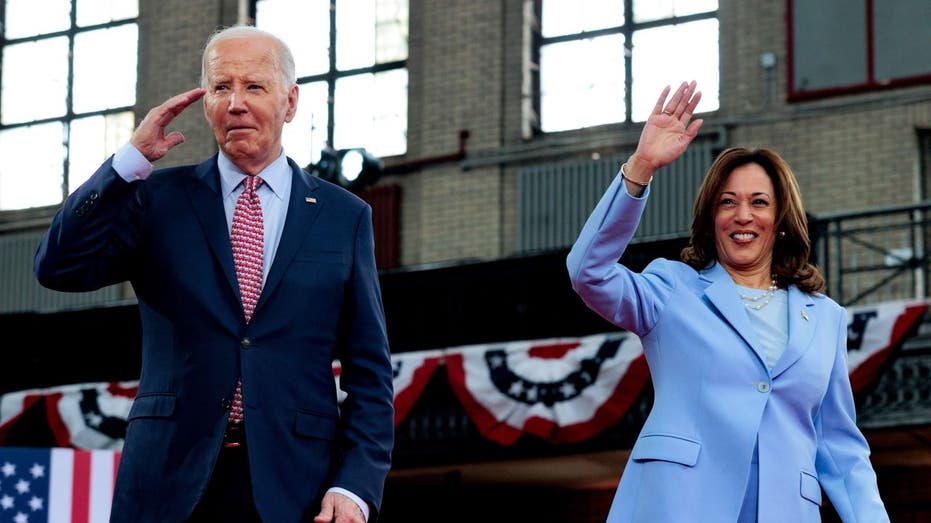

How the Biden-Harris administration threatens your retirement savings

Biden-Harris policies discouraged companies from going public. There were only 154 IPOs in 2023

4% yield on the equity markets could be a fairly decent headwind for stocks: Kenny Polcari

'The Claman Countdown' panelists Kenny Polcari and Sam Stovall unpack market performance heading into the end of the year.

Despite subsequent rallies, the steep stock-market declines in early August and following volatility highlight the damage that Biden-Harris administration policies are inflicting on U.S. markets with dire consequences for the retirement savings of Americans who are not government employees with pensions. These destructive policies need to be reversed as soon as possible to protect the retirement savings of average Americans.

Under the Biden-Harris administration, the Securities and Exchange Commission (SEC) has continued Obama-era policies that are steadily reducing the number of public companies in the U.S. and drastically limiting the investing choices of average Americans, including in their 401(k) or IRA retirement accounts.

In 2021, when most of the Trump administration’s policies were still in place, the U.S. had 1,035 initial public offerings (IPO) of company stock, including many transactions involving the merger of public special purpose acquisition vehicles (SPACs) with private companies. Once the Biden-Harris SEC implemented its policies, U.S. initial public offerings plunged to 181 in 2022 and 154 last year.

The Biden-Harris SEC’s policies have actively discouraged companies from going public and have built on Obama-era policies to continue the long-term decline in the number of U.S. public companies since the 1990s.

The Biden-Harris administration continued bad regulatory policies promoted by the Obama administration. (Hannah Beier/Bloomberg via Getty Images / Getty Images)

In 2021, President Biden appointed new leaders at the SEC who suddenly asserted that SPACs were investment companies that should be regulated like mutual funds despite decades of approving SPACs as public companies. The threat of such regulation, made without a law or a rulemaking proceeding allowing for public comment, chilled the SPAC boom that had reversed the decline in public companies.

The Obama-era Dodd-Frank law required public companies to make various disclosures on political hot topics such as the ratio of CEO pay to employee pay, the use of "conflict minerals" or participation in "extractive resources" industries, all of which make it unpleasant and expensive to be a public company.

Requiring disclosure on issues that typically have no relationship to a company earning a return for its shareholders opens up a new revenue source for the trial lawyers who file lawsuits against public companies alleging that they got such disclosure wrong. These lawsuits are often settled to avoid litigation costs, thus increasing the cost of being a public company.

The market plunges of Aug. 5 and Sept. 3 showed the devastating effects of the decline in the number of public companies. Despite a dwindling number of public companies, down to about 4,000 from a high of close to 8,000 in 1996, biweekly reductions from worker’s paychecks continue to pour into 401(k) and IRA accounts that generally can only invest in liquid securities like public stocks.

There's 'no link' between Kamala Harris' economic policies and her goals: Tomas Philipson

Former White House Council of Economic Advisers acting chair Tomas Philipson analyzes Vice President Kamala Harris aiming to close the polling gap with former President Trump on the economy on 'The Bottom Line.'

No surprise that the top 10 stocks in the S&P 500 index represent almost one-third of the market value of the index. The crowding of retirement savings into fewer and fewer stocks means that steep market declines like Aug. 5 and Sept. 3 are particularly unsettling for older investors watching their savings dwindle. An increase in the number of public companies would enable retirement investors to spread out their risk by diversifying their investments into more companies.

Perhaps the most dramatic illustration of the problem is the Wilshire 5000, an index that tracks the performance of the entire U.S. stock market. Established in 1974 with — as the name suggests — around 5,000 stocks, that number has now dropped below 3,500.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

A recent report in The Wall Street Journal attributed the decline to two decades of cheap money used to finance mergers among public companies. While mergers are contributing to the decline, the dwindling supply of new companies entering the market via IPOs is the real culprit.

Why are IPOs becoming an endangered species? It is unattractive and expensive to be a public company in the U.S., so entrepreneurs are reluctant to go public. Not content with rapid decline in public companies, the SEC continues to propose new disclosure requirements, including recent proposals to require disclosure of Environmental Social and Governance issues.

The Obama-era Dodd-Frank law required public companies to make various disclosures on political hot topics such as the ratio of CEO pay to employee pay, the use of "conflict minerals" or participation in "extractive resources" industries, all of which make it unpleasant and expensive to be a public company.

The Sarbanes-Oxley Act created the Public Company Accounting Oversight Board, which keeps piling on more and more accounting requirements. A public company requires an expensive army of lawyers and accountants to comply with disclosure and accounting rules and if the company gets any of this wrong, it is subject to strike suits or hostile hearings in Congress.

Moreover, the growth of private equity funds (fueled by investments from pension plans for state and local government workers) provides a ready path for promising private companies that wish to stay private to sell their shares to such funds rather than pursuing an IPO.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

As with so many other issues, common sense policies to restore the vibrancy of U.S. public stock markets are readily available. The SEC must remove the regulatory uncertainty surrounding SPACs, including reforming them if necessary, and reduce the disclosure and accounting burdens on all public companies to bring down the high cost of being a public company.

These steps will encourage successful private companies to access the public markets for capital to build their businesses and give everyday Americans the chance to invest in those innovative companies.

Norm Champ is a former director of the Division of Investment Management at the U.S. Securities and Exchange Commission and author of "Going Public: My Adventures Inside the SEC and How to Prevent the Next Devastating Crisis" (McGraw-Hill 2017).