Nvidia, Microsoft, Apple about to rock big tech ETF

State Street’s Technology Select Sector SPDR XLK has gained 19% this year

Ripple CEO: XRP ETF comes in 2025

Ripple CEO Brad Garlinghouse discusses the possibility of an XRP ETF on 'The Claman Countdown.'

Nvidia, Microsoft and Apple all jockeyed this week for the title of world’s most valuable company as investors bet big on the future of AI.

The moves coincide as one of the biggest tech exchange-traded funds, State Street’s Technology Select Sector SPDR with assets near $80 billion, prepares for a monster rebalance.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 185.41 | +13.53 | +7.87% |

| AAPL | APPLE INC. | 278.12 | +2.21 | +0.80% |

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

"It is an anomalous event where you have three securities, a market capitalization greater than $3 trillion, all at the same time, all within one sector. That is unprecedented. Never happened before," Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors, told FOX Business.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLK | TECHNOLOGY SELECT SECTOR SPDR ETF | 141.06 | +5.47 | +4.03% |

Nvidia on Tuesday unseated Microsoft as the world’s most valuable company for the first time, though ongoing volatility this week still has the two – and Apple – neck and neck.

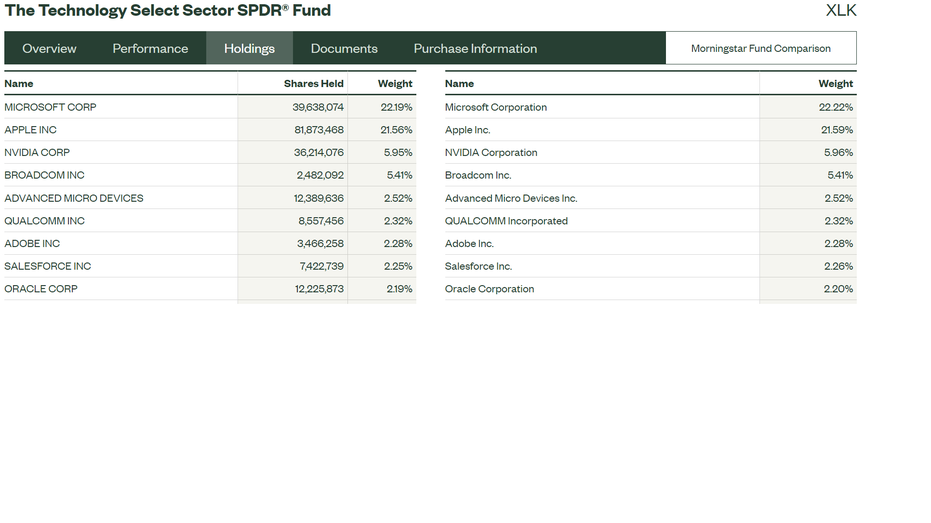

The chipmaker represents just under 6% of the XLK ETF, while Apple and Microsoft are over 21% each, according to the firm. After the rebalance, Nvidia will leapfrog Apple.

State Street’s Technology Select Sector SPDR (XLK) (State Street Global Advisors )

"Right now, because the fund hasn't rebalanced, Apple is the second-largest security. So that means you have to rebalance and sell Apple shares to buy Nvidia shares," Bartolini said.

The rebalancing will take place on Friday after the close of trading, with the fund’s changes visible on Monday.

Nvidia has seen its shares skyrocket nearly 160% this year as it continues to lead the race for AI chips. Last quarter, it posted a record $26 billion in revenue, a 262% jump from the year-ago period. The company also completed its 10-for-1 stock split, which began trading on June 10, and it also boosted its quarterly dividend payout 150% to 10 cents per share.

Nvidia

Constellation Research founder R "Ray" Wang is betting shares will top $200 this year.

