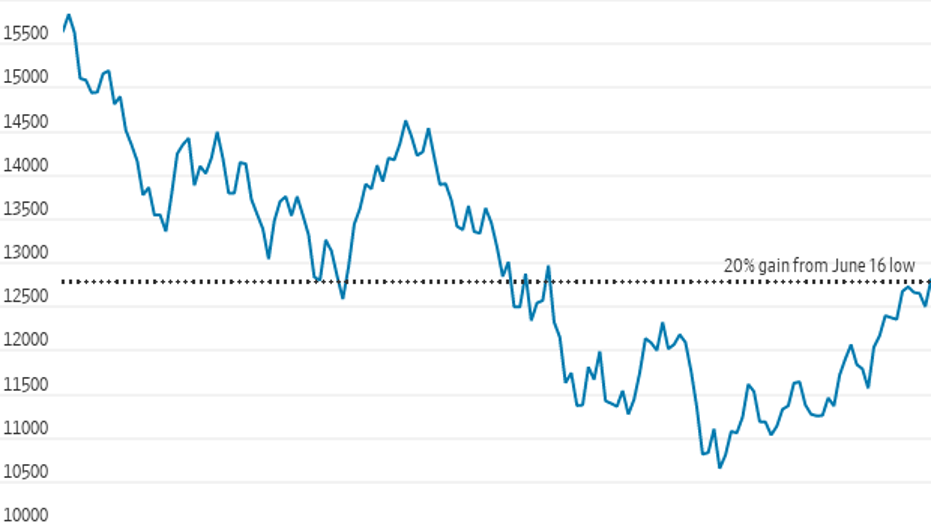

Nasdaq enters bull market, exits worst bear market since 2008

Tech stock inflows hit record levels for BofA clients last week

Peter Schiff rips Fed for lighting inflation fire: Recession about to get much worse

Euro Pacific Capital chief economist Peter Schiff, SlateStone Wealth chief market strategist Kenny Polcari and Seaport Securities founder Teddy Weisberg debate if inflation has peaked on 'The Claman Countdown.'

The Nasdaq Composite kissed its worst bear market in 14 years goodbye.

Wednesday, the tech-heavy composite gained 2.9% closing at 12,854.80, officially entering a new bull market, as tracked by Dow Jones Market Data Group. The gains were fueled, in part, by a slight easing of inflation which rose 8.5% in July, down from June’s 9.1%. Still, prices remain near 40-year highs an overhang on the economy.

INSIDE JULY'S LATEST INFLATION REPORT

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 22682.729157 | -70.91 | -0.31% |

"If inflation continues to drop, the bull-steepening trade will gain further momentum. The Nasdaq has just rallied 20% in 55 days, which is making a lot of traders abandon the idea that this is a bear market rally" wrote Edward Moya, senior market analyst, The Americas OANDA.

FACEBOOK'S META DEFENDS ACTION WITH COPS DURING INVESTIGATION

NASDAQ Composite Index (FactSet)

BofA's institutional clients plow into tech stocks at record levels

Bank of America’s institutional clients continued to pile into tech and communication stocks with inflows hitting the most on record last week, $3.3 billion, as noted by the team led by Jill Carey Hall, Equity & Quant Strategist, BofA.

Despite July’s consumer price index pullback, several economists, including former Treasury Secretary Larry Summers, continue to sound the alarm on inflation.

(REUTERS/Joshua Roberts / Reuters Photos)

"I still think we have a very serious inflation problem in this country. I don't think that inflation problem is going to go away of its own volition. And so I think we're likely to have some quite turbulent times ahead," he said during an interview on MSNBC following the report.

Despite the gains, the Nasdaq is still off about 20% from its all-time high of 16,057.44 reached in November 2021.

Nasdaq Composite

"We see risk that tech may not prove to be as defensive as some investors expect; Nasdaq earnings revisions have continued to lag S&P 500 earnings revisions" Carey’s team cautioned.