PepsiCo hikes prices, consumer demand steady for drinks, snacks

Beverage, snack giant lifts full-year guidance after strong start to 2023

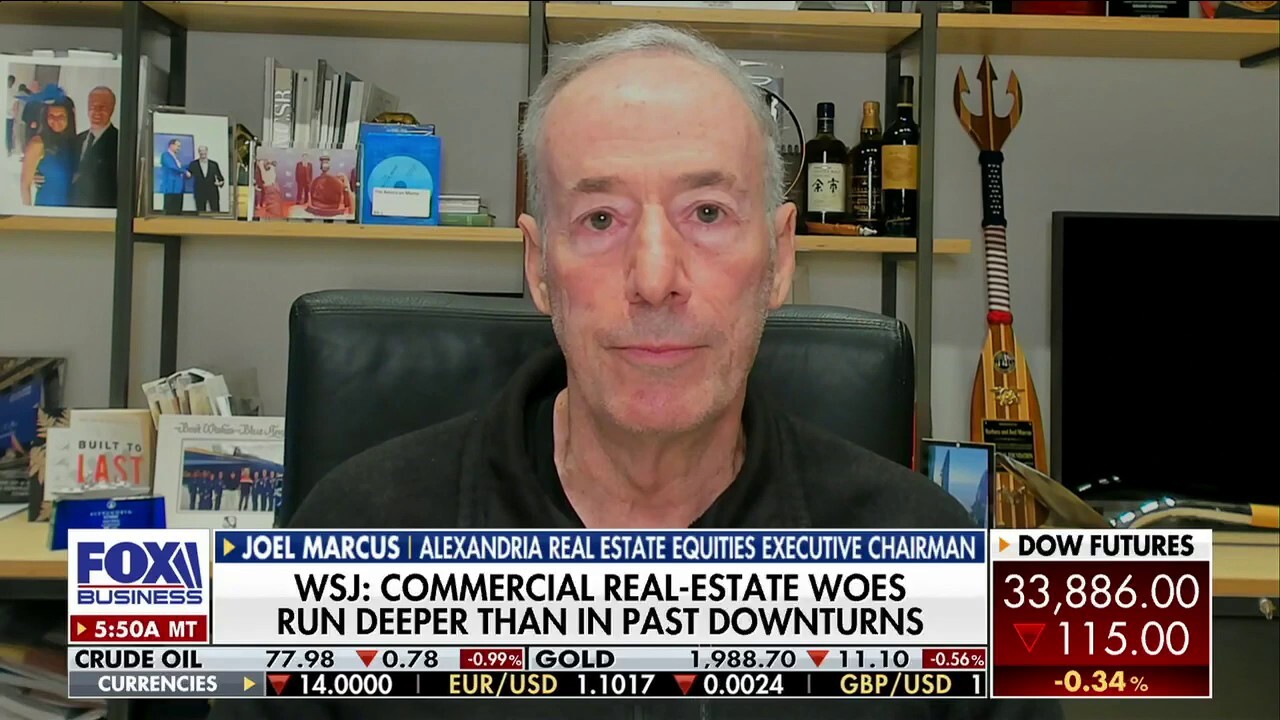

Regional banks will cause a ‘tsunami’ of economic trouble in commercial real estate: Joel Marcus

Alexandria Real Estate Equities Executive Chairman Joel Marcus joined ‘Mornings with Maria’ to discuss the fragile commercial real estate market.

PepsiCo's first-quarter earnings surpassed Wall Street expectations after the beverage and snack company raised prices to compensate for ongoing inflationary pressures.

Global consumer goods companies have raised prices to battle sky-rocketing costs of everything from aluminum cans to labor and shipping since the supply-chain disruptions during the pandemic and aggravated by the Russia-Ukraine conflict.

Meanwhile, the Frito-Lay maker also plans to raise prices in some regions, in stark contrast to its decision earlier this year to hit a pause.

Pepsi’s average prices rose 16% in the first quarter, while organic volumes slipped 2%.

"We do not expect commodity prices to decrease for us, only the rate of inflation will get a little bit lighter during the course of the year," Chief Financial Officer Hugh Johnston told Reuters.

PEPSICO TO USE OVER 700 EVS FOR FRITO-LAY DELIVERIES BY YEAR'S END

The company reported adjusted earnings of $1.50 per share on $17.85 billion in sales for the quarter ending March 25, after analysts predicted earnings of $1.38 a share on sales of $17.24 billion.

This time last year, the company reported earnings of $1.29 a share on sales of $16.2 billion.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| PEP | PEPSICO INC. | 170.49 | +2.96 | +1.77% |

"Given our strong start to the year, we now expect our full-year 2023 organic revenue to increase 8% and core constant currency EPS to increase 9%," PepsiCo CEO Ramon Laguarta said in a statement.

BUD LIGHT RIVALS STEALING SALES AFTER DYLAN MULVANEY CONTROVERSY

"We will continue to invest in our people, brands, supply chain, go-to-market systems, and digitization initiatives to build competitive advantages and win in the marketplace," he added.

PepsiCo Doritos brand chips for sale at a Dollar General department store in Simpsonville, Kentucky, U.S., on Thursday, Aug. 12, 2021. Dollar General Corp. is scheduled to release earnings figures on August 26. (Photographer: Luke Sharrett/Bloomberg via Getty Images / Getty Images)

PepsiCo now expects full-year earnings of $7.27 per share, up from a previous forecast of $7.20, and slightly above the FactSet consensus of $7.26.

CLICK HERE TO GET THE FOX BUSINESS APP

Reuters contributed to this report