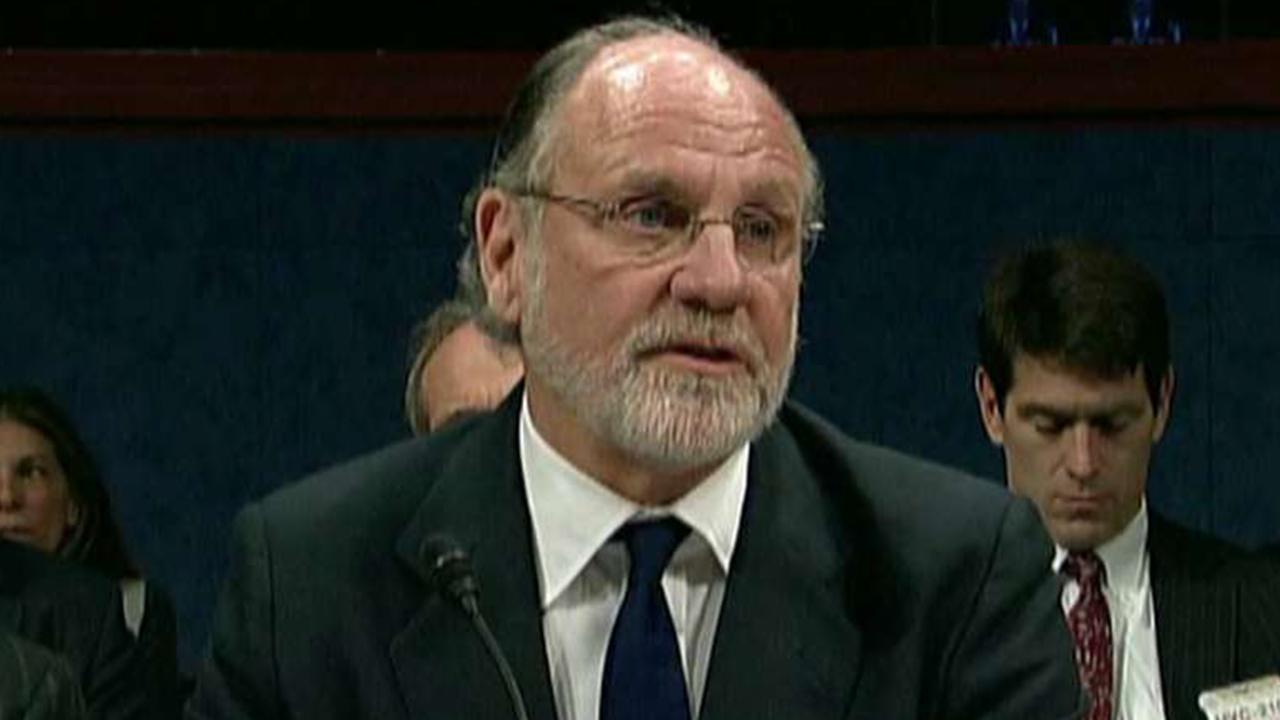

Jon Corzine’s Wall Street comeback in jeopardy so far as hedge fund attracts trickle

Jon Corzine plotted his return to Wall Street in grand fashion: The former chief of Goldman Sachs, U.S. senator and New Jersey governor would use his name recognition in financial and political circles to raise hundreds of millions of dollars from investors to start a hedge fund that would take advantage of what he believed would be wild market swings resulting from the new and possibly unsettling economic policies of President Donald Trump.

While some of Trump’s policies on such issues as trade have been unsettling to investors, Corzine’s plans to raise boatloads of investor cash have far from materialized, putting his Wall Street comeback in jeopardy, FOX Business has learned.

His new hedge fund, the JDC-JSC Opportunity Fund, has attracted just about $20 million in new money from about a dozen investors, a spokesman for Corzine confirms.

JDC are the initials of Corzine’s late son, Jeffrey, who died in an apparent suicide in 2014, while JSC are his own.

By contrast, former SAC Capital chief Steve Cohen was able to raise $3 billion in outside investor money in what was seen as a lackluster debut to his new hedge fund.

Industry executives and people close to Corzine cite a number of reasons for the lack of investor enthusiasm for Corzine’s new hedge fund including his unfortunate reign as CEO of MF Global, the investment firm he took over in 2010 after he left New Jersey politics. Under his watch, the firm imploded with nearly $1 billion of customer money missing, resulting in one of history’s largest bankruptcies.

Another factor: A widely distributed sales document obtained by FOX Business, which some potential investors believed underscored a heavy level of risk that the fund would assume.

Meanwhile, the sales document barely mentioned Corzine’s work at MF Global and didn’t explain the controversial trade he made in European debt that ultimately led to the firm’s demise in 2011.

Corzine didn’t return an email for comment. A spokesman for Corzine said he has raised “tens of millions of dollars,” but wouldn’t deny the funds raised so far have been less than his fundraising goal.

“We expect to raise $50 million by June,” the spokesman, Steven Goldberg, told FOX Business. “We’ve always wanted to start small."

