Las Vegas Strip returns from coronavirus with less of its notorious excess

Social-distancing rules will force operators to turn off at least half of slot machines

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

Before the COVID-19 pandemic, what happened in Las Vegas stayed in Las Vegas. Now, much of it won't even happen. Casino buffets? Forget about them. Slot machines? Won’t be nearly as prevalent. Cash? Maybe a thing of the past. And then there's the once-notorious nightlife.

Las Vegas Strip operators collectively have lost about $4 billion of revenue since the COVID-19 pandemic forced them to close their doors for the first time since former President John F. Kennedy’s assassination in November 1963.

And when they reopen on June 4, they're unlikely to bring in the revenue they did before, at least not right away. With a fight to contain the pandemic in the U.S. still underway, the venues will be operating under new, more restrictive rules. They'll have smaller capacities and additional expenses from enhanced health-safety measures.

CORONAVIRUS REOPENING PLAN DEALS LAS VEGAS CASINOS A LOSING HAND

The combined market capitalization of Las Vegas Sands, MGM Resorts and Wynn Resorts, the companies that make up the S&P 500 Casino & Gaming subsector, has plunged by 37 percent this year to $85.07 billion, according to Dow Jones Market Data.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LVS | LAS VEGAS SANDS CORP. | 57.78 | +0.84 | +1.48% |

| MGM | MGM RESORTS INTERNATIONAL | 37.49 | +1.21 | +3.32% |

| WYNN | WYNN RESORTS LTD. | 117.96 | +4.76 | +4.20% |

To try and recoup lost market value, those casino operators will look to cut costs and emerge from the pandemic with leaner businesses.

“It's always difficult to effectuate change when processes are sort of in place,” Barry Jonas, a New York-based analyst for SunTrust Robinson Humphrey, told FOX Business. “But with properties closed for a significant period, you can somewhat accelerate some of those plans.”

Some of the loss leaders, like buffets, may not come back or will be scaled down, according to Jonas. They are “fairly expensive to run,” he noted, and there's “a lot of waste.” In other instances, buffets might come back, but the “self-service aspect will be gone,” he said. Giveaways and handouts could also fall by the wayside.

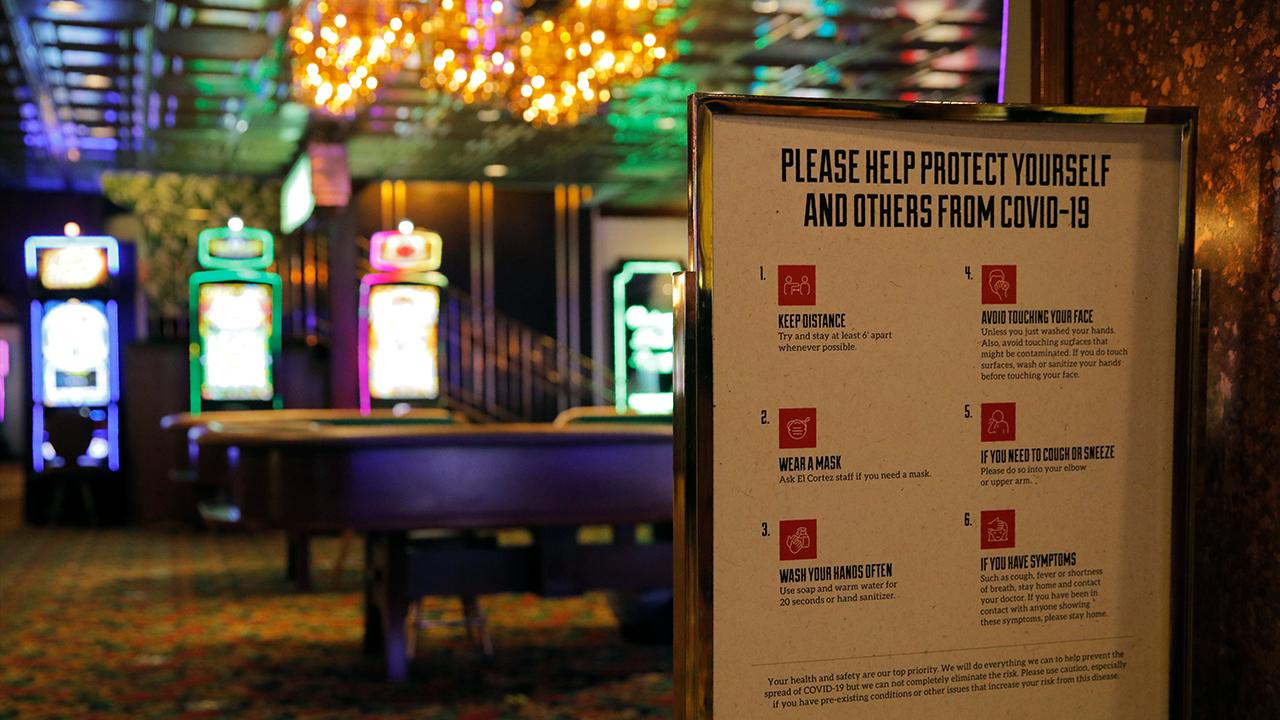

Casino floors, which accounted for $6.45 billion, or 34 percent, of Las Vegas Strip sales in 2019, will be cleaned vigorously, and patrons will have to undergo temperature checks before entering and wear masks. The facilities will be limited to 50 percent of their usual capacity.

“Ensuring employee and consumer safety and a quality patron experience is everyone’s top priority as the Strip reopens,” American Gaming Association spokesperson Casey Clark told FOX Business.

Operating at reduced capacity will mean fewer players per table as well as fewer options. Table games will be downsized to a handful of players, and poker rooms will be mostly shut.

Slot machines, which raked in $3.55 billion, or 55 percent of all gaming revenue in 2019, typically have occupancy rates of 50 percent or less.

Social-distancing rules will force operators to turn off at least half of those machines and will likely prompt the realization that operators “maybe don't need to buy quite as many,” according to Jonas.

CORONAVIRUS LEAVES VEGAS CASINOS ROLLING SNAKE EYES

Meanwhile, owners are expected to make a greater push to improve technologies.

“Cash is dirty,” Jonas said, noting there may be a push to get regulatory approvals for credit cards and virtual wallet systems, which could “increase the amount of money that passes through gaming floors.”

Free flights and accommodations are likely to be scaled back as C-suite executives cut costs to keep businesses as healthy as possible on a “long road to recovery,” he added.

And those changes, while stark, don't even take into account the nightclubs, concerts and shows that will remain closed, giving people incentive to stay closer to home and allowing regional casino operators around the country to take advantage of pent-up demand.

Full House Resorts said revenue at its Mississippi location was up 12 percent year-over-year in the first five days after it reopened. Twin River’s Mississippi revenue surged 50 percent from a year ago in its first day back.

CLICK HERE TO READ MORE ON FOX BUSINESS

“I think from an investor perspective, we've certainly seen a recovery in the stocks and in some cases back to near pre-coronavirus levels,” Jonas said. “But you do sort of worry, 'Is this too easy?'”