Net Margin

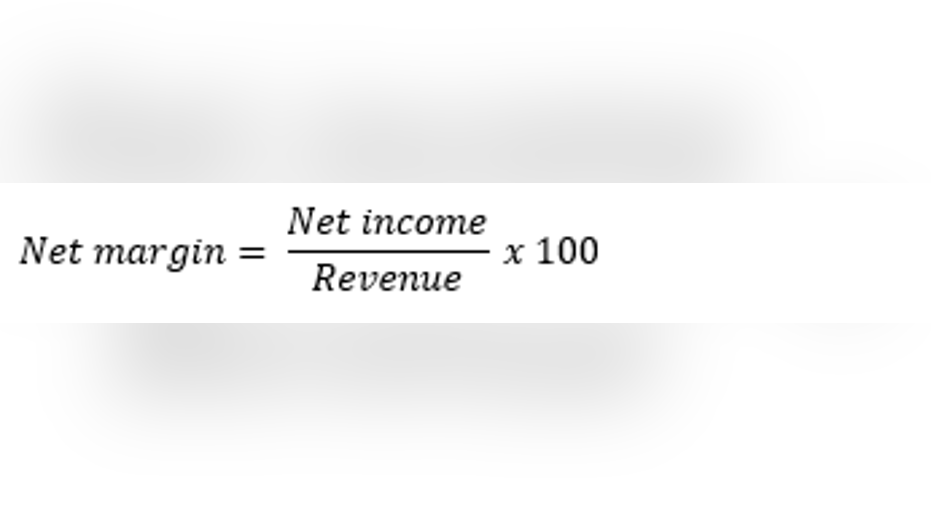

Simply put, net margin refers to a company's profit margin after all of its expenses have been accounted for, such as operating expenses, interest, and taxes. To calculate a company's net margin, divide its net income for a certain period by its total revenue, both of which can be found on the company's income statement. Then, multiply the result by 100 to convert to a percentage.

Keep in mind that net margin can be positive or negative, with a negative net margin representing a company that was unprofitable during a certain time period.

How to use net marginNet margin can give you an idea of how profitable a company is, but this is only useful for comparisons between companies in the same industry. Companies in certain industries are considered to be quite profitable with a net margin of just a few percentage points, while others typically operate at net margins well into the double digits. To illustrate this, consider the average net margins of certain industries as of January 2016.

|

Industry |

Average Net Margin |

|---|---|

|

Pharmaceuticals |

17.52% |

|

Furniture/Home furnishings |

4.48% |

|

Homebuilding |

7.98% |

|

Restaurants |

8.99% |

|

Retail (general) |

2.44% |

|

Software (Internet) |

12.52% |

Data source: NYU.

An exampleLet's say that you are doing investment research on two athletic apparel companies --Nike and Under Armour-- and you want to know which company operates at a more attractive net margin.

During 2015, Under Armour generated total revenue of $3.96 billion. After its operating expenses, interest expense, income taxes, and other various expenses, the company produced net income of $233 million. So, if we use these figures in our net margin formula, we see that Under Armour operated at a net margin of 5.9%.

Also in 2015, Nike's total revenue was $30.6 billion. After accounting for all of its expenses, the athletic apparel giant produced net income of $3.27 billion. From this information, we can calculate Nike's net margin to be 10.7%, far greater than Under Armour's.

Now, this doesn't necessarily mean that Nike is the better investment. First, Under Armour is a much more rapidly growing company, and may invest more in marketing and development than Nike. More important, net margin is just one piece of the puzzle when evaluating a potential investment -- there are many other metrics to consider before making a decision.

What else should you look at?There are literally hundreds of metrics you can look at when evaluating a stock, but just to name a few of the most useful ones you can use:

Price-to-earnings (P/E) ratio-This tells you how much the market is willing to pay relative to a company's profits, and can be useful for comparing companies in the same industry.

Price-to-book (P/B) ratio-This useful value investing metric tells you how much a stock trades for relative to the value of the company's assets.

Payout ratio-This is the company's dividend as a percentage of its earnings. A high payout ratio can be a sign that the dividend is unsustainable.

Debt-to-equity-High debt can be a sign of trouble in a company.

Free cash flow-Shows investors how much money in flowing into a company after all expenditures.

PEG Ratio-A version of the P/E ratio that takes growth into account. Can help to find growth companies trading for attractive prices.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us atknowledgecenter@fool.com. Thanks -- and Fool on!

The article Net Margin originally appeared on Fool.com.

The Motley Fool owns shares of and recommends Nike and Under Armour. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.