How to Calculate Profitability Ratios for Banks

To determine the profitability of banks, simply looking at the earnings per share isn't quite enough. It's also important to know how efficiently a bank is using its assets and equity to generate profits. For this reason, three key profitability ratios to look at when evaluating a bank stock are

- Return on assets (ROA)

- Return on equity (ROE)

- Net interest margin (NIM)

Here's how to calculate each one, as well as an example of each using 2015 data from Wells Fargo.

Return on assetsTo calculate a bank's return on assets, you need to know two pieces of information. First, you need to find the net income, which can be found on the bank's income statement. Next, you need to find the bank's assets (loans, securities, cash, etc.), which can be found on the bank's balance sheet. To calculate return on assets, simply divide the net income by the total assets, then multiply by 100 to express it as a percentage.

As an example, Wells Fargo produced net income of just over $23 billion in 2015, and had total assets of $1.787 trillion at the end of the year. Dividing these two numbers and multiplying by 100 shows a ROA of 1.29%.

Now, we're going to complicate things just a little. If you want the most accurate calculation possible for ROA (or ROE), you need to take an average of the assets or equity over the time period you're considering. In the case of a bank's annual ROE, the best practice is to take the average of the assets at the end of the last five quarters. For Wells Fargo, the five-quarter average assets were $1.737 trillion, which produces a slightly higher ROA of 1.32%.

Return on equityFor return on equity, you'll need the net income as well as the total shareholders' equity, which can be found on the balance sheet. The formula for ROE is similar to the ROA formula, except that you divide by equity instead.

Continuing our Wells Fargo example, we can determine that the bank's five-quarter average equity is $189.8 billion. Using this, along with the bank's $23 billion in net income shows a ROE of 12.1%.

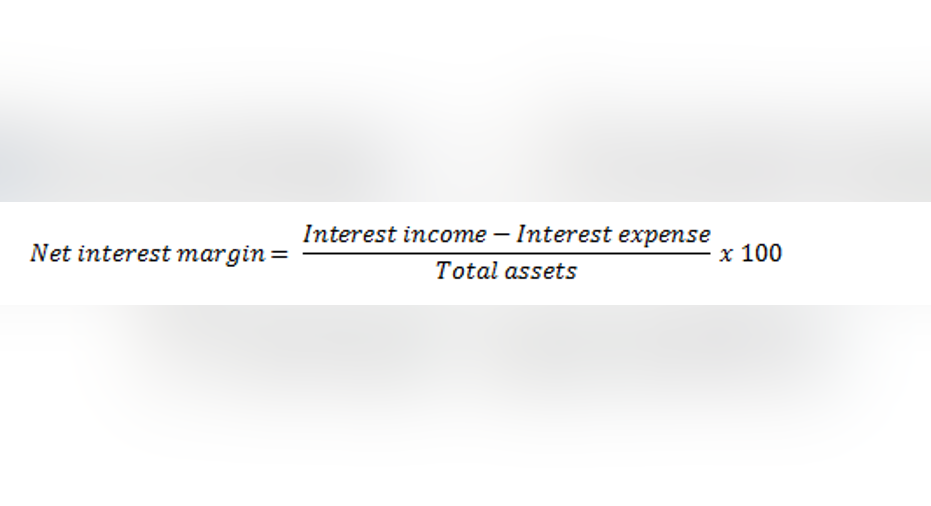

Net interest marginFinally, to calculate the net interest margin, you need to determine the bank's net interest income. You can find this on the income statement, or you can subtract the bank's interest expense from its interest income. Then, divide this by the bank's assets. Similarly to the other two metrics, use a five-quarter average of assets in order to produce an accurate NIM.

For Wells Fargo, its income statement shows 2015 interest income of $49.28 billion, and interest expense of $3.98 billion. Therefore, we can calculate its net interest income as $45.3 billion, and its net interest margin as 2.6%.

So, what is "good" profitability?In terms of ROA and ROE, 1% and 10%, respectively are generally considered to be good performance numbers. And, for the fourth quarter of 2015, the industry averages were 1.03% (ROA) and 9.21% (ROE). Net interest margin tends to fluctuate over time depending on the prevailing interest rates -- that is, interest margins tend to be higher when market interest rates are up. In the fourth quarter of 2015, the industrywide average NIM was 3.02%, but was as high as 4.91% in the mid-1990s.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us atknowledgecenter@fool.com. Thanks -- and Fool on!

The article How to Calculate Profitability Ratios for Banks originally appeared on Fool.com.

The Motley Fool owns shares of and recommends Wells Fargo. The Motley Fool has the following options: short March 2016 $52 puts on Wells Fargo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.