IRA Investment Options: Top Choices for Your Portfolio

Image source: Getty Images.

Traditional and Roth IRAs can be summed up with one word: Freedom. Where 401(k) plans are often limited to a handful of investment choices, you can use an IRA to invest in everything from individual stocks to mutual funds and ETFs. But all this freedom means that you'll be in the driver's seat; it's up to you how to invest your IRA.

Here are a few great choices for investors who are puzzled by the many choices in their IRA.

Set-and-forget funds for an IRA

Don't have a lot of time? You're not alone. The fund industry recognizes that most people don't want to spend the time managing their accounts. If you find yourself prioritizing convenience and ease over cost, thentarget-date funds may be for you.

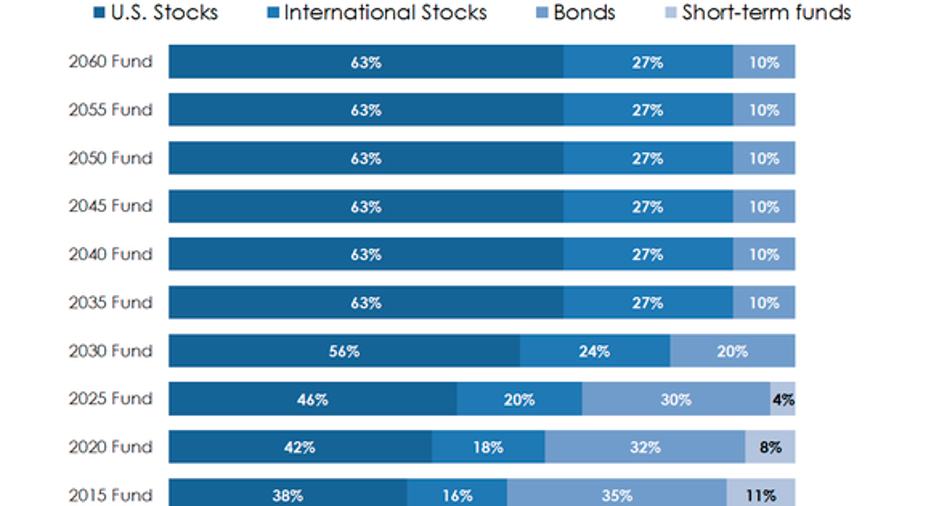

Target-date funds are designed to take the hard work out of managing a retirement account. All you have to do is pick a year that best corresponds to your expected retirement date. Target date funds automatically rebalance so that your account slowly shifts from higher-risk stocks to lower-risk bonds. The goal is to grow your investment quickly while retirement is still decades away and then to protect more of your capital from volatility as you approach the day when you'll rely on it for income.

As an example, see how Fidelity's Freedom Fundsdesigned for 2020 retirees invest more conservatively than funds designed for 2050 retirees.

You could easily set up automatic investments through your bank account, set the fund to automatically reinvest distributions (the fund equivalent of dividends), and forget that the account exists. It's really that simple.

The ideal investor: Target-date funds are best for people who are just getting started. Their higher expenses may amount to a rounding error on $10,000 or $20,000 accounts, but investors with larger balances will find it harder to justify the additional expenses. Target-date funds carried average expense ratios of about 0.55% in 2015, making them more expensive than less convenient choices.

Cheap and diversified funds

Investors who want broad diversification at a low cost would do well to consider index funds. Index funds eschew active management and instead passively track an index by holding all the same stocks in exactly the same proportions. Because index funds simply track an index of stocks or bonds, they don't have all the expenses of paying analysts and portfolio managers to pick stocks. Low overhead enables index funds to pass on fees that are about 87% lower than those of actively managed funds.

Here are some of the most popular indexes that funds track:

- S&P 500 -- Often regarded as "the index" for U.S. stocks, the S&P 500 includes 500 of the largest companies listed on American exchanges. These companies account for about 80% of the total value of the stock market. Top components include Apple, Microsoft, and ExxonMobil.

- Russell 1000 -- Like the S&P 500, this index is mostly a large-cap index. It includes twice as many companies as the S&P 500 and thus ventures further into mid-cap stocks than the S&P 500 index. The Russell 1000 includes 92% of the U.S. stock market by market value, making it more diverse than the S&P 500.

- Russell 2000 -- This is a small-cap index that includes the 2000 companies that don't make the cut for the Russell 1000 index. Widely regarded as the small-cap index, it holds 2,000 of the smallest companies on the American exchanges. All in all, these 2,000 stocks make up about 8% of the American stock market's value.

- Russell 3000 and Total Stock Market Index -- These indexes seek to track the entirety of the investable market, or all U.S. stocks that are of practical size for a fund to hold. The Russell 3000 includes about 98% of U.S. stocks by market value, while the Total Stock Market Index includes stocks that make up 99.9% of the market's value. What they exclude is largely a function of practicality: If they bought smaller stocks, then funds that tracked the indexes might be the only buyers and sellers on any given day.

The best thing about these indexes is that they are the basis for a number of dirt-cheap index funds. There are mutual funds and exchange-traded funds that track these indexes with expense ratios as low as 0.05% per year, or $0.50 for every $1,000 invested. It doesn't get much cheaper than that.

