Let the Spending Spree Begin!

Debt ceilings have done little to curb the U.S. government’s escalating debt load and if you thought overspending was a serious problem before, welcome to the next cycle.

That’s because U.S. politicians just approved a bill that suspends the government’s borrowing limit until March 16, 2015. That means no more last minute showdowns about a debt ceiling (until next year). It also means the government can theoretically spend however much it deems fit.

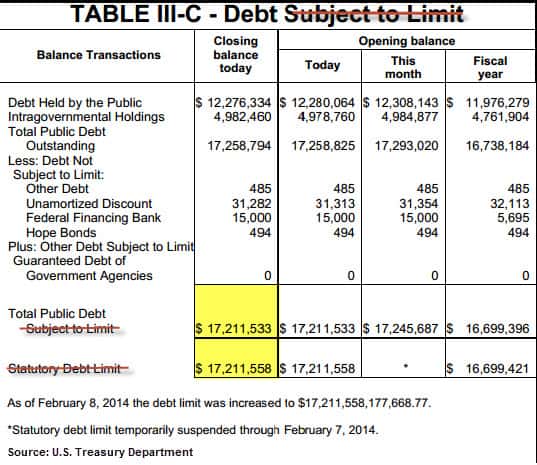

Outstanding public debt is currently at $17.21 trillion, according to the U.S. Treasury’s daily statement. (See table below)

For now, the U.S. Treasury market (NYSEARCA:TLT) has shrugged off concerns about mounting debt and the risk of a future credit event.

The yield on 10-year Treasuries (ChicagoOptions:^TNX) has calmly declined almost 9% since the start of the year and yields are hovering around 2.75%. Likewise, the yield on 30-year Treasuries (ChicagoOptions:^TYX) has quietly moved lower around 6% toward a yield of 3.72%.

Treasury ETFs that leverage daily performance to government bonds with durations longer than 20 years like the Direxion Daily 20+ Yr Treasury Bull 3x Shares (NYSEARCA:TMF) and the ProShares Ultra 20+ Yr Treasury ETF (NYSEARCA:UBT) have scored year-to-date gains between 9% to 13%.

Treasury ETFs that leverage daily performance to government bonds with durations longer than 20 years like the Direxion Daily 20+ Yr Treasury Bull 3x Shares (NYSEARCA:TMF) and the ProShares Ultra 20+ Yr Treasury ETF (NYSEARCA:UBT) have scored year-to-date gains between 9% to 13%.

With emerging markets like China, Brazil, and Turkey in a tailspin, U.S. Treasuries have been a temporary beneficiary of money flows.

Now that the debt ceiling has been removed, will it ever be reinstated?

From a fiscal perspective, it probably doesn’t matter.

Even with a statuary debt limit in place, spendthrift politicos always found a loophole, which allowed them to borrow and spend at will.

Since 1993 alone, the U.S. debt limit was “temporarily” raised no less than 18 times, which increased total debt by more than $13 trillion.

The velocity of the U.S. debt outstanding over shorter time periods is especially alarming. Since 2007, total federal debt has almost doubled from just under $9 trillion.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. In 2013, 70% of our weekly ETF picks were gainers.

Follow us on Twittter @ ETFguide