Conflicts haven't hurt markets before and Iran crisis may be no different

As markets reach another all-time high history repeats itself

Stock market gyrations have traditionally played havoc with investors, particularly during times of geopolitical crisis. The situation with Iraq is no different.

History says, however, that stocks are resilient, even in the worst of times -- as record stock market close where the Dow finished just 42 points away from 29,000 points, a number that 5 years ago seemed eons away.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DOW | DOW INC. | 31.78 | +1.18 | +3.86% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

Following the Jan. 3 American airstrike that killed top Iranian military chief General Qasem Soleimani, the Dow Jones Industrial Average closed 230 points lower while U.S. oil prices ticked up. Following Iran's missile attack on a U.S. airbase in Iraq and President Trump's address on the issue, the Dow was up 161 points while oil saw a marginal uptick.

Jeffrey A. Hirsch, chief market strategist at Probabilities Fund Management and editor in chief of Stock Trader’s Almanac told FOX Business that stocks tend to “overreact to these things unless it’s something that becomes prolonged," explaining that "new highs in the face of this conflict mean this conflict is not much of a conflict."

Here's a look back at on how overseas conflicts have impacted the markets:

September 11, 2001

To prevent a stock market meltdown, the New York Stock Exchange and the NASDAQ Composite did not open for trading that Tuesday morning following the early morning attacks that saw two jetliners destroy the World Trade Center. Anticipating panic and an epic loss of value, officials elected to keep both exchanges closed until September 17, the longest shutdown since 1933.

When the markets re-opened, the calm did not set in and the market fell 684 points for a 7.1 percent decline, setting a then-record for the biggest loss in exchange history for one trading day. At the close of trading that Friday the Dow Jones was down almost 1,370 points, representing a loss of more than 14 percent. An estimated $1.4 trillion in value was lost in those five days of trading.

The market's renowned resilience and the country's pulling together contributed to a rebound and before a one month had elapsed all three indexes regained their pre-9/11 price levels.

Two years later, when U.S. troops hit the ground in Iraq, stocks were up more than 2 percent and finished the year up more than 30 percent.

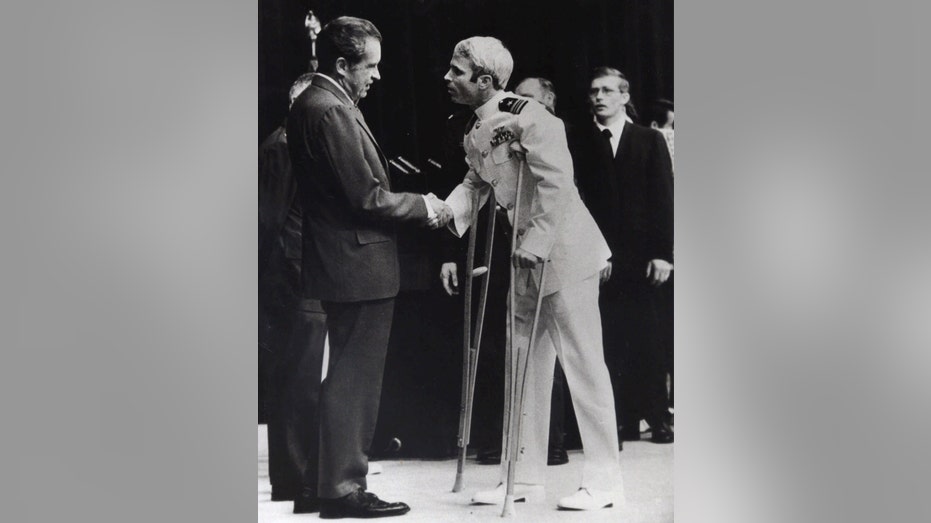

FILE - In this May 25, 1973, file photo, U.S. Navy Lt. Cmdr. John McCain is greeted by President Richard Nixon, left, in Washington, after McCain's release from a prisoner of war camp in North Vietnam. (AP Photo/Harvey Georges, File) (AP)

Vietnam War

It is a tricky era to gauge in part because American involvement in the region started in the mid 1950s, when most Americans had never even heard the word Vietnam. By the mid-1960s due to increased intervention, citizens were more than familiar with the region due in part to television coverage.

Under President Lyndon B Johnson, (Nov. 22, 1963 to Jan. 20, 1969), military actions in Vietnam escalated. However, during LBJ's time in the White House the stock market averaged a 7.7 percent return. Johnson's successor, Richard Nixon (Jan. 20, 1969 until Aug. 9, 1974) was not as fortunate. Plagued by rising inflation and his ending of the gold standard to prevent a run on gold, Nixon's time in office saw the market lose an average of 3.9 percent per year.

Cuban Missile Crisis

For 13 days, The Cuban Missile Crisis had the entire world on edge as the then Soviet Union and the United States had a staredown over a missile base just 90 miles away from the U.S, mainland. The confrontation that began on October 16, 1962, and lasted until October 28 may have wrecked the nerves of the world, but the nerves of the stock market remained relatively calm as the Dow lost just 1.2 percent during this period and would gain more than 10 percent for the year.

World War II

When Germany invaded Poland in 1939 to start World War II, the United States was still reeling from the Stock Market Crash of 1929 and the impact of the Great Depression. In 1939, the unemployment rate in the U.S was still an eye-popping 17 percent.

When Japan bombed Pearl Harbor on Dec. 7, forcing the United States' entry into the war, it was a Sunday and markets were closed. The next day, the Dow fell 3 percent. By April 28 the Dow had hit its lowest levels since 1934, on April 28, 1942. A little over one week later, the Dow gained 1.1 percent to 97.77. From that day onward, as Investor's Business Daily noted, it marked the " beginning of a bull market that carried the Dow up 130% in four years."

So what to make of all this history? Hirsch contends “if there is war, the market is more volatile but it [typically] bounces back quickly. It’s the uncertainty that causes volatility and depresses prices.

ROCKETS HIT IRAQ'S GREEN ZONE, ONE COMES CLOSE TO US EMBASSY

“As an investor, you don’t need to do a lot. Your portfolio should be built for volatility. It has been more beneficial over time to stick to your system or allocations during uncertain times. I don’t think people should make any major investment moves based on the Iran situation,” he said, outside of making sure their portfolios are well-balanced and diverse.

Still, there is fear that tension in the Middle East could continue. On Wednesday, Iran fired ballistic missiles into Iraq that targeted the U.S. military. That has some investors worried.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Greg McBride, chief financial analyst at Bankrate.com, preached caution: “Investing time horizons stretch for decades,” he told FOX Business. “Over time, we’ll go through countless elections, crises, national disasters and more. If you change course every time something scary pops up you’ll just spin your wheels. Instead, maintain the long-term focus.”