The spokesman declined to comment on investors’ critiques of the sales document and its risk parameters.

“If that’s what they’re telling you, that’s what they’re telling you,” he said. When asked to comment on their specific concerns, he said some of them “were flat out wrong” but didn’t elaborate when provided with the examples.

"We believe we have the appropriate risk limits, which were developed in conjunction with an outside risk consultant, that take into account diversification, risk of loss measurements and leverage limits," Goldberg added.

Regarding Corzine’s role at MF Global, Goldberg pointed to a section of the sales document that discusses the regulatory settlement and would not comment on whether Corzine should have provided more detail into the trade that sank the firm.

"Mr. Corzine does not shy away from talking about his tenure at MF Global within the constraints of the CFTC settlement," Goldberg said, referring to the Commodity Futures Trading Commission. "He generally raises the topic of MF Global proactively and expresses willingness to discuss any questions or concerns, including making his lawyers available."

Last year, Corzine reached a civil settlement with securities regulators over MF Global. Without admitting wrongdoing, he paid a $5 million fine and agreed to a life-time ban from dealing in commodities, which was MF Global’s area of focus.

The settlement allowed him to trade most other types of securities, and he soon began plotting his Wall Street comeback as a hedge fund manager that would be registered with the Securities and Exchange Commission.

He had some tailwinds. Corzine is well-liked on Wall Street and still has plenty of friends in the investment business. Moreover, MF Global’s bankruptcy trustee recovered all of the investors’ money, and criminal charges were never filed against the firm or any of its senior executives.

Corzine began telling friends he would seek his redemption by returning to his roots as a trader—the skills that brought him to the pinnacle of Goldman Sachs in the 1990s as its senior partner. He started a hedge fund that would tap into his knowledge of trading and politics, given the unpredictable new president in the White House and how his economic plans might rattle global markets.

The fund would make its debut in 2018, and the concept sounded good on paper until Corzine and his team began making the rounds late last year in search of outside investor cash. People close to Corzine say that through January 2018 he failed to raise nearly any outside money and the fund consisted mainly of his own family’s fortune. These people say his fundraising got rolling in recent months and investor cash has begun to trickle in.

Still, while Corzine may have friends on Wall Street, the implosion of MF Global continued to worry some investors, several of them told FOX Business. Another factor: waning investor appetite for hedge funds and their high fees when it’s cheaper to buy an index fund, particularly in a bull market.

And adding to Corzine’s woes: a “strictly confidential” sales document he distributed to potential investors outlining the hedge fund’s strategy and risk parameters.

This document, obtained by FOX Business, has put off many investors, who worry that some of Corzine’s strategies and his description of how much risk he is willing to take on may lead to a repeat of the MF Global debacle, these investors tell FOX Business.

On top of those worries, Corzine failed to mention in the document the trade that cost him dearly in 2011 while at MF Global: his wager on European debt during the euro-bond crisis that began in 2009 and lasted for several years. His investments triggered concern from investors and ratings agencies alike. The firm’s lack of controls allowed nearly $1 billion of customers’ funds to go missing for years.

“That’s the elephant in the room that people just wanted him address,” said one possible investor.

According to the sales document, the JDC-JSC Opportunity Fund described Corzine’s strategy as investing in “idiosyncratic global events in liquid markets, with macro and corporate events serving as drivers of the portfolio.”

The document described the “macro events” as elections and government policies that affect markets.

Corzine, according to potential investors, provided his trading records for the past year, when he managed his own money, and they are said to be impressive. What was less than impressive, investors tell FOX Business, was some of the risk parameters described in the sales document.

The document states that Corzine and his traders would at any given time have between five and 20 positions, and that each position could lose up to 5% per position. Translated: If 20 positions lost 5%, the fund would effectively be wiped out, said one possible investor who reviewed the document.

The fund’s possible exposure to emerging markets also caused concern to some investors. The document states: “Exposure in any emerging market country generally not to exceed 200 percent of fund NAV (Net Asset Value).” But investors say exposure to a single country at most hedge funds is far less.

“Given Corzine’s past history of mismanaging risk, this stuff caught people’s eye,” said another investor.

The document also stated: “Total emerging market exposure generally not to exceed 300 percent of NAV.” Investors worried about this provision allowing traders to take on more risk, or as one of them told FOX Business: “The fact that the document says ‘generally’ means it can be larger.”

Then there’s the touchy issue of MF Global. Corzine’s tenure as CEO of the firm is mentioned in his bio, but not much more than that.

Nearly at the end of the sales presentation, in a section titled “Past Performance Is No Guarantee of Future Results. Real Results May Vary,” there is a fine-print description of Corzine’s regulatory settlement with the Commodity Futures Trading Commission that largely bars him from engaging in securities regulated by this agency but allows him to trade other securities for the hedge fund.

“Everyone I know wants to know what he was thinking when he made that trade,” said one investor.

Corzine’s spokesman, Goldberg, said a fuller description of the MF Global matter is offered to investors in what he described as an “offering memorandum,” but he didn’t elaborate.