Nasdaq board-diversity rule takes center stage in court battle

Two conservative groups argue Nasdaq's diversity targets for listed companies amount to illegal racial and gender quota

Disney overtakes Meta as 'most woke' company in minds of conservative investors: Survey

American Conservative Values ETF President Tom Carter explains how investors are shying away from 'woke' companies

Lawyers for conservative groups argued in federal court Monday that Nasdaq Inc.’s push to set diversity targets for listed companies amounts to an illegal racial and gender quota.

Two right-leaning groups sued the Securities and Exchange Commission last year, setting up a battle over the hot-button issue of corporate diversity and how far regulators can go to foster it. The groups sued the SEC because the agency approved Nasdaq’s listing rules, acting in its capacity as the stock exchange’s regulator.

"These rules impose unprecedented demographic quotas and disclosure requirements regarding race, sexual preference and sex on companies valued at over $20 trillion," Peggy Little, a lawyer for the National Center for Public Policy Research, one of the two groups suing the SEC, argued in court.

The Nasdaq building at the Time Square, New York, on July 8, 2017. (Avalon/Universal Images Group via Getty Images / Getty Images)

GARY GENSLER'S GROSS SEC OVERREACH

Monday’s oral arguments in the New Orleans-based Fifth U.S. Circuit Court of Appeals marked the first time that the legality of Nasdaq’s listing rule has been debated in a courtroom.

Both the SEC and Nasdaq have argued that the exchange’s rule isn’t discriminatory and urged judges to reject the court challenge. Legal observers and some lawyers involved in the case say it is likely the case could eventually reach the Supreme Court.

Nasdaq’s rule consists of two key parts. One part, which took effect earlier this month, requires Nasdaq-listed companies to disclose the gender and ethnic makeup of their boards using a standardized template.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NDAQ | NASDAQ INC. | 84.83 | -0.68 | -0.80% |

The other part, set to take effect in phases over the next few years, sets minimum diversity targets for company boards. For most U.S. companies, the ultimate target will be to have one female director and one director who self-identifies as a racial minority or as lesbian, gay, bisexual, transgender or queer. Companies that don’t meet the targets will need to explain in writing why they didn’t do so.

The groups suing the SEC say the rule effectively shames companies into appointing members of minority groups to their boards, while discriminating against other candidates. The SEC and Nasdaq have countered that the exchange’s rule is just a disclosure requirement, aimed at satisfying demand from investors who wish to put money in companies run by diverse boards.

"It is a classic disclosure rule," Allyson Ho, a partner with law firm Gibson, Dunn & Crutcher LLP who is representing Nasdaq, said in court.

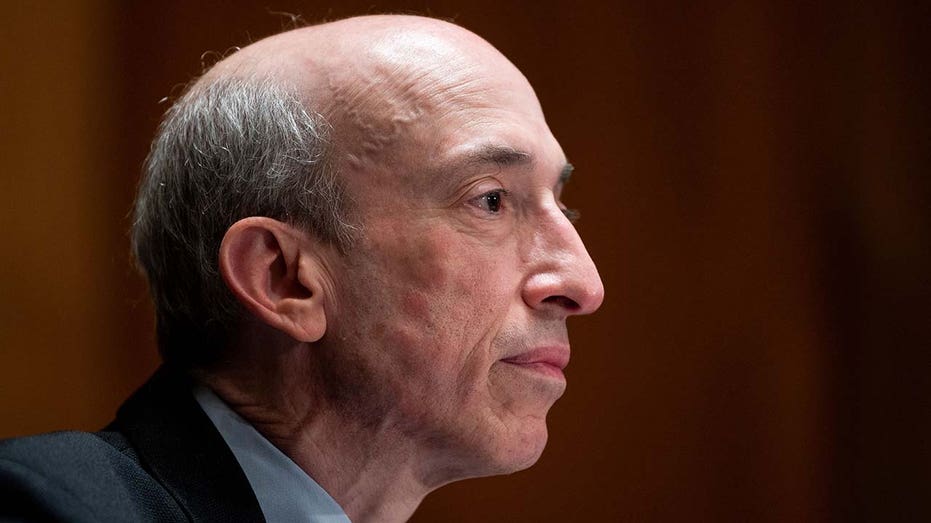

Gary Gensler, chair of the Securities and Exchange Commission, testifies during the Senate Banking, Housing, and Urban Affairs Committee hearing on "Oversight of the US Securities and Exchange Commission" on Sept. 14, 2021 in Washington, D.C. ((Photo by Bill Clark/Pool/AFP via Getty Images) / Getty Images)

The SEC and Nasdaq also said the U.S. government didn’t force the exchange to implement the rule, and that Nasdaq developed the rule on its own initiative. As a consequence, they argued, the courts can’t consider a challenge based on whether Nasdaq’s rule violates the U.S. Constitution, since the provisions of the constitution generally apply to state actors rather than private companies.

"This was a private initiative undertaken by Nasdaq," SEC attorney Tracey Hardin said.

The lawyers fighting Nasdaq’s diversity rule said it violates the constitutional right to equal protection. They argued that the SEC’s decision to approve the rule, as well as Nasdaq’s obligations as an SEC-regulated exchange, made the dispute a matter of constitutional law.

"A rule that facially discriminates on the basis of race and sex now has the imprimatur of the federal government," said Jonathan Berry, a lawyer for the Alliance for Fair Board Recruitment, the other group challenging the Nasdaq rule.

Some members of the three-judge panel hearing Monday’s arguments voiced skepticism of whether Nasdaq’s rule amounted to a racial or gender quota.

"Nasdaq’s rule is disclose or explain," Judge Stephen Higginson said during questioning. "To me it sounds like investors get whatever crazy information they want, because that’s going to decide where they put their money."

While the Fifth Circuit is seen by lawyers as one of the country’s most conservative federal appeals courts, the three-judge panel selected by lottery to hear Monday’s oral arguments consisted solely of appointees by Democratic presidents.

South Building on the campus of UNC-Chapel Hill.

If the plaintiffs lose before the three-judge panel, they could seek a rehearing by the full Fifth Circuit—which is dominated by Republican-appointed judges—or appeal to the Supreme Court.

The Alliance for Fair Board Recruitment was founded by conservative activist Edward Blum, who is better known for his high-profile challenges to affirmative action in college admissions.

Mr. Blum also leads Students for Fair Admissions, the group suing Harvard University and the University of North Carolina at Chapel Hill over their race-conscious admissions policies in a pair of cases being heard by the Supreme Court later this fall.