Presidential race lures Wall Street newbies to market minefield

Landslide results may roil markets that have bet heavily on uncertainty

Wall Street is prepared for stock-market volatility if a flood of mail-in ballots leaves the U.S. presidential election in limbo, but it would be caught off guard by a landslide victory for either side.

After months of debate over mail-in ballots, more common during the COVID-19 era and more time-consuming to count, the options market has priced in outsized stock-market volatility through Election Day and on to the Jan. 20 inauguration.

Monthly pricing for volatility contracts in the highly efficient S&P 500 futures market typically varies by a tenth or a quarter of a so-called vol point from one contract to the next. Right now, however, September volatility is trading at 17.5 while November is at 23.5, a gap of six points, and January is at 24.

CORONAVIRUS VACCINE OPTIMISM TO BOOST STOCKS INTO YEAR-END: GOLDMAN SACHS

"A lot of surprises are kind of built into these volatility levels around the election," Anthony Saliba, CEO of the Chicago-based Matrix Execution Group, an executing broker-dealer that specializes in options and equities, told FOX Business.

"The one outcome that might surprise people is if there isn't this protracted" period in which the result is unknown. If there were a landslide in either direction, Saliba added, "that outcome actually prevents the questioning and so on and so forth."

It would also prove costly for market players who bet heavily on volatility that didn't materialize. Over the past six months, retail investors boosted their bullish options bets, especially in single-stock contracts, to more than 20 million contracts for the first time.

Small traders, or those with less than 10 contracts, now make up a record 45% of the market, up from less than 30% at the beginning of this year.

For the first time since options trading began in the 1970s, their underlying value traded every day is greater than the underlying value of stocks that trade every day.

Photo credit: Getty/AP

“There is no doubt that there is a mania underway in this market and it is driven by retail investors through the options market,” said Jim Bianco, president of Chicago-based Bianco Research.

The explosion in options trading by the retail investor has coincided with the S&P 500 surging 50% from its March low, boosted by what Bianco says is a newfound love of “unrecoursed leverage,” or the idea that buying an option gives them a large amount of leverage and the chance to make a lot of money really quickly if the underlying security’s price soars. If the option expires worthless, they take the hit of a few hundred dollars and try again.

TRUMP URGES GOP SENATORS TO FILL GINSBURG VACANCY WITHOUT DELAY

Eventually, when as much cash has been poured into the trade as the market can stand, the easy-money party will end.

“On the trading floors, they just like to say it [the market] will do whatever it needs to do to f--- the most amount of people,” Bianco said.

The catalyst is anyone’s guess, but aside from a sharp selloff in the stock market, the event will need to be driven by an unexpected drop in volatility that will leave unsuspecting newbie traders scratching their heads.

CORONAVIRUS RECESSION IS OVER: BIG MONEY MANAGERS

Right now, there are huge premiums for call options -- which give holders the right to buy a stock at a specified price -- that are either at-the-money (close to the current share price) or out-of-the money (far above the share price).

The interest is due to the heightened uncertainty surrounding the election and a desire to take advantage of outsized market reactions.

Traders speculate there may be a similar scenario to the 2000 election where a winner isn’t known for weeks. Back then, the S&P 500 plunged 12% until former President George W. Bush was eventually named the victor.

This time around, however, an election with no clear winner seems to be the expected outcome, with traders betting on an extended delay in results while mail-in ballots are counted. Former Vice President Joe Biden is expected to receive the majority of those votes due to Democrats heavily favoring vote-by-mail while Republicans prefer to cast their ballots in person.

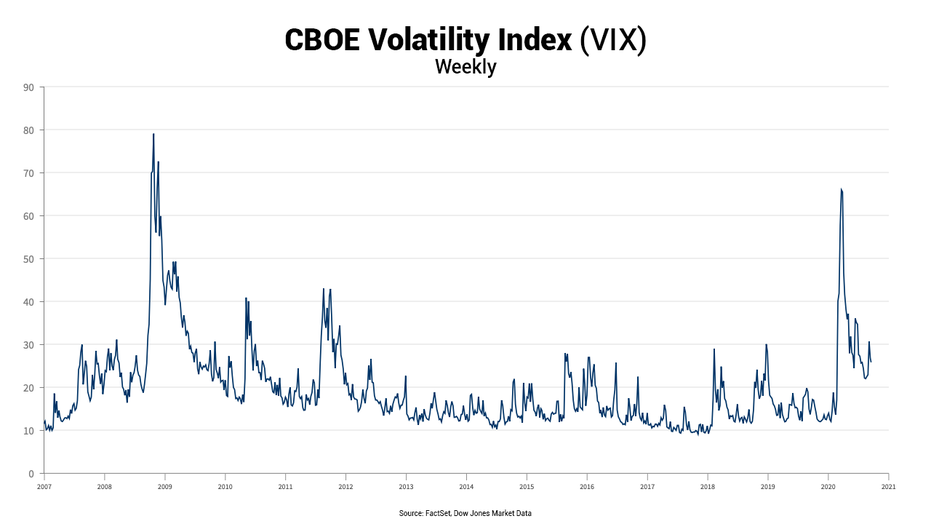

Against that backdrop, “the outlier outcome is a landslide one way or the other that takes the air out of volatility,” Saliba said, speculating that such an event could cause the Volatility Index, or VIX, to fall from its current level of almost 30 to 20 or lower.

The stock market’s so-called fear gauge has settled into an elevated range between 20 and 30 following the sharp selloff that engulfed equities in March. It has typically traded in the high teens amid periods of calm.

Another scenario that could suck volatility out of the market would be if the first debate that is set to take place on Sept. 29 swings public opinion toward either President Trump or Biden.

“This is the most important debate in American history,” Bianco said. “This debate is going to come down to only one thing: Joe Biden's confidence. If he manages to get through it without looking like he's lost his fastball, he wins.”

Bianco isn’t ruling out an “October surprise,” which he thinks may be reflected in Biden’s lead narrowing from 24 points in August to almost 50/50 in September. Another possibility is the discovery of a vaccine that puts the country on a faster path to reopening.

WECHAT BAN IMPERILS US BUSINESSES IN CHINA

Absent those outcomes, the doomsday election scenarios of a prolonged count of the mail-in ballots or a result that hangs in the balance until Inauguration Day will probably keep volatility at elevated levels and could even send it higher.

How the death of liberal Supreme Court Justice Ruth Bader Ginsburg and the looming fight between Democrats and Republicans to replace her may affect markets is still unknown.

Trump has urged Senate Republicans to vote quickly on his eventual nominee, despite an election less than two months away and the GOP's refusal to do the same for Democratic President Barack Obama's last Supreme Court nomination, made some nine months before the 2016 election. A difference being the White House and Senate were controlled by different parties back then.

CLICK HERE TO READ MORE STORIES ON FOX BUSINESS

From now until the election and beyond, experienced options traders will look at volatility and the number of days before decisive results, among other factors, to figure out the right price to pay for bets.

“There is a lot of science involved, but then there's a bit of art and you can triangulate around it and come up with a reasonable assumption,” Saliba said.