Nasdaq’s nosedive nears pandemic crash of 2020

The 10-year yield hit 3.203% Monday – a 3.5 year high

Margin calls creating a cascading effect throughout the market: Hayes

Fidelity Investments regional VP John Gagliardi and Great Hill Capital chairman Tom Hayes debate when the market sell-off will end on 'The Claman Countdown.'

In the current market downturn, while all three of the major averages have been hit, investors have hammered the Nasdaq Composite the most. It's down 27% this year.

"The tech stocks that have been taken out into the woodshed are on fears of excessively high rates and never endings," Thomas Hayes, chairman and managing member at Great Hill Capital LLC told FOX Business.

BOND KING WARNS OF LOOMING RECESSION

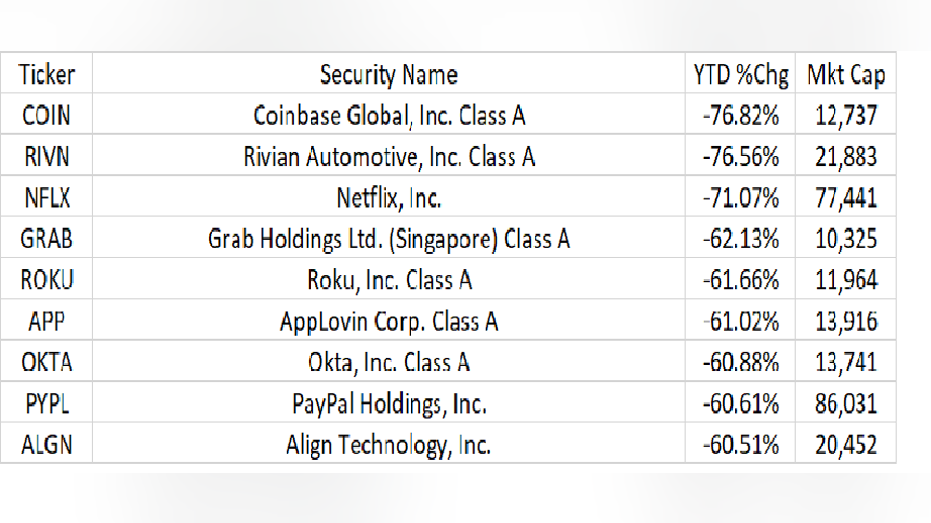

(Source: Dow Jones Market Data Group )

The top three worst-performing Nasdaq stocks are Coinbase, Rivian and Netflix, all off well over 70% this year and feeling the sting of more and potentially larger rate hikes by the Federal Reserve.

STOCK CARNAGE, POWELL'S APOLOGY HINTS AT POLICY FAILURE

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COIN | COINBASE GLOBAL INC. | 165.12 | +19.00 | +13.00% |

| RIVN | RIVIAN AUTOMOTIVE INC. | 14.80 | +1.07 | +7.79% |

| NFLX | NETFLIX INC. | 82.20 | +1.33 | +1.64% |

"I told you the guidance that broad support on the Committee is to have 50 basis point hikes on the table at the next couple of meetings," said Federal Reserve Chairman Jerome Powell during the Q&A portion of his press conference earlier this month after policymakers raised the benchmark interest rate by a half-point for the first time in two decades.

TWITTER PAUSES HIRING, EXECUTIVES CANNED

Even so, Hayes sees a silver lining tied to the last tightening cycle in 2015-2016. "I think we're seeing a similar situation that the fear of the tightening was and will be far more painful than the actual tightening itself," he added.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

Still, the tech-heavy composite is on pace to cross the lows hit in the pandemic crash of March 2020, if it falls to or below 11,221.68, as tracked by Dow Jones Market Data Group.

CLICK HERE TO READ MORE ON FOX BUSINESS

Nasdaq Composite

Already down 30% from its November 2021 peak, it's now tracking for the worst bear market since the October 2007 peak to November 2008 bottom when it lost over 53%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Still, Hayes sees a break in the selling. "I think what you've seen in the last 48 hours is actually very, very constructive in that the 10-year yield has backed off from 3.19% peak," settling at 2.815% Thursday.