Oil and Gas Stock Roundup: Sliding Crude Slams the Weakest Links

What happened

Oil prices continued their slow sell-off this week, ending down another 1.7% and below $48 per barrel. As in prior weeks, the main weight on crude prices were rising U.S. oil stockpiles, which set another record according to the U.S. Energy Information Administration.

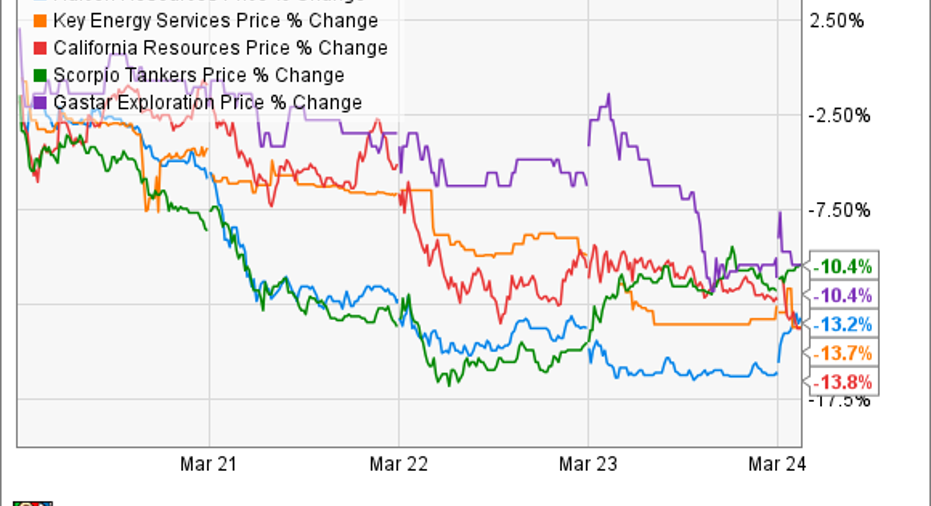

Those weak crude prices weighed on most oil stocks this week. However, the hardest hit were more vulnerable companies that really need higher oil prices to thrive. Topping that list, according to data fromS&P Global Market Intelligence, wereHalcon Resources (NYSE: HK), Key Energy Services (NYSE: KEG), California Resources (NYSE: CRC), Scorpio Tankers (NYSE: STNG), and Gastar Exploration (NYSEMKT: GST).

So what

Shale driller Gastar Exploration was one of the few oil stocks that had some non-oil price news that accelerated its decline that week. That's because the company also announced that it spent $51.4 million to acquire additional working interests in several producing wells and 5,670 net acres in the STACK play of Oklahoma. Gastar Exploration will pay for the deal by issuing $75 million of convertible notes to a private equity fund that recently provided it with financial support, bringing the total up to $200 million. The issue for investors is that those convertible notes will likely lead to substantial future dilution. For example, Gastar anticipates converting $37.5 million of those notes to equity in the near future by issuing more than 25 million new shares, which alone represents nearly 14% dilution.

Meanwhile, California Resources' oil price sell-off seemed to accelerate after it held its analyst and investor day this week. While the California oil company detailed its progress over the past year, it also made it clear that there is still much work left to do. Topping that priority list is its balance sheet, which still has way too much debt for the current environment. In fact, at $55 oil, the company's leverage ratio would be over 7.0 times this year, while many peers are keeping their leverage ratio below 3.0 times. Because of that, a significant portion of its cash flow is going toward interest payments instead of capital investments. Meanwhile, if oil keeps falling, so will cash flow, which would put more pressure on its balance sheet.

Image source: Getty Images.

Finally, refined product tanker company Scorpio Tankers, shale driller Halcon Resources, and oil-field service company Key Energy Services all seemed to sell off as a result of weaker oil prices. Halcon Resources and Key Energy Services both recently emerged from bankruptcy after collapsing under the weight of debt during the oil market downturn. While the companies emerged with less debt, they need higher oil prices to thrive. Meanwhile, Scorpio seems to be falling due to concerns surrounding tanker demand given the amount of crude piling up in storage.

Now what

Sell-offs are often a good chance to go bargain-hunting. However, that's not the case here as all five companies have fragile balance sheets and need higher oil prices to drive growth, which means these stocks could continue to sink if oil prices remain weak. Because of that, investors are better off looking somewhere else for sell-off-inspired bargains worth buying.

10 stocks we like better than California ResourcesWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and California Resources wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017

Matt DiLallo has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.