JP Morgan not planning to settle Jeffrey Epstein lawsuit brought by US Virgin Islands

The bank said any improprieties on the part of Jeffrey Epstein was attributed to US Virgin Islands' government

JP Morgan Chase CEO says other states should learn from Florida and Texas's "pro-business" culture

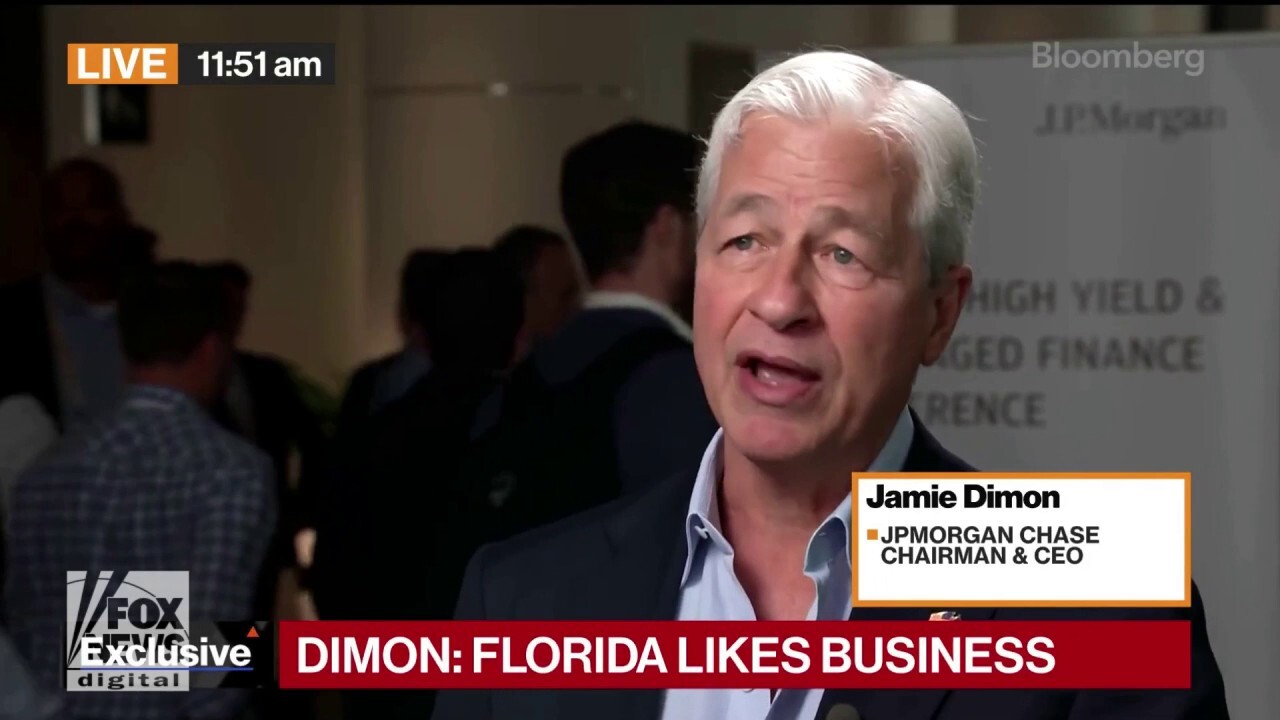

J.P. Morgan Chase CEO Jamie Dimon praised Florida and Texas's "pro-business", "pro-America" policies during an interview with Bloomberg TV Monday. Dimon was being interviewed at a J.P. Morgan conference being held in Miami.

EXCLUSIVE - JP Morgan has no plans to settle a lawsuit brought by the U.S. Virgin Islands that alleges the bank helped facilitate the alleged sex trafficking of disgraced financier Jeffrey Epstein, despite a recent settlement with one of Epstein’s alleged victims over similar claims, FOX Business has learned.

In a lawsuit filed in Manhattan federal court, the island government alleges the nation’s largest bank profited from Epstein’s sex trafficking crimes through a banking relationship that lasted nearly two decades. The lawsuit alleges that JP Morgan ignored obvious red flags to Epstein’s crimes including money laundering to maintain a lucrative business relationship with the convicted sex trafficker.

JP Morgan has denied it ignored warning signs of possible money laundering by Epstein to facilitate his sex crimes; it says the bank investigated money transfers and reported them to bank regulators.

