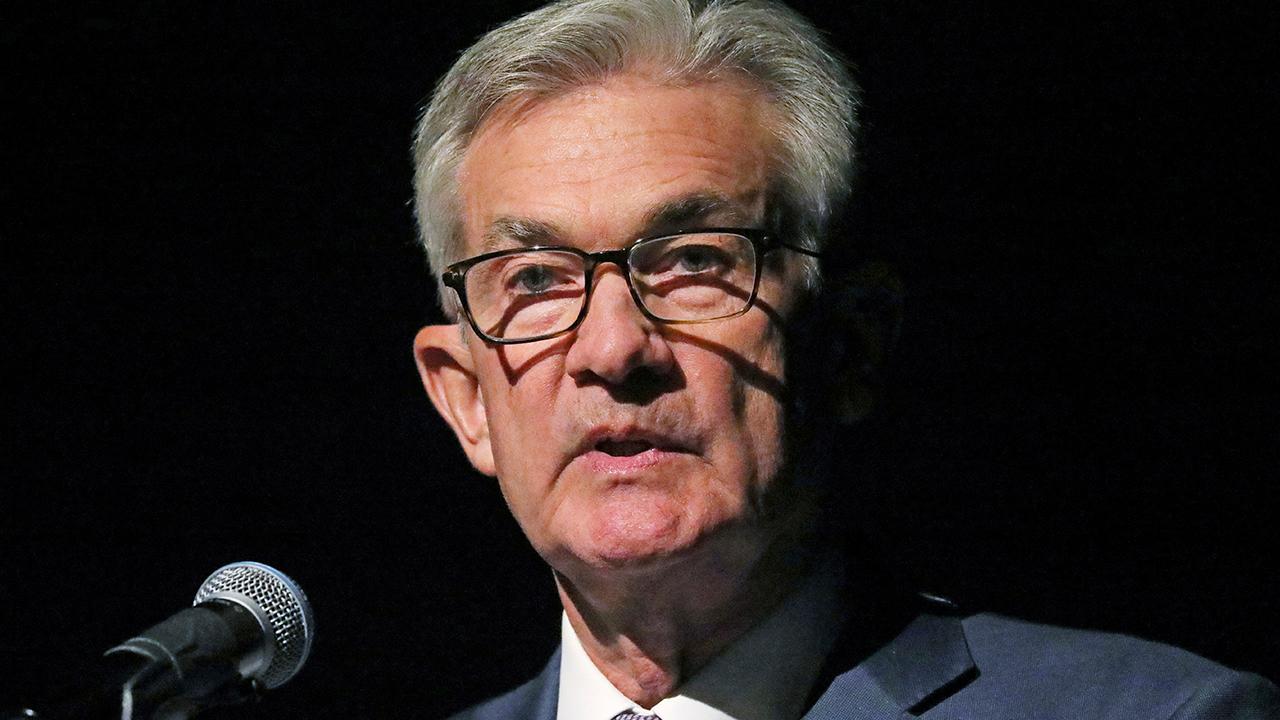

Fed's Powell dismisses possibility of negative interest rates in US

Federal Reserve Chairman Jerome Powell dismissed the idea the U.S. central bank will one day use negative interest rates combat an economic downturn.

“It’s something we didn’t see as an ideal tool in our institutional context,” he said during a question-and-answer session in Denver on Tuesday.

At the beginning of September, the European Central Bank announced a sweeping round of stimulus to boost the European Union’s sluggish economy, including slashing rates deeper into negative territory. President Trump, a frequent critic of both Powell and the U.S. central bank, applauded the ECB’s decision -- before launching another attack on the Fed.

“They are trying, and succeeding, in depreciating the Euro against the VERY strong Dollar, hurting U.S. exports.... And the Fed sits, and sits, and sits. They get paid to borrow money, while we are paying interest!” he wrote in a tweet.

So far this year, Fed officials have voted to cut interest rates twice, sending them to a range between 1.75 percent and 2 percent. Although Wall Street widely expects the Federal Open Market Committee to make a third quarter-point cut during its meeting at the end of October, Powell stressed that the central bank is not at the beginning of a lengthy series of rate cuts.

Speculation has mounted, however, that a recession could prompt the Fed to eventually send U.S. overnight rates -- which have remained historically low in the aftermath of the 2007 recession -- into negative territory.

But Powell threw cold water on that theory.

“I think different central banks around the world did different things, and we can observe how those things work,” he said. “But I don’t think we regard that as a first-order tool, or something we’d be likely to use.”