The ideal investor: Low-cost index funds are great for the cost-conscious investor. They're widely available and inexpensive to buy and hold, and you know exactly what you get with index funds. From Vanguard to Charles Schwab and Fidelity, virtually every major broker offers low-cost index funds that can suit your IRA investing needs.

Risk-reducing investment choices

No diversified portfolio is complete without a dose of bonds. As boring and as foreign as they may be, bonds help balance out the risk of stocks. When stocks rise, investors can take some risk off the table by rebalancing into bonds. When stocks fall, bond holdings can be tapped to rebalance into lower-priced stocks.

|

Stocks and Bond Mix |

Worst Year From 1926 to 2015 |

Average Annual Return From 1926 to 2015 |

|---|---|---|

|

100% stocks |

(43.1%) |

10.1% |

|

70% stocks and 30% bonds |

(30.7%) |

9.1% |

|

50% stocks and 50% bonds |

(22.5%) |

8.3% |

|

30% stocks and 70% bonds |

(14.2%) |

7.2% |

|

100% bonds |

(8.1%) |

5.4% |

Source: Vanguard.

You can take some of the edge off your portfolio with some high-quality bond funds. Again, index funds are a great place to start. Here are some bond indexes to consider tracking:

- U.S. Aggregate Bond Index -- This index is to investment-grade bonds what the Total Stock Market Index is to stocks. (One of Vanguard's best bond funds is actually named the Total Bond Market Index.) It seeks to match the makeup of the entire bond market. Returns won't be earth shattering, as government and government-backed bonds make up about two-thirds of the index. However, as risk reducer, the aggregate bond index has held up well when stocks have taken a dive.

- Short-term bond indexes -- There are many short-term bond indexes that track investment-grade government and corporate bonds. TheVanguard Short-Term Corporate Bond Index Fundonly invests in short-term corporate bonds. An iShares ETF like the iShares Core 1-5 Year USD Bond ETFadds government bonds into the mix, too. Short-term bond funds are inherently safer than other bond funds because their holdings mature faster, reducing the risk of loss due to default, inflation, and interest rate fluctuations.

The ideal investor: Quite literally everyone. Diversifying by holding stocks and bonds has long been heralded as the "only free lunch" in investing. Although it is true that portfolios of 100% stocks have historically provided higher returns than portfolios that include bonds, bonds greatly reduce volatility (ups and downs) without giving up much in the way of reduced returns. Fees are especially important with bond funds, as bonds have a much lower expected return than stocks.

Funds for an income portfolio

Investors often use the freedom an IRA allows to employ specific investing styles. Dividend investing has been especially popular. Some dividend mutual funds might pique your interest due to their ability to generate income that roughly approximates the income you'd earn from bonds, with all the potential upside and downside of stocks.

Dividend funds tend to focus on established, blue-chip stocks in order to attain yields that are higher than the stock market average. Some of the best-performing high-dividend mutual funds are in the table below.

|

Fund |

Yield |

Type (expense ratio) |

Expense Ratio |

Portfolio |

|---|---|---|---|---|

|

Vanguard High Dividend Yield Fund |

3.1% |

Index fund |

0.16% |

More than 400 mostly large-cap stocks with above-average yields. |

|

Columbia Contrarian Core Fund |

2.8% |

Actively managed fund |

0.65% |

Value portfolio of 60-80 stocks, often added after striking new lows. |

|

Vanguard Dividend Appreciation Fund |

2.1% |

Index fund |

0.19% |

More than 180 stocks with histories of dividend raises and likely future dividend growth |

Source: The Vanguard Group, Columbia Threadneedle.

Don't go overboard, though. Dividend stocks are still stocks, and they shouldn't be used as a substitute for bonds. After all, dividend stocks fall hard in downturns, just as non-dividend paying stocks do. But for investors who want to generate a little extra yield from their portfolios, low-cost active and passive dividend funds can be a good way to do just that.

The ideal investor: Dividend funds can be a good investment for people who want to add a little extra yield to their portfolio without taking unnecessarily high risk. As a general rule, a yield much higher than two times the market average (currently about 2%) should be viewed as a red flag: The fund may be taking extraordinary risk or paying out distributions that are unsustainable.

A company you like

Even if you're a hands-off investor who prefers to own funds rather than individual stocks, I think everyone should have something in their portfolio that reflects who they are or what they enjoy. You don't have to go overboard -- even a single share in one company will do.

Consider it an educational investment. Commit to holding it for years, perhaps forever. Whether it goes on to be the world's best-performing stock or it heads straight to bankruptcy court, what you learn will easily exceed the financial gains or losses. You might learn that day-to-day price swings don't mean all that much, or that shareholders have important responsibilities as owners. You might learn that how a particular business makes money is very different from how consumers think it does.

But most importantly, no matter how insignificant your single stock investment may be, you'll have something to root for.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known Social Security secrets could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Jordan Wathen has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Apple. The Motley Fool owns shares of ExxonMobil and Microsoft and has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.