Intel to Buy Driverless Car-Tech Firm Mobileye for $15B

U.S. chipmaker Intel agreed to buy driverless car-technology firm Mobileye for $15.3 billion on Monday, positioning itself for a dominant role in the autonomous-driving sector after missing the market for mobile phones.

The $63.54-per-share cash deal marks the largest purchase of a company solely focused on the self-driving sector.

Mobileye's shares jumped as much as 30 percent to $61.51 in early U.S. trading, while Intel's shares were down 1.3 percent.

The deal underscores the expanding alliances between automakers and their suppliers as they race to develop self-driving cars, a concept that once seemed a science-fiction dream but is drawing closer to reality.

While Intel is known for hardware chips and Mobileye for collision detection software, the merger promises to create a large portfolio of technologies needed for driverless vehicles.

That includes cameras, sensor chips, in-car networking, roadway mapping, machine learning and cloud software, as well as the data-centers needed to manage all the data involved.

"It's an area where (Intel) has had very little presence - the automotive market, and so this is a tremendous opportunity for them to get into a market that has significant growth opportunities," said Betsy Van Hees, an analyst at Loop Capital Markets.

"Mobileye's technology is very critical ... The price seems fair," she added.

The offer represents a premium of about 33 percent to Mobileye's Friday closing price of $47.

Intel will integrate its automated driving group with Mobileye's operations, with the combined entity being run by Mobileye Chairman Amnon Shashua from Israel.

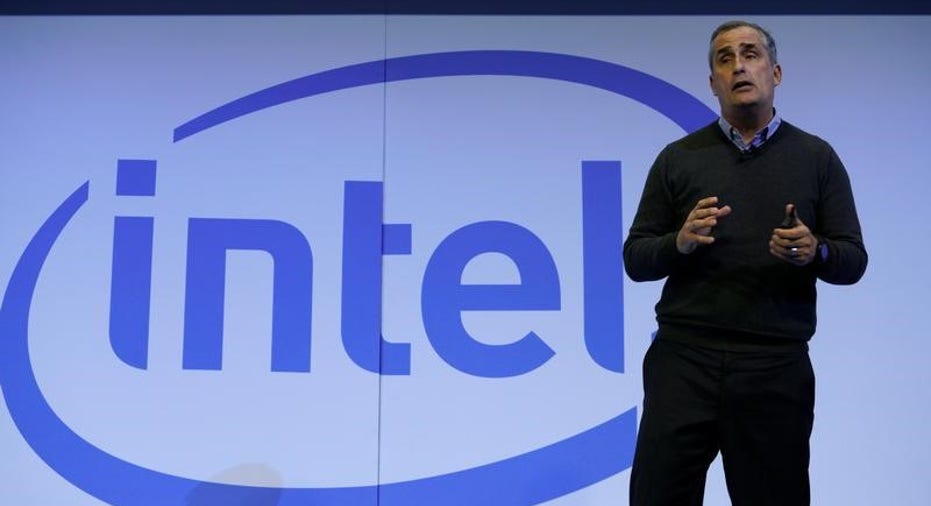

Intel Chief Executive Brian Krzanich said the acquisition was akin to merging the "eyes of the autonomous car with the intelligent brain that actually drives the car."

Mobileye supplies cameras, chips and software for driver- assist systems - the building blocks for self-driving cars - to more than two dozen manufacturers.

The company was an early supplier of vision systems to Tesla, but the two companies had an acrimonious and public breakup last summer after the driver of a Tesla Model S was killed while operating the vehicle using Tesla's Autopilot system.

Intel said it expects the vehicle systems, data and services market to rise to $70 billion by 2030.

Mobileye, founded in 1999, accounts for 70 percent of the global market for driver-assistance and anti-collision systems. It employs 660 people and had adjusted net income of $173.3 million last year.

Analysts said that mounting a counterbid would be difficult as Mobileye's Shashua would remain in charge and the combined entity would be based in Israel.

Shashua and two other senior Mobileye executives stand to do well by the deal: together they own nearly 7 percent of the company. Shmuel Harlap, Israel's biggest car importer and one ofMobileye's earliest investors, also holds a 7 percent stake.

BATTLE FOR SELF-CONTROL

Mobileye and Intel are already collaborating with German automaker BMW on a project to put a fleet of around 40 self-driving test vehicles on the road in the second half of this year.

At the same time, Mobileye has teamed up with Intel for its fifth-generation of chips that will be used in fully autonomous vehicles that are scheduled for delivery around 2021.

Last October, Qualcomm announced a $47 billion deal to acquire the Netherlands' NXP, the largest automotive chip supplier, putting pressure on other chipmakers seeking to make inroads into the market, including Intel, Mobileye and rival Nvidia.

The Qualcomm-NXP deal, which will create the industry's largest portfolio of sensors, networking and other elements vital to autonomous driving, is expected to close later in 2017.

For a dozen years, Mobileye has relied on Franco-Italian chipmaker STMicroelectronics to produce chips that the Israeli company sells to many of the world's top automakers for its current, third-generation of driver-assistance systems.

Mobileye's relationships with automakers, leading suppliers and STMicroelectronics will continue uninterrupted, the companies said in their statement, and Mobileye's current product roadmap will not be affected. (By Tova Cohen and Ari Rabinovitch; Additional reporting by Edward Taylor, Eric Auchard and Narottam Medhora; Editing by Luke Baker, Mark Potter and Saumyadeb Chakrabarty)