JPMorgan shares jump after outlook raised

The megabank lifted its forecast for interest income

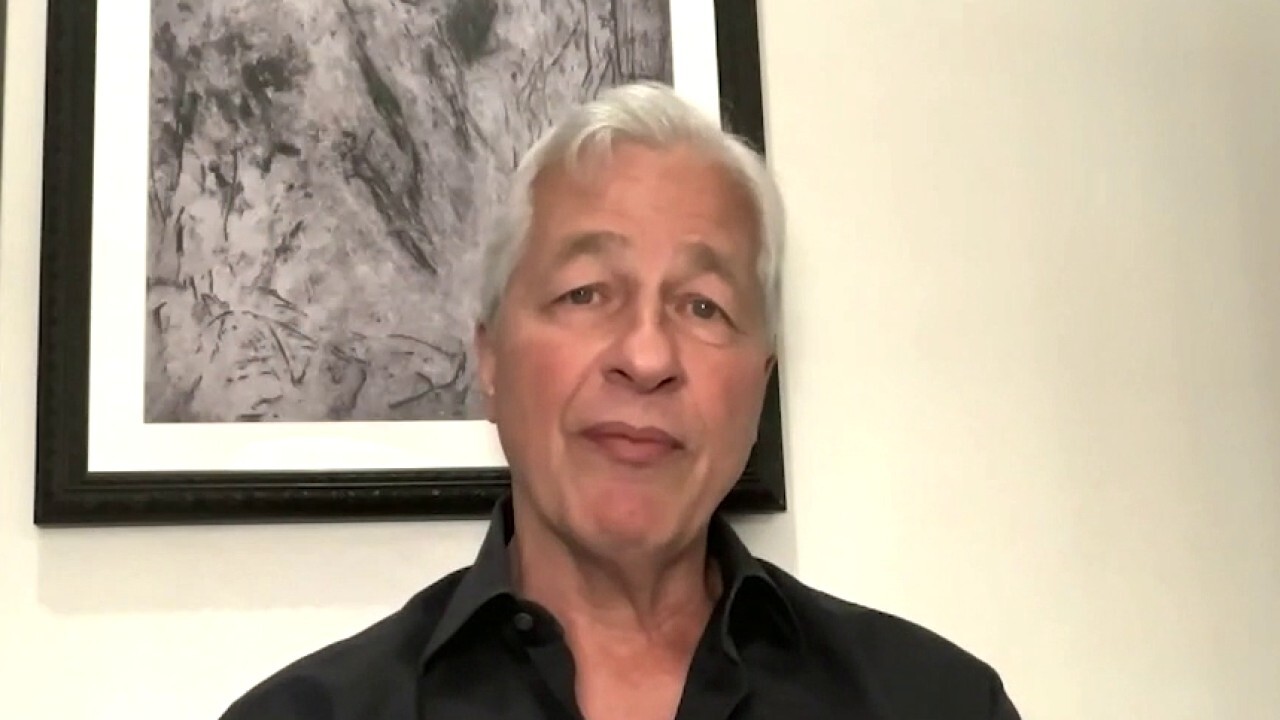

JPMorgan CEO expects ‘a lot’ of volatility in 2022, but still predicts a strong economy

JPMorgan Chase CEO Jamie Dimon discusses his outlook for the markets in 2022, the pandemic, rate hikes, and loan growth.

JPMorgan Chase & Co. shares climbed more than 5% on Monday after the mega bank lifted its forecast for interest income for the year in a presentation to investors.

The logo for JPMorgan Chase & Co. appears above a trading post on the floor of the New York Stock Exchange in New York. JPMorgan Chase admitted Tuesday, Sept. 29, 2020 (AP Photo/Richard Drew, File / AP Newsroom)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 308.03 | -0.76 | -0.25% |

The nation's largest lender now expects $56 billion in net interest income excluding markets in 2022, after saying in January that it expected the figure to be $50 billion.

The new outlook assumes the Federal Reserve raises short-term interest rates up to 3% by the end of the year, and the bank anticipates "high single-digit loan growth" with credit card revolving balances approaching pre-pandemic levels.

US GDP ESTIMATES LOWERED FOR 2022 BY JPMORGAN

A view of the exterior of the JP Morgan Chase & Co. corporate headquarters in New York City May 20, 2015. REUTERS/Mike Segar/Files (REUTERS/Mike Segar/Files / Reuters Photos)

"The U.S. economy remains fundamentally strong, despite recent mixed data," the firm said in its analysis, adding that "recent developments have increased the risk of a future adverse outcome."

GAS PRICES WILL SURPASS $6 NATIONWIDE BY AUGUST, JPMORGAN SAYS

JPMorgan said that net charge-offs for bad loans are at historic lows, but that it expects "charge-offs to return to pre-pandemic levels over time."

People pass the JP Morgan Chase & Co. Corporate headquarters in the Manhattan borough of New York City, May 20, 2015. (REUTERS/Mike Segar/File Photo / Reuters Photos)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The bank left its expense outlook unchanged at $77 billion, and reaffirmed its target for a 17% return on tangible capital equity (ROTCE), which it said could be achieved in 2022.

Reuters contributed to this article.