How to Figure Out Par Value on Balance Sheet

The par value of a stock is an arbitrary number assigned to each share of stock when it is first sold to investors. The par value has no actual relation to the market value of each share; it's just an accounting requirement to create an initial point of reference for future accounting transactions.

The process to figure out the par value is very simple when using the company's balance sheet. Here's how to figure it out.

Gather the needed information from balance sheet

Figuring out the par value requires a basic understanding of the balance sheet. Because par values represent legal capital, the information we need will be found in the equity section of the balance sheet, along with the other capital accounts.

Within that section, we'll look for a line item labeled as "Common Stock." For public companies, the common stock line will include additional information in parenthesis that we'll need to calculate par value.

To do the math yourself, we'll first need to note the par value per share. This is usually shown with the per-share amount followed by "par value."

Next, we'll need to note the number of total shares issued. This will be listed with the word "issued," followed by the number of shares. For a large, public company, this number will likely be 10 figures or longer.

The common-stock line may include other information, as well -- for example, the total number of authorized shares. We will not need this information to figure out par value.

The company's par value is calculated by multiplying the par value per share by the total number of shares issued. That means you'll just need to grab your calculator and key in the math.

Figuring out par value can be even easier than that

That math is pretty simple, but the accountants at these companies make figuring out par value even easier. They do the calculation for you.

The balance sheet number listed with the "Common Stock" line item will equal the par value per share multiplied by the total shares issued. Because the math will always be done for you, some balance sheets will not include the par value per share and total shares issued information.

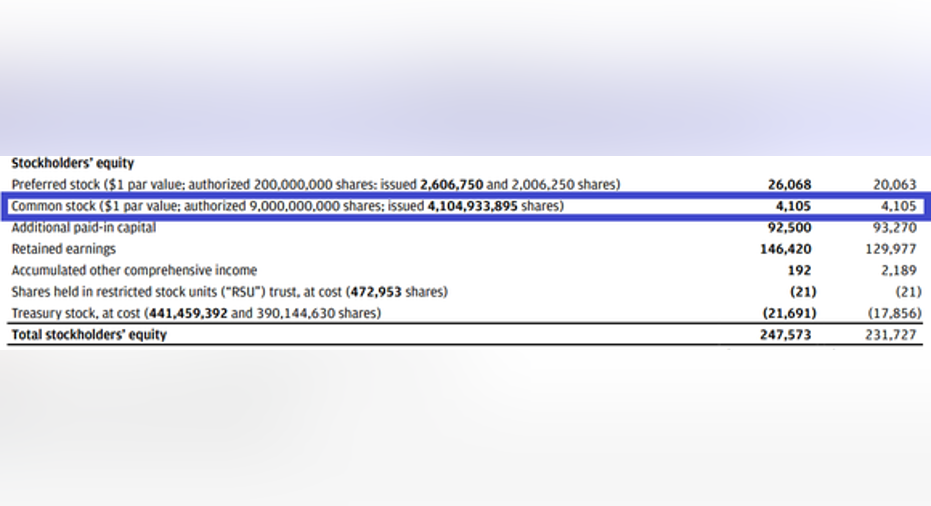

Here's an example from JPMorgan Chase's2015 annual report.

The company's common stock has a par value of $1, with 4.1 billion shares issued. Multiplied together, the bank has an overall par value of $4.1 billion, as shown on the "Common Stock" line of the balance sheet's equity section.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center, in general, or this page, in particular. Your input will help us help the world invest, better! Email us at knowledgecenter@fool.com. Thanks -- and Fool on!

The article How to Figure Out Par Value on Balance Sheet originally appeared on Fool.com.

The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.