Oil tops $90 as inflation kicks up

Crude prices spiked to highest level in 10 months

President Biden's war on fossil fuels has powered recent spike in oil prices

Heritage Foundation Vice President Victoria Coates calls out the Biden administration's "political game" on "Making Money."

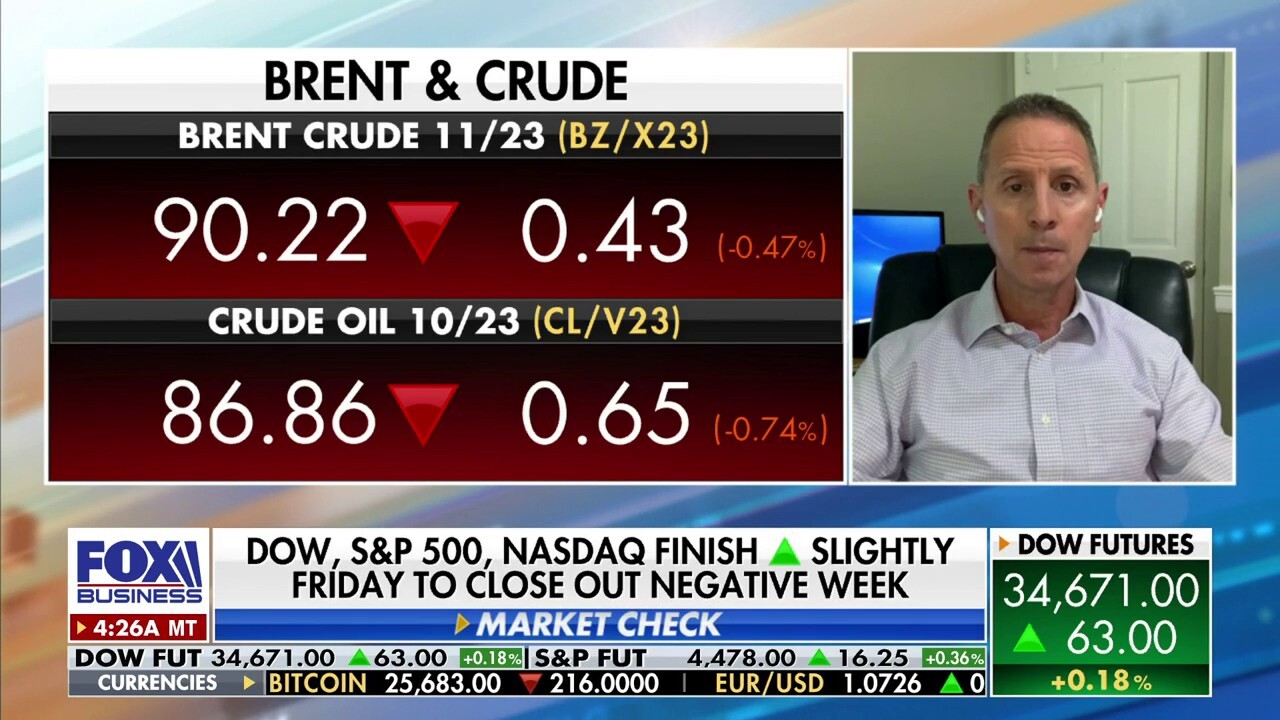

The price of oil moved over the $90-per-barrel mark on Thursday as crude supplies tighten and as Saudi Arabia and Russia cut production.

Crude is now at the highest level in 10 months.

The climb has added to inflationary pressure.

On Wednesday, the consumer price index rose 3.7% annually in August, more than expected. The jump was fueled by a surge in gas prices, which accounted for more than half of the increase last month, the Labor Department said in the report. In total, energy prices climbed 5.6% in August from the previous month, including a 10.6% jump in gas prices.

The producer price index, reported Thursday, which measures inflation at the wholesale level before it reaches consumers, climbed 0.7% in August from the previous month. On an annual basis, prices are up 1.6%.

AMERICAN AIRLINES, SPIRIT LOWER GUIDANCE ON HIGHER FUEL COSTS

Meanwhile, the Russian and Saudi output reductions will result in a market deficit through the fourth quarter, the International Energy Agency said Wednesday before a bearish U.S. inventories report prompted a slight pullback in prices.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.98 | +0.28 | +0.37% |

| BNO | UNITED STATES BRENT OIL FUND - USD ACC | 32.03 | +0.20 | +0.63% |

ExxonMobil’s Beaumont refinery expansion adds 250,000 barrels per day to the oil company’s processing capacity. (Fox News Digital / ExxonMobil / File / Fox News)

West Texas Intermediate is up over 13.5% the last five days and now more than 31% the last quarter, while Brent Crude, the global benchmark, is now roughly 3.8% higher the last five days and almost 24% higher the last three months.

OIL PRICES HIT 9-MONTH HIGH AS SUPPLY CONCERNS MOUNT

'Absurd' policies could send oil costs over $100 per barrel: veteran trader

TJM Institutional Services Director James Iuorio looks ahead at a big week of inflation data, including the latest numbers out of China.

Priyanka Sachdeva, senior market analyst at Phillip Nova, said supply fears are underpinning oil prices as producers "adamantly stick to restricted production."

SAUDI ARABIA EXTENDS OIL PRODUCTION CUTS TO END OF 2023, SENDING PRICES SOARING

The Organization of the Petroleum Exporting Countries (OPEC) recently issued updated forecasts of solid demand and also pointed to a 2023 supply deficit if production cuts are maintained.

The price of oil moved over the $90-per-barrel mark on Thursday as crude supplies tighten and as Saudi Arabia and Russia cut production. (Dado Ruvic / File / Reuters Photos)

Meanwhile, oil producers like Chevron, Hess, ExxonMobil and Occidental Petroleum historically have benefited from higher oil prices.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVX | CHEVRON CORP. | 180.86 | +1.63 | +0.91% |

| HES | NO DATA AVAILABLE | - | - | - |

| XOM | EXXON MOBIL CORP. | 149.05 | +2.97 | +2.03% |

| OXY | OCCIDENTAL PETROLEUM CORP. | 46.31 | +1.22 | +2.71% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business' Megan Henney and Reuters contributed to this report.