Peloton stock jumps higher after reporting quarterly loss

Expert: ‘Only a matter of time before the hype dies off’

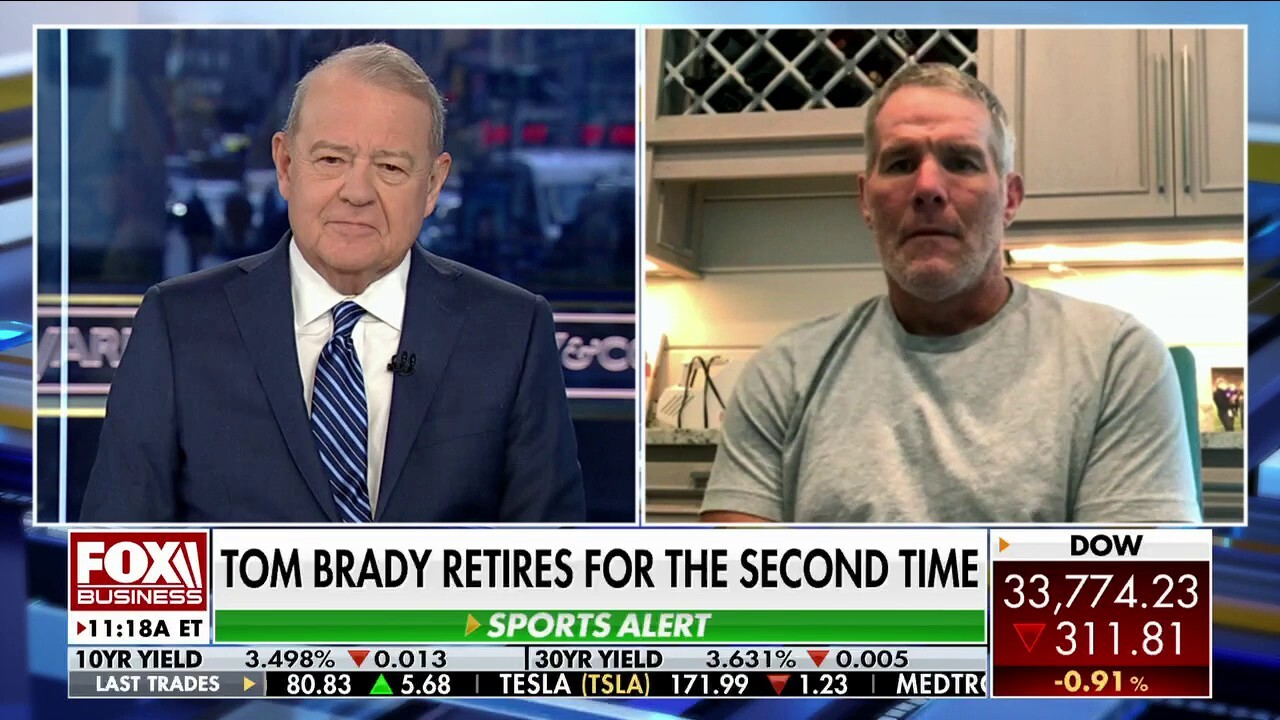

NFL legend Brett Favre on Tom Brady’s second retirement: My gut says ‘this is it’

Hall of Fame quarterback Brett Favre joined ‘Varney & Co.’ to discuss Tom Brady and his controversial decision to retire from the NFL for the second time.

Peloton shares are spiking Wednesday despite the company losing $335.4 million in its latest quarter and revenue tumbling 30% to $792.7 million.

The fitness and media company forecast current-quarter revenue above expectations, in an early sign that its efforts to boost sales, including by selling on third-party platforms, were beginning to yield fruit.

For the third quarter, Peloton forecast revenue between $690 million and $715 million, above expectations of $689.1 million, as per Refinitiv data.

Peloton

In an interview with FOX Business, Adam Kobsissi, founder of the financial newsletter, The Kobeissi Letter, said "Overall, it was a disappointing quarter for Peloton, except that markets see the 10% jump in connected fitness subscriptions as a strong bullish indication."

"Margins are significantly higher for this recurring revenue segment," he continued. "Gross margins for its connected fitness products were - 11.2%, but gross margins for subscription sales were +67.6%."

However, "This is just a case of markets looking for a reason to rally after a severely oversold technical picture developed," he added.

In its latest quarter, Peloton reported 6.7 million members, down 1% year-over-year, and a 10% increase in connected fitness subscriptions to 3.033 million. In the September quarter, the company showed 2.973 million ending connected fitness subscribers.

In addition to access to the Peloton Bike, Hilton Honors members who are first-time Peloton users will receive a free 90-day trial to the fitness giant's app, which offers thousands of live and on-demand classes without the need for equipment, as wel (Peloton/Hilton)

While subscriber growth has been bullish, Kobeissi said, "There are no long-term merits for the company now that Peloton has become a product instead of a company."

"Only a matter of time before the hype dies off," he finished.

Free cash flow was an outflow of $94 million after peaking at $747 million nine months ago.

The company kept its goal of break-even free cash flow by the end of fiscal 2023, a key milestone being watched by investors.

Year-to-date, the stock is up more than 90%. Over the last year, Peloton shares remain off by more than 40%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Peloton Interactive

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| PTON | PELOTON INTERACTIVE INC. | 4.42 | +0.10 | +2.31% |

Reuters contributed to this report.