How to Calculate Accrued Interest Payable

When you take out a loan, or carry a balance on a credit card, the interest accrues constantly. However, if you make regular payments, this interest isn't compounded. For this reason, calculating the unpaid interest that has accrued on a loan is pretty straightforward to do.

Calculating accrued interest payableFirst, take your interest rate and convert it into a decimal. For example, 7% would become 0.07. Next, figure out your daily interest rate (also known as the periodic rate) by dividing this by 365 days in a year.

Next, multiply this rate by the number of days for which you want to calculate the accrued interest. Finally, multiply by the account balance in order to determine the accrued interest.

It's also worth noting that not all accounts use 365 days to determine the daily interest rate. For example, many bonds use 360 days in a year. So, for the most precise calculation possible, confirm with your creditor or lender before calculating. For loan products like credit cards, you should be able to find this information in your cardholder agreement or any document with your loan's terms.

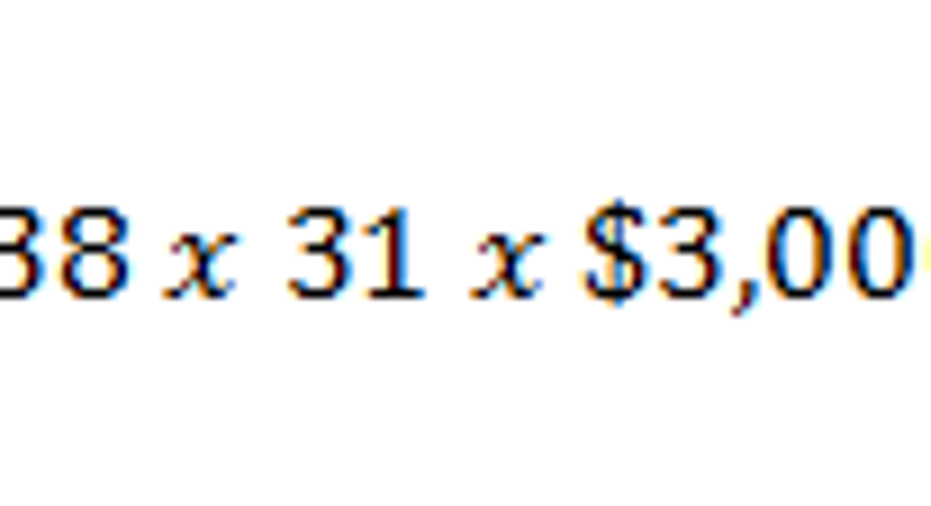

An exampleLet's say that you carry a $3,000 credit card balance at an APR of 16%, and that you want to know how much interest you can expect to pay on your March bill. First, you can determine the daily interest rate by dividing 0.16 by 365 days in a year.

Since March has 31 days, we can use the accrued interest formula to calculate your interest payable for the month.

Average daily balanceThis is a simplified example, as it assumes your credit card balance stays the same throughout the billing period. In practice, however, credit card balances change as you make purchases, which complicates the calculation.

To calculate accrued interest for a changing balance, you can use the above formulas along with your average daily balance, which can be found using the following method.

For example, let's say that in a 30-day month, you carried a balance of $1,000 for 10 days and then made some purchases which brought your balance to $2,000 for the other 20 days. In this case, you can compute your average daily balance as:

So, when calculating the accrued interest for a certain time period, be sure to use the average daily balance for an accurate calculation.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us atknowledgecenter@fool.com. Thanks -- and Fool on!

The article How to Calculate Accrued Interest Payable originally appeared on Fool.com.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.