Procter & Gamble Co.'s Best Moves in 2016

Image source: Getty Images.

Procter & Gamble (NYSE: PG) is on track to post a sales growth rebound this fiscal year as organic revenue ticks up to a 2% expansion pace. If it manages to hit that number, it will be the first time in three years that the consumer goods giant has seen an improvement in its growth pace.

The news is looking even better on the bottom line, where core earnings are set to return to their steady gains after two straight years of declines.The company's fiscal year ends in June. Here are a few of the key strategic initiatives that put the business on firmer footing heading into 2017.

Simplifying

With its recent sale of 41 major beauty franchises, P&G finished a massive slimming-down initiative that's sliced 100 brands from its portfolio. These products were responsible for a relatively small portion of revenue and an even tinier piece of earnings, and so the company should now be able to grow at a faster, more profitable pace going forward. The sales also helped raise tons of cash, which P&G has used mainly to boost its direct returns to shareholders.

Image source: P&G investor presentation.

The simplification strategy hasn't been limited to the product portfolio. P&G this year reduced its manufacturing footprint, slashed the number of advertising agencies it does business with, and lowered its overhead employment burden by 35%. It has made big strides in overhauling its distribution infrastructure, too. As a result, executives are steering a much nimbler enterprise that ideally will have the flexibility to more quickly respond to changing consumer preferences and shifting competitive threats.

Cutting costs

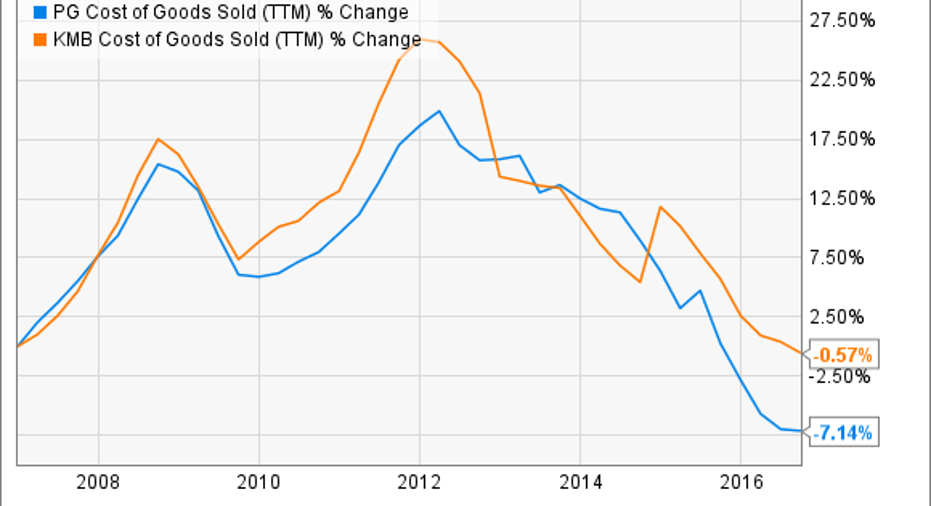

P&G's climb back to to solid earnings growth has more to do with cost cuts than with sales gains. After all, its revenue pace has trailed rivals like Kimberly-Clark (NYSE: KMB) and Unilever (NYSE: UL) as its market share ticked lower for the second straight year. Compare P&G's 1% sales boost last year with the 3% to 5% gains that Kimberly-Clark and Unilever enjoyed.

PG cost of goods sold (TTM) data by YCharts.

Yet its savings track record has more than offset those top-line weaknesses. P&G removed $1.5 billion out of its annual cost of goods expenses this past year -- trouncing management's original goal of $1.2 billion. In fact, since laying out their efficiency targets in 2012 the company has delivered $7 billion of savings. Thanks to those improvements, gross profit margins are already ticking up and P&G is forecasting even bigger cuts ahead. It plans to save $10 billion over the next five fiscal years in cost cuts alone.

Investors can thank that cost progress for the fact that P&G now sees earnings growing in the mid-single digits in fiscal 2017 after two straight years of 2% declines.

Investing in growth

With costs trending lower, and money flooding into its coffers from one-time brand sales, P&G has found itself flush with cash this year. A good portion of those funds are making their way into shareholders' pockets. However, the company's priority has been to invest in the business, and it has seen one of the best returns on its investment in marketing.P&G significantly boosted its advertising spending in 2016 while also shelling out to widen its sampling programs.

Both investments have paid quick dividends. Executives credit increased ad presence for helping produce volume-driven sales gains last quarter. Meanwhile, its sampling programs, like the one that gets trial versions of Gillette razors in the hands of nearly every young man in the country on his 18th birthday, put P&G on the cusp of ending its market share slide in its grooming business.

P3M = prior three months. Image source: P&G investor presentation.

However, even P&G's improved sales growth pace is below what shareholders had come to expect from the consumer goods leader. Its brand-shedding strategy carries serious risks, too, in trading growth potential for a one-time cash infusion. But the good news is these moves have put the company in position to produce improving sales and profits for the first time in years.

10 stocks we like better than Procter and Gamble When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Procter and Gamble wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Demitrios Kalogeropoulos has no position in any stocks mentioned. The Motley Fool recommends Kimberly-Clark and Unilever. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.