Nvidia continues AI-driven surge, announces $25B stock buyback

Nvidia announced a $25 billion stock buyback as its Q2 earnings beat expectations

What will Nvidias earnings report show?

I/O Fund lead tech analyst Beth Kindig explains how investors should approach the stock on Making Money.

Nvidia exceeded analysts’ expectations with its latest earnings announcement, riding the artificial intelligence (AI) boom on its advanced chips and announcing a $25 billion stock buyback.

Santa Clara, California-based Nvidia has emerged as a powerhouse in the AI space in large part due to its advanced computer chips, which are used in most generative AI apps and the training of large language models that power them. Nvidia’s earnings results from the second quarter of the company’s fiscal year showed that its momentum is continuing to build.

"A new computing era has begun," said Jensen Huang, Nvidia’s CEO. "The industry is simultaneously going through two platform transitions: accelerated computing and generative AI. Data centers are making a platform shift from general purpose to accelerated computing. The trillion dollars of global data centers will transition to accelerated computing to achieve an order of magnitude better performance, energy efficiency and cost."

NVIDIA ANNOUNCES NEW CHIP TO POWER AI MODELS, REDUCE COSTS

Nvidia announced a $25 billion stock buyback after a blockbuster Q2 earnings report and a strong revenue forecast for Q3. (REUTERS/Tyrone Siu / Reuters Photos)

"Accelerated computing enabled generative AI, which is now driving a platform shift in software and enabling new, never before possible applications. Together, accelerated computing and generative AI are driving a broad-based computer industry platform shift," he added. "Nvidia has been preparing for this for over two decades and has created a new computing platform that the world’s industries can build upon."

Nvidia’s second-quarter revenue came in at $13.5 billion, beating estimates of $11.2 billion. Its forecast for the third quarter projects a jump to about $16 billion, plus or minus 2%, which exceeded the expectations of analysts polled by Refinitiv, who on average projected $12.6 billion.

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., said Nvidia has been preparing for the rise of accelerated computing and generative AI for two decades during the company's Q2 earnings call. (Photographer: I-Hwa Cheng/Bloomberg via Getty Images / Getty Images)

The company reported a 53% jump in its inventory commitments from the prior quarter as it looks to meet and secure long-term demand for its data center chips.

"Our demand is tremendous. We are significantly expanding on our production capacity. Supply will substantially increase for the rest of this year and next year," Huang added.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 185.41 | +13.53 | +7.87% |

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Colette Kress, Nvidia’s chief financial officer, briefly discussed the impact of restrictions on the export of high-end semiconductors to China.

The current export controls have prompted Nvidia to rework one of its chips so that it can still be sold to customers in China without violating those restrictions – although the U.S. government is weighing additional curbs that Kress said could have a detrimental long-term impact if they’re implemented.

"We believe that the current regulation is achieving the intended result. Given the strength of demand for our products worldwide, we do not anticipate that additional export restrictions on our data center GPUs, if adopted, would have an immediate material impact to our financial results. However, over the long term, restrictions prohibiting the sale of our data center GPUs to China, if implemented, will result in a permanent loss of an opportunity for U.S. industry to compete and lead in one of the world’s largest markets," she said.

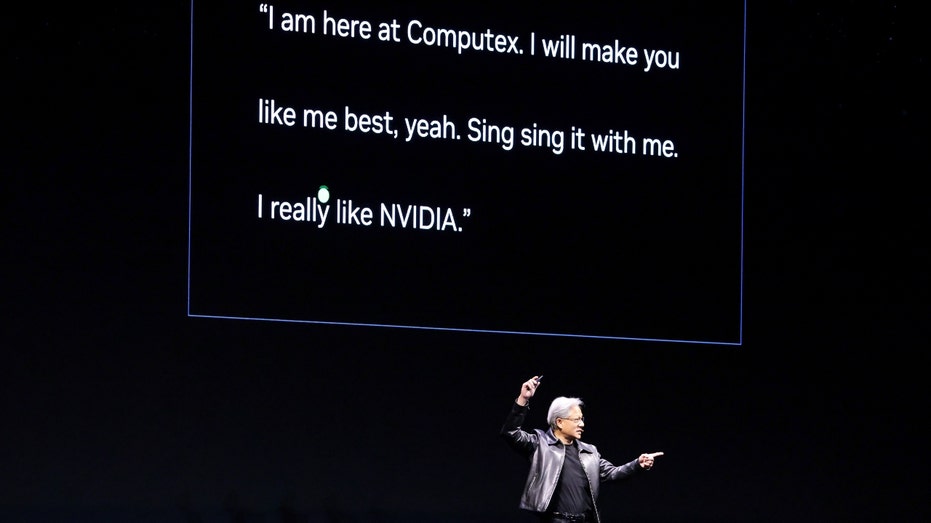

Jensen Huang, CEO of NVIDIA, said the company's demand is "tremendous" and it will increase supply this year and next to meet it. ((Photo by SAM YEH/AFP via Getty Images) / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia also announced the approval of a $25 billion stock buyback – a boon to shareholders who have seen the company’s stock price surge this year, which drove its market value over the $1 trillion threshold in late May.

Nvidia’s stock was up by 3.17% during Wednesday’s trading session. Following the earnings call after the bell, Nvidia’s stock rose a further 6.8% in after-hours trading – bringing its year-to-date gains to about 229%.

Reuters contributed to this report.