Microsoft sales beat estimates as customers prepare for AI rollout

Compared to what analysts had forecasted, both the tech giant's revenue and EPS came in higher

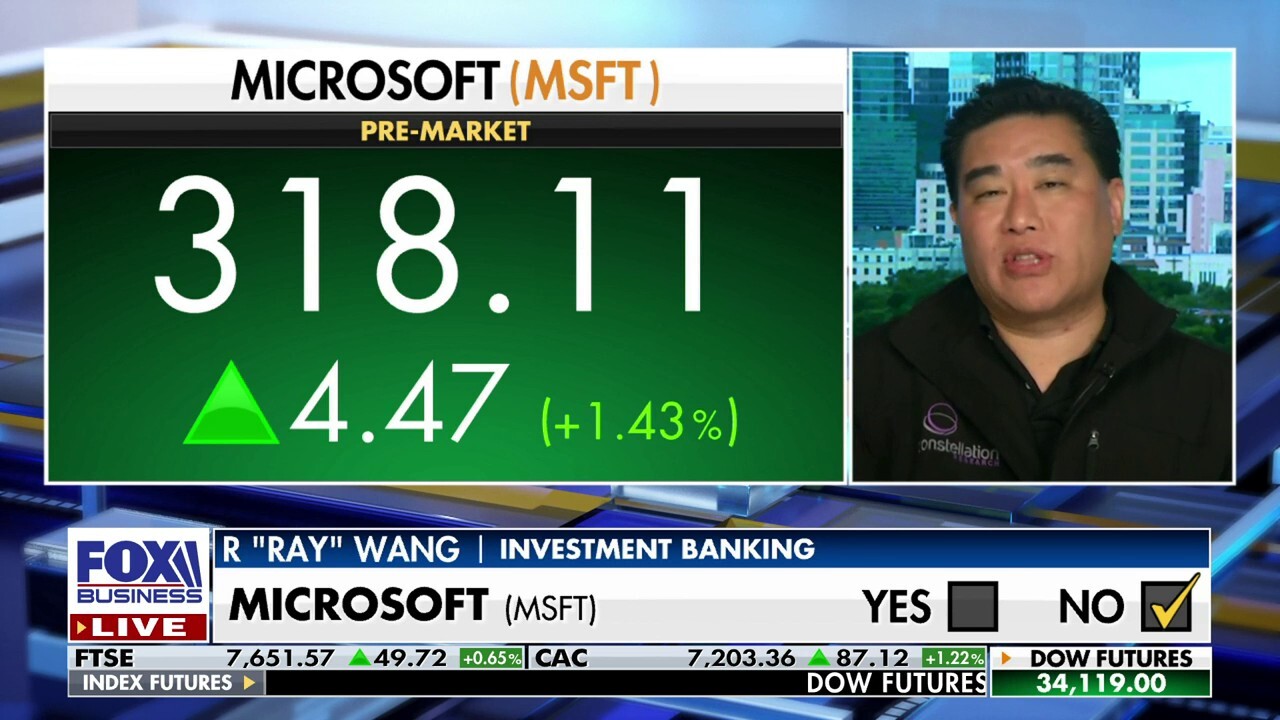

Microsoft making its own AI chips is significant: R 'Ray' Wang

Constellation Research founder R 'Ray' Wang joins 'Varney & Co.' to discuss reports Microsoft is pursuing a chip solution that would make them less dependent on Nvidia.

Microsoft on Tuesday beat Wall Street estimates for fiscal first-quarter results in all segments, driven particularly by strength in its cloud-computing and PC businesses.

The company's revenue rose 13% to $56.5 billion in the quarter ended Sept. 30, compared with analysts' consensus estimate of $54.52 billion, according to LSEG data.

Microsoft shares were up 4.2% in after-hours trading.

Signage outside the Microsoft Campus in Redmond, Washington, U.S., on Thursday, March 3, 2022. (Photographer: Chona Kasinger/Bloomberg via Getty Images / Getty Images)

"The results indicated that artificial intelligence products are stimulating sales and already contributing to top and bottom-line growth," said Jesse Cohen, senior analyst at Investing.com.

Revenue from Microsoft's Intelligent Cloud unit, which houses the Azure cloud-computing platform, grew to $24.3 billion, compared with analysts' estimate of $23.49 billion, LSEG data showed. Azure revenue rose 29%, higher than a 26.2% growth estimate from market research firm Visible Alpha.

MICROSOFT DISCLOSES IRS SAYS THE TECH GIANT OWES NEARLY $29 BILLION IN UNPAID TAXES

The company does not break out the absolute revenue figure for Azure, the part of Microsoft's business best situated to capitalize on booming interest in artificial intelligence.

Wall Street is looking at how generative AI services may benefit Microsoft, which secured an early lead with investments in startup OpenAI, owner of the popular ChatGPT service.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

Many of those AI services are not yet widely available. Brett Iversen, Microsoft's vice president for investor relations, said much of the sales growth reported on Tuesday came from customers rekindling their use of Microsoft's cloud in anticipation of using those services.

"What AI is doing ... is opening up either new conversations or extending existing conversations or getting us back in touch with customers that we maybe weren't doing as much with," Iverson told Reuters.

By comparison, Google-parent Alphabet's cloud division missed estimates for third-quarter revenue on Tuesday as an uncertain economy and high interest rates led its customers to trim their budgets.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GOOGL | ALPHABET INC. | 322.86 | -8.39 | -2.53% |

Microsoft said on Tuesday that its fiscal first-quarter profit was $2.99 per share, above analyst estimates of $2.65 per share, according to LSEG data.

The new Operating System Microsoft Windows 11 is available in France since October 5 , 2021 (Photo by Daniel Pier/NurPhoto via Getty Images) (Daniel Pier/NurPhoto / Getty Images)

"There are some weaker areas; search advertising revenues, for one, is growing slower than most segments," said Jeremy Goldman of research firm Insider Intelligence.

Microsoft said search and news advertising revenue excluding traffic acquisition costs increased by 10%. It does not break out the revenue figure for these operations.

Microsoft Corp

Microsoft is weaving AI into its own products, such as the $30-a-month "Copilot" for its Microsoft 365 service that can summarize a day's worth of emails into a quick update. While the tool is being shown only to a small number of pilot customers until it becomes available next month, it requires businesses to make a number of upgrades to their Microsoft-based systems in order to use Copilot. Analysts say this could generate sales for the Redmond, Washington, company ahead of Copilot's wide release.

MICROSOFT TO ASSUME AI COPYRIGHT LIABILITY FOR COPILOT USERS

Investors are also tracking how much Microsoft spends on the massive data centers to power AI software. Microsoft said on Tuesday that fiscal first-quarter capital expenditures were $11.2 billion, up from $10.7 billion in the previous quarter, which itself was the biggest spend since at least fiscal 2016.

Sales of its Windows operating system and other products in the segment grew to $13.7 billion, compared with analysts' consensus estimate of $12.82 billion, according to data from LSEG.

FILE PHOTO: Smartphone is seen in front of Microsoft logo displayed in this illustration taken, July 26, 2021. REUTERS/Dado Ruvic/Illustration/File Photo (REUTERS/Dado Ruvic/Illustration/File Photo / Reuters Photos)

The segment containing the LinkedIn social network and its office productivity software grew to $18.6 billion, compared with analysts' consensus estimate of $18.20 billion, according to LSEG data.