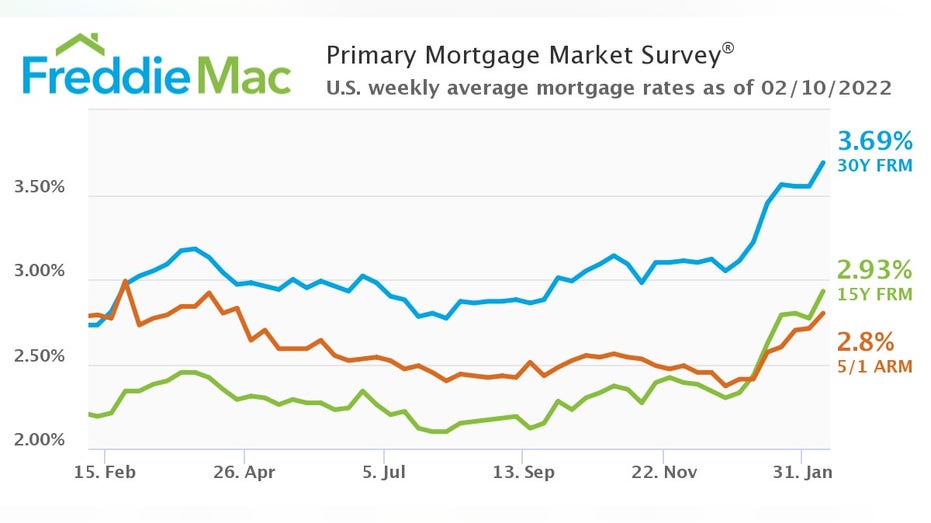

Mortgage rates hits pandemic era high

30-year fixed-rate mortgage: 3.69%

U.S. inflation hits 40-year high after jumping 7.5 percent in January

U.S. inflation rose 7.5 percent in January, the highest since February 1982. FOX Business Ed Lawrence with more.

It is not just food and energy prices that are getting more expensive, add borrowing costs to the list as bond yields spiked.

Mortgage rates have returned to pre-pandemic levels with the 30-year fixed-rate hitting 3.69% as of Thursday, according to Freddie Mac.

STOCKS VOLATILE AFTER HOT CPI REPORT

"Rate increases are expected to continue due to a strong labor market and high inflation, which likely will have an adverse impact on homebuyer demand," said Sam Khater, Freddie Mac’s chief economist.

HOUSTON'S MATTRESS MACK PLACES BIGGEST MOBILE SUPER BOWL BET EVER

Yields on the 10-year Treasury, which dictates mortgage rates, rose to 2%, the highest level since 2019, after the Consumer Price Index jumped 7.5% in January, the highest in nearly 40 years.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IEF | ISHARES 7-10 YEAR TREASURY BOND ETF - USD | 96.07 | 0.00 | 0.00% |

MOST SMALL BUSINESSES SINCE 1974 ARE HIKING PRICES TO OFFSET INFLATION

Rates for a 15-year adjustable-rate mortgage or ARM, also rose, to 2.93%, while a 5/1 ARM ticked up to 2.8%.

Higher rates will accompany higher home costs tied to short supply, according to the National Association of Realtors. In the fourth quarter, mortgage payment for an average single-family home valued around $361,700, with a 20% down payment, was $1,240 or $201.

That's a nearly 17% jump from a year ago. Expect those figures to rise well into 2022.