Is Goldcorp Inc. Really a Better Buy Than Barrick Gold Corporation?

Image source: Getty Images.

An analyst at TD Securities recently upgraded Goldcorp's (NYSE: GG) stock from hold to a buy while at the same time downgrading shares of Barrick Gold (NYSE: ABX) from buy to hold. Driving that swap is a view that there's nothing left to excite investors at Barrick Gold because it has mostly completed its turnaround. Meanwhile, Goldcorp has the potential draw attention should it release a compelling plan at its investor day in January. While that thesis makes sense, investors should notrush out to swap Barrick Gold for Goldcorp. Here's why.

The bull case for Goldcorp

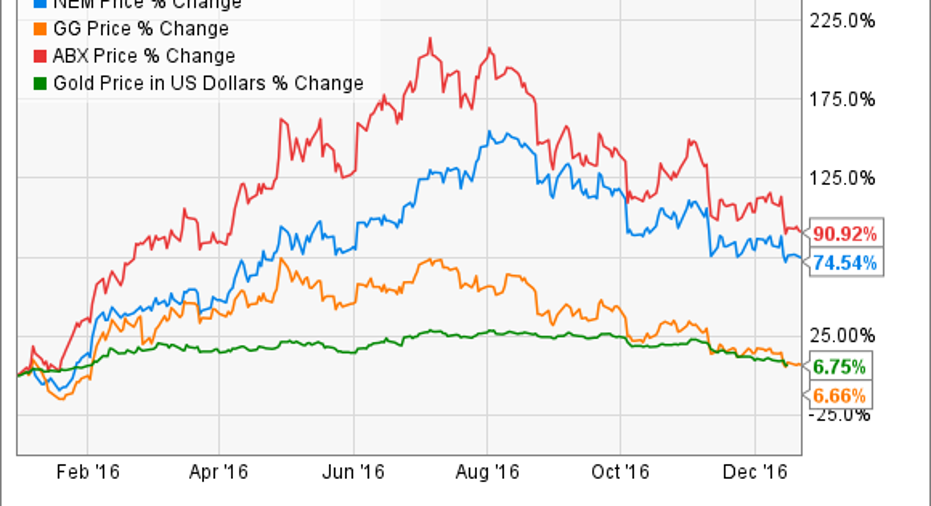

TD Securities believes that Goldcorp's days of underperforming rivals Barrick Gold and Newmont Mining (NYSE: NEM) are in the past. As the following chart shows, both of its larger competitors have thrived this year, due in part to rising gold prices as well as operational turnarounds:

Meanwhile, driving Goldcorp's underperformance is investor frustration due to a lackluster operational turnaround, which has taken much longer than expected. However, TD believes that Goldcorp intends to address this underperformance at its investor day next year. In fact, it predicts that the company will unveil a new three- to five-year production plan and provide an update on its $250 million cost-reduction initiative. These updates could reinvigorate investors, which might shine a light on the stagnant stock.

TD is not alone in this bullish view. An analyst at Desjardins Capital Markets recently selected Goldcorp as its top pick, believing that the gold miner will show an encouraging production trend when it provides multiyear guidance next year. The Desjardins analyst expects the company to announce excellent progress on its $250 million cost-savings initiative as well.

The case against Barrick Gold

Meanwhile, the TD analyst believes that Barrick Gold does not have much more upside becauseits catalysts have already played out. After all, it's finished most of its debt reduction and operational overhaul, which better positions the company to weather lower gold prices. The TD analyst also has concerns about the company's declining production profile, which could fall 23% by 2021, the weakest outlook among senior North American gold producers.

That lack of clear upside catalysts leads TD to believe that Barrick Gold's stock could meander along for quite some time.

Image source: Getty Images.

The other side of the story

There's no doubt about it: Barrick Gold has undergone a dramatic transformation over the past few years. It cut debt from more than $13 billion at the end of 2014 to below $8 billion. In addition, the company plans to get debt below $5 billion in the near term, while aiming to be debt-free within a decade. It intends to take several steps to achieve that goal, including potentially monetizing its Australian superpit joint venture, which it co-owns with Newmont Mining, and generating excess cash flow for debt reduction.

That said, Barrick Gold's primary aim is not to be debt-free but to become a free cash flow machine. That means generating a growing stream of free cash flow in any gold price environment by owning the best-run and lowest-cost gold mines in the world. Given that Barrick Gold still has much work to do to achieve its ambitious transformation, there still appears to be upside catalysts on the horizon.

It is also worth noting that despite the run-up this year, Barrick Gold's stock is still ridiculously cheap, even compared to Goldcorp. That relative valuation gap suggests that Barrick Gold's stock could still have room to run, especially when investors embrace its strategy to grow value over increasing production.

Investor takeaway

It is likely that Goldcorp will have good things to say at its investor day next year, which could lead to some enthusiastic buying. However, the company has had trouble meeting expectations in the past, meaning that there are no guarantees it will meet them in the future. Furthermore, there still appears to be more upside at Barrick Gold, especially if gold prices stop their slide. Not only could the company announce additional value-unlocking asset sales, but its management team has an ambitious plan to transform the leading gold miner into a premier value creator. As that strategy starts bearing fruit, it could be the catalyst that sends the stock out of the bargain bin.

10 stocks we like better than Barrick Gold When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Barrick Gold wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Matt DiLallo has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.