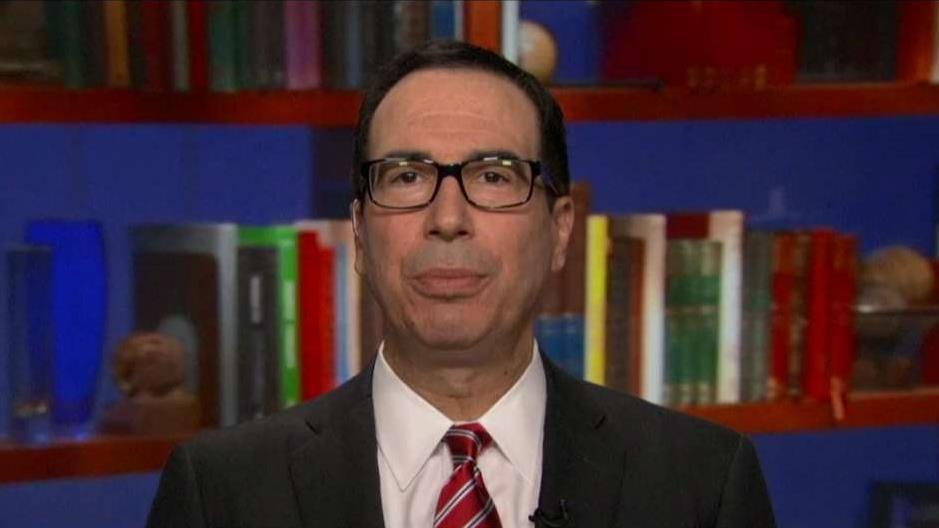

Mnuchin: Market reaction to Fed rate hike 'completely overblown'

Treasury Secretary Steven Mnuchin told FOX Business that the market selloff in reaction to the Federal Reserve’s rate-hike decision was “completely overblown.”

“I think that the market was disappointed in the Chairman’s comments,” he said during an exclusive interview with Stuart Varney on Thursday. “But I would say if you look at the specifics you can’t just look at the headline which was two more rate hikes you have to actually look at the seventeen dots on the dot plot.” The dot plot is a chart the Fed uses to convey expectations for the federal funds rate.

The Federal Reserve raised the key interest rate a quarter-point on Wednesday, as expected, and said they only anticipate two more hikes next year, down from the three that were forecasted.

In Mnuchin’s opinion the data showed more policymakers favored a slower pace of rate hikes.

“So each one of the governors and the people on the committee put their views. If you look at this the high end of the range came down significantly, and there’s still a pretty wide dispersion,” he said. “So there’s clearly people on the committee who don’t think they need to raise rates much here.”

With the Dow and S&P 500 on pace for the worst December since 1931 and with many stocks hitting 52-week lows, Mnuchin added that he feels “U.S. equities are tremendous value.”

The stock market declines in the final weeks of the year have come amid high volatility, a pattern Mnuchin blamed on algorithmic trading and the Volcker Rule.

“I think that with the advent of computerized trading which has such a big part of the market now combined with the Volcker Rule where you can’t have market makers commit capital, you just have much bigger moves in both directions,” he said. “Clearly you have a situation here where the market has overreacted to the Fed’s comments and you see program trading taking over.”

Mnuchin also said the Fed’s decision to downsize its balance sheet will give them more capacity in the future.