t really a very satisfactory arrangement.

Black-clad protestors hold gasoline bombs in Hong Kong, Tuesday, Oct. 1, 2019. Hong Kong police shot a protester at close range, leaving him bleeding from his shoulder and howling on the ground, in a fearsome escalation of anti-government demonstrations that spread across the semi-autonomous Chinese territory on Tuesday. Tens of thousands marched in a day of rage as Communist leaders in Beijing celebrated 70 years in power. (AP Photo/Vincent Thian)