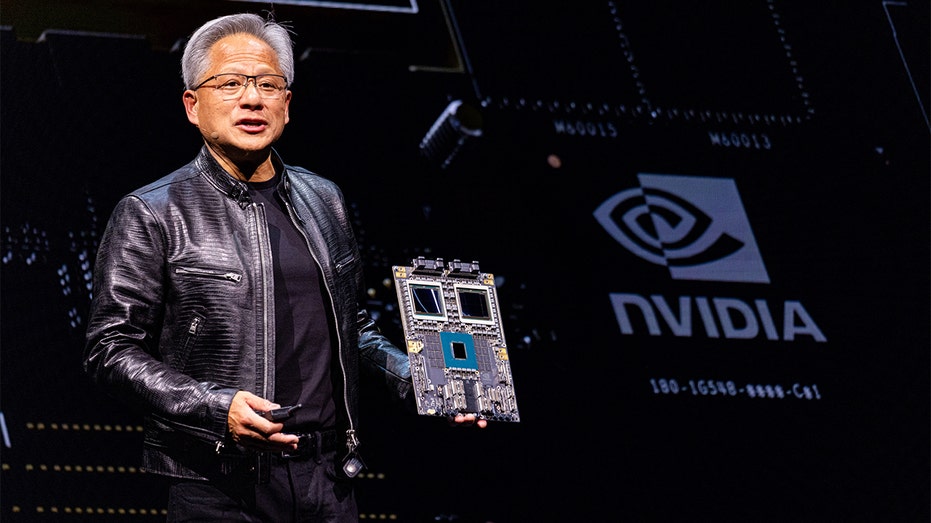

"They are the dominant one in market share, competitors are barely catching up and of course their product roadmap, we are only seeing one-tenth of what they’re able to deliver, and they’ve made the GPU the standard in AI, and the growth numbers don’t lie," Wang said during an appearance on "Varney & Co." "If you look at sales, they are there, even if the P/E numbers are crazy, they are catching up with the sales numbers and, of course, they have a visionary founder."

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., during a news conference in Taipei, Taiwan, on Tuesday, June 4, 2024. ( Photographer: Annabelle Chih/Bloomberg via Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

CEO Jensen Huang, whose signature look is a black leather jacket, has a cult following that is growing around the globe as the company fires on all cylinders. During a recent trip to Taiwan, his birth country, he got the rock star treatment.

Jensen Huang, co-founder and CEO of Nvidia Corp., gives a talk in Taipei, Taiwan. (Annabelle Chih/Bloomberg via Getty Images / Getty Images)

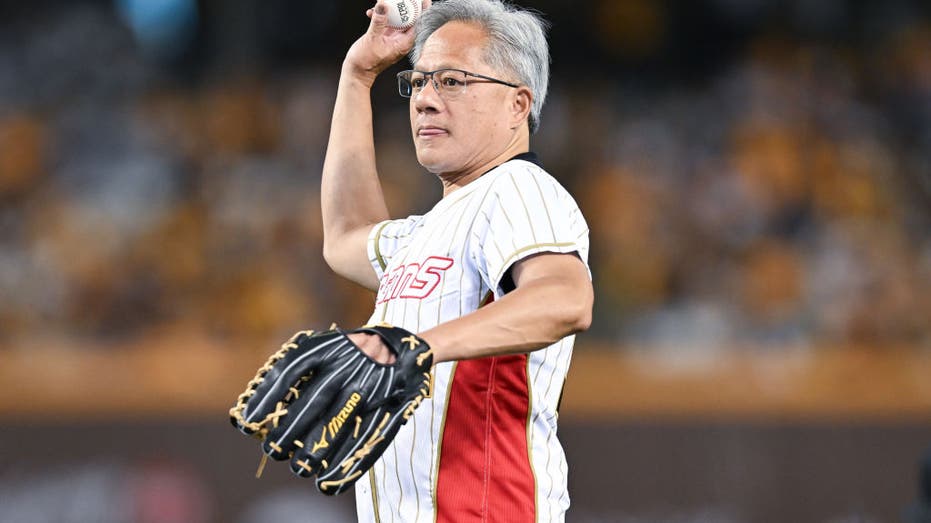

He even threw out ceremonial first pitches, including one before a game between the CTBC Brothers and Wei Chuan Dragons at Taipei Dome.

Nvidia CEO Jensen Huang throws out the ceremonial first pitch to the CPBL game between CTBC Brothers and Wei Chuan Dragons at the Taipei Dome on June 1, 2024, in Taipei, Taiwan. ((Photo by Gene Wang/Getty Images))