The JPMorgan Chase logo is seen at their headquarters building on May 26, 2023 in New York City. JPMorgan Chase chief executive Jamie Dimon is set to be deposed under oath for two civil lawsuits that claim that the bank ignored warnings that Jeffrey (Michael M. Santiago/Getty Images / Getty Images)

Now, people inside JP Morgan tell FOX Business the Virgin Islands’ government itself was mostly culpable for Epstein’s crimes because the territory was home to his infamous abode dubbed "pedophile island." Epstein owned a mansion and two-private islands in the territory, where US law-enforcement officials alleged he brought underage girls for sex.

In a recent court filing, the bank accused island officials of condoning Epstein’s crimes after accepting bribes from the convicted pedophile and granting him special treatment such as tax breaks to live and work in the territory. "He gave them money, advice, influence, and favors. In exchange, they shielded and even rewarded him," the filing stated.

In a statement, a spokesman for the territory said: "We are gratified to hear about the settlement that will provide victims of Jeffrey Epstein some compensation for JPMorgan Chase’s role in facilitating Epstein’s crimes against them. The U.S. Virgin Islands will continue to proceed with its enforcement action to ensure full accountability for JP Morgan’s violations of law and prevent the bank from assisting and profiting from human trafficking in the future. The U.S Virgin Islands is committed to protecting women and girls who could otherwise become victims going forward."

FILE - This March 28, 2017, photo provided by the New York State Sex Offender Registry shows Jeffrey Epstein. JPMorgan Chase is defending itself against a lawsuit by the U.S. Virgin Islands accusing it of empowering Jeffrey Epstein to abuse teenage g ((New York State Sex Offender Registry via AP, File) / AP Newsroom)

A spokeswoman for JP Morgan told FOX Business there was "nothing new to share" on the matter.

The pair of islands, also known as Little St. James and Great St. James, which two years ago was worth a combined $240 million, although Epstein bought them for $7.95 million and $17.5 million respectively in 1998 and 2016.

Both islands were sold in May to financier Stephen Deckoff who paid $60 million for both. The U.S. Virgin Islands government is due to receive half the proceeds from the sale of Little St. James, with the money going towards a trust to fund support services for victims of sexual abuse.

FOX Business was first to report that JPMorgan intended to settle with a victim known as "Jane Doe", who sued the bank in Manhattan federal court also over allegations that it facilitated Epstein’s crimes through its banking relationship with him. On Monday, JPMorgan announced it agreed to pay $290 million to the victim, admitting no guilt.

Epstein was convicted in 2008 of having sex with an underage prostitute but spent just 13 months in prison, where he was allowed special privileges, such as leaving the jail six days a week for 12 hours a day on work release.

Jamie Dimon, billionaire and chief executive officer of JPMorgan Chase & Co., following a Bloomberg Television interview at the JPMorgan Global Markets Conference in Paris, France, on Thursday, May 11, 2023. Dimon said US regulators are likel (Photographer: Cyril Marcilhacy/Bloomberg via Getty Images / Getty Images)

Using his connections as a long-time wealth advisor to the rich and famous such as L Brands’ founder and CEO Les Wexner and former CEO of Apollo Global Management Leon Black, Epstein soon sought to remake his career on Wall Street after his release from jail. He resumed doing business with clients using JP Morgan as his primary bank (Wexner said he ceased doing business with Epstein in 2007; Black maintained his relationship until 2018).

JP Morgan eventually cut ties with Epstein in 2013, citing the notoriety of doing business with an alleged child molester. The disgraced financier was arrested for a second time in 2019 after federal law enforcement discovered additional victims. He was found dead in his jail cell a month later in an apparent suicide.

But even from the grave, Epstein continues to haunt JP Morgan and its CEO Jamie Dimon, who recently testified about JP Morgan’s relationship with Epstein.

Dimon said in his deposition that he never met Epstein; he said the company’s former private banking and investment banking chief Jes Staley, was the point-man for the Epstein relationship.

FILE - The logo of JPMorgan bank is pictured at the new French headquarters of JP Morgan bank, Tuesday, June 29, 2021, in Paris. JPMorgan Chase is defending itself against a lawsuit by the U.S. Virgin Islands accusing it of empowering Jeffrey Epstein ((AP Photo/Michel Euler, Pool, File) / AP Newsroom)

Staley left the bank in 2013 and has denied any wrongdoing. Documents show he fostered a close personal relationship with Epstein, and had visited Epstein’s island villa years ago (A lawyer for Staley had no immediate comment).

JP Morgan officials say Staley was the main reason the bank retained a relationship with Epstein, and when he left the bank, Epstein’s accounts were terminated. Epstein then took his business to Deutsche Bank, where he remained a client nearly to the day of his arrest.