A look at past oil shocks, Israel's war and Iran as wild card

Iran's potential involvement between Israel, Hamas could rock oil prices

Oil sales to Iran are a big issue: Mnuchin

Former Treasury Secretary Steven Mnuchin provides insight on potential sanctions following Hamas' attack on Israel on "Kudlow."

Global investors are keeping a close eye on commodity and stock prices after the surprise attacks by Hamas on Israel a week ago that killed 1,300 Israelis, most of them civilians, and took dozens of hostages back to Gaza. The Gaza Health Ministry said more than 2,300 Palestinians have been killed since the fighting erupted, and on Sunday, an Israeli ground assault on Gaza was looming.

After bouncing between losses and gains during the week, oil rose more than 5% to the $87.69 per-barrel level, with the bulk of those gains coming on Friday, as tracked by Dow Jones Market Data Group.

U.S. Oil Fund

IRAN WARNS ISRAEL AS WAR RAGES

"When we first had the invasion, oil prices rose sharply higher, everybody got long, and then a few hours later everybody said wait a minute, Israel doesn't produce any oil, supplies are not at risk, so everybody that was trying to jump into the market to take advantage of that got crushed when prices fell," said Phil Flynn of Price Futures Group and a FOX Business contributor.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.98 | +0.28 | +0.37% |

| BNO | UNITED STATES BRENT OIL FUND - USD ACC | 32.03 | +0.20 | +0.63% |

"But this is a new game, a new phase," he added, with the wild card being Iran and its meeting with Hamas last week that pushed prices higher on Friday. Iran is also the biggest financial backer of Hezbollah, the Lebanese militant group.

Iran’s foreign minister has warned that an Israeli ground offensive in Gaza would force Iran to intervene, likely expanding the war to other parts of the Middle East, according to a report.

A picture of Iranian leaders is displayed during demonstrations in Tehran to celebrate Hamas' attack on Israel on Oct. 7, 2023. (Hossein Beris / Middle East Images / AFP / Getty Images)

Hossein Amir-Abdollahian made the comment during a meeting with the United Nations' envoy to the Middle East, Tor Wennesland, on Saturday in Beirut, Axios reported, citing two diplomatic sources with knowledge of the situation.

Saudi Arabia is the largest OPEC producer, according to the EIA, while Iran is fifth.

This view shows the Abadan oil refinery in southwest Iran. (Reuters / Essam Al-Sudani / File / Reuters Photos)

But crude's climb, so far, has not matched other conflicts, according to some strategists.

INFLATION RISES MORE THAN EXPECTED IN SEPTEMBER AS HIGH PRICES PERSIST

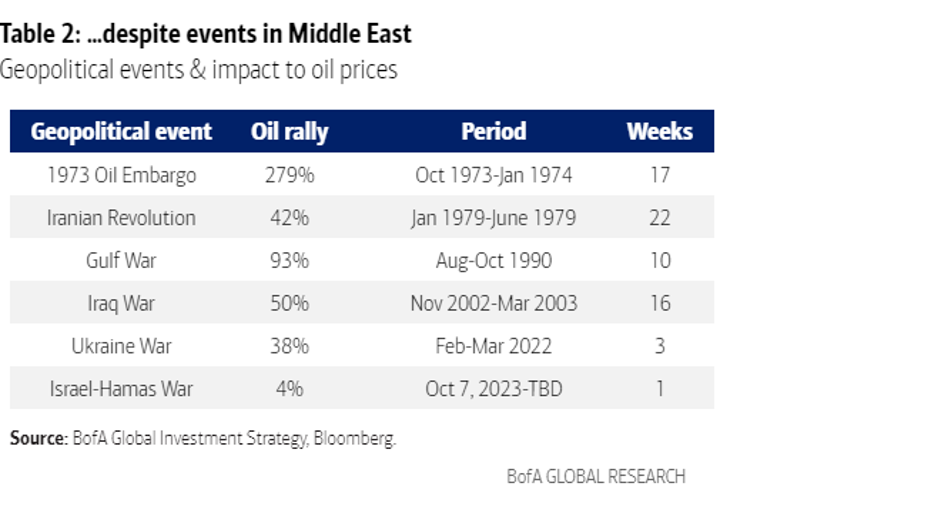

Michael Hartnett, investment strategist at Bank of America, noted that the move in oil has been much less muted than other global conflicts.

"Other shocks saw oil jump 40% to 90% in short order. Oil barely moved [last] week; maybe geopolitics don’t spiral or maybe oil is sending [a] recession signal" he wrote in a research note with accompanying charts.

He outlined the "Tale of the Tape: 5 'oil shocks' of past 50 years," which included the Yom Kippur War in 1973 that saw oil go up about 300% in four months; the Iraq War in November 2002 that saw a 50% jump in about three weeks; and the Ukraine War, which began in February 2022 and saw a nearly 40% jump in less than a month.

Michael Hartnett, investment strategist at Bank of America, noted that the move in oil has been much less muted than other global conflicts. (Bank of America)

Still, the world markets will continue to monitor the situation in the coming days.

Last week, JPMorgan CEO Jamie Dimon warned about all the geopolitical unrest in the world today.

"This may be the most dangerous time the world has seen in decades," he said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Fox News' Stephen Sorace contributed to this report.