Jes Staley must face JP Morgan's lawsuit tied to Jeffrey Epstein, judge rules

Staley's over 30-year tenure at JPMorgan ended in 2013

A judge issued a decision Wednesday about whether the Jeffrey Epstein-related lawsuit filed by JPMorgan Chase against Jes Staley can proceed.

U.S. District Judge Jed Rakoff ruled against the former bank executive, saying the case that dates back to early March will not be tossed out and can move forward. The reasoning used in his decision on the matter will come "in due course," he said.

Staley, who worked at JPMorgan from 1979 to 2013, had submitted his motion to dismiss in April. The JPMorgan Chase lawsuit made allegations that during his employment at the bank, Staley protected Epstein.

JP MORGAN SUES FORMER EXECUTIVE OVER JEFFREY EPSTEIN TIES, POTENTIAL DAMAGES

Epstein’s 15-years as a JPMorgan client ran from 1998 to 2013.

In 2020, Staley said he "deeply regret[s] having any relationship with Jeffrey," adding, "Obviously I thought I knew him well and I didn’t," according to the Associated Press.

Jes Staley stepped down as chief executive of Barclays PLC under pressure from regulators about how he characterized his relationship with the convicted sex offender and financier Jeffrey Epstein. (Jim Spellman/Getty Images / Getty Images)

In addition to saying he regretted the relationship, Staley has denied knowing about Epstein’s crimes and accused JPMorgan of making him a fall guy for its supervisory failures.

The bank is seeking for Staley to cover losses that it could potentially wrack up in two other lawsuits and to get back the compensation it paid him from 2006 to 2013.

FOX Business reached out to a lawyer for Staley for comment.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.31 | +3.97% |

Late last year, the U.S. Virgin Islands sued JPMorgan Chase on claims the bank "knowingly facilitated, sustained, and concealed the human trafficking network operated by Jeffrey Epstein from his home and base in the Virgin Islands, and financially benefitted from this participation, directly or indirectly, by failing to comply with federal banking regulations," as previously reported by FOX Business.

ELON MUSK SUBPOENAED BY US VIRGIN ISLANDS IN JPMORGAN CHASE-JEFFREY EPSTEIN LAWSUIT

JPMorgan has also made allegations against the U.S. Virgin Islands, claiming Tuesday in a filing that the territory was "complicit in the crimes" of Epstein.

Pedestrians walk past the JP Morgan Chase headquarters in New York on March 17, 2008. JP Morgan Chase bought Bear, Stearns & Co, for 2 USD a share, with help of 30,000 billion in financing of Bear, Stearns assets from the US Federal Reserve. (DON EMMERT/AFP via Getty Images / Getty Images)

For the second one, the bank faces accusations from Epstein accusers in the form of a class action lawsuit.

"Epstein’s behavior was monstrous and his victims deserve justice," a JPMorgan Chase spokesperson told FOX Business on Wednesday. "In hindsight, any association with him was a mistake and we regret it, but we did not help him commit his heinous crimes."

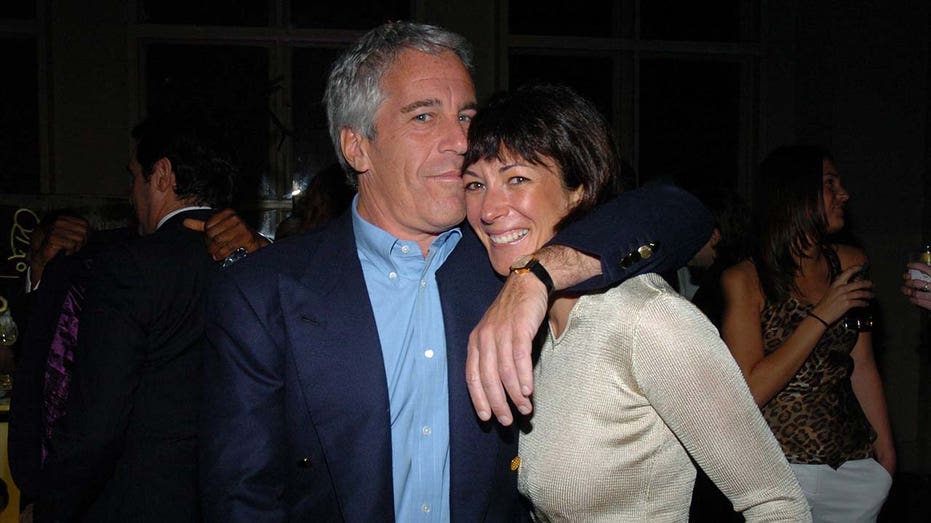

Jeffrey Epstein and Ghislaine Maxwell attend de Grisogono Sponsors The 2005 Wall Street Concert Series Benefitting Wall Street Rising, with a Performance by Rod Stewart at Cipriani Wall Street on March 15, 2005, in New York City. (Joe Schildhorn/Patrick McMullan via Getty Images / Getty Images)

Prior to Epstein’s death in 2019, he was facing one charge of sex-trafficking minors and one of conspiracy to engage in sex-trafficking minors that he was supposed to go to trial for. His death, ruled a suicide, took place Aug. 10, 2019 in jail.

DEUTSCHE BANK TO PAY $75M IN EPSTEIN LAWSUIT SETTLEMENT

Ghislaine Maxwell, a longtime associate of Epstein’s, received 20 years of imprisonment last year for charges in connection to the crimes the deceased financier was accused of. She has launched efforts to appeal her conviction.

Reuters, Breck Dumas and Ken Martin contributed to this report