Billionaire Richard Branson, hit by pandemic, aims to raise $460M

VG Acquisition plans to sell 40 million units, made up of shares and warrants, on the New York Stock Exchange.

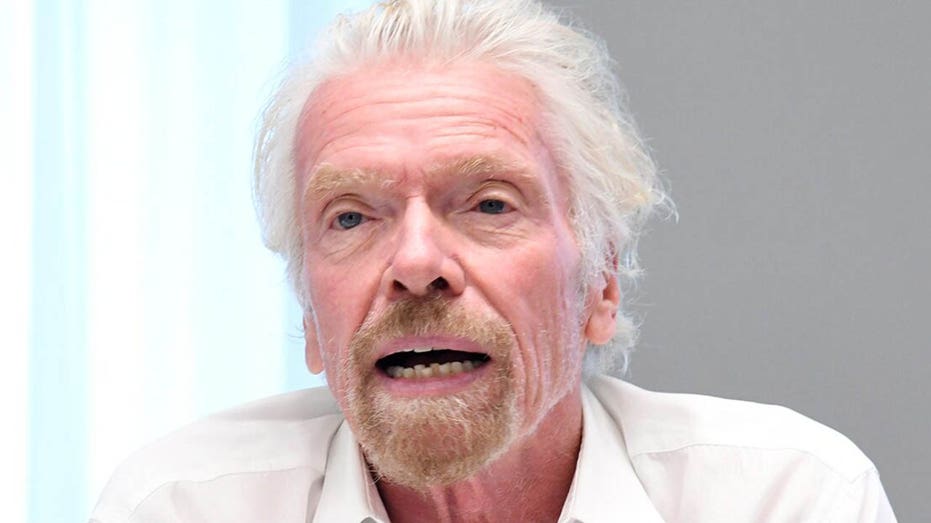

Maverick billionaire Richard Branson, founder of Virgin Group, is looking to ride the hot SPAC trend with the hopes of raising $460 million.

Branson's VG Acquisition Corp is the latest to move on a SPAC -- special purchase acquisition company -- according to filings with the Securities and Exchange Commission. In the filing, the company said it plans to use the money raised through the initial public offering to acquire an existing business. Virgin's success and expertise have been in the travel, leisure, entertainment and financial services sectors.

OPENDOOR TO GO PUBLIC VIA MERGER IN $4.8B DEAL

Branson is tapping into a hot investing trend. According to SPACInsider, a web site that tracks such deals, 102 IPOs have come to market this year via SPAC, which creates a company strictly to raise capital through an IPO for the purpose of acquiring an existing company.

VG Acquisition plans to sell 40 million units at $10 per unit, made up of shares and warrants, on the New York Stock Exchange.

The move comes in an effort by Branson to expand Virgin's portfolio as the travel company has been slammed by the coronavirus pandemic, causing the company to file for Chapter 15 bankruptcy protection in the US last month.

BILL GATES-BACK BATTERY STARTUP QUANTUMSCAPE TO GO PUBLIC IN SPAC DEAL

"We believe that the Covid-19 crisis has caused temporary dislocations in several of our focus sectors, creating a rare opportunity to invest in fundamentally strong target businesses at attractive valuations," the company wrote in the filing.

NEW YORK, NEW YORK - SEPTEMBER 24: Sir Richard Branson, Virgin Founder, speaks at the Business Refugee Action Network event in the margins of the United Nations General Assembly on September 24, 2019 in New York City. At the event, more than a dozen

Branson's own finances and that of his Virgin Group have been stretched by the pandemic, with the billionaire floating in April that he may have to mortgage his home in the British Virgin Islands.

"As with other Virgin assets, our team will raise as much money against the island as possible to save as many jobs as possible around the Group," he said in a blog post.

In a filing in May, it was revealed that Branson was also preparing to sell up to $504.5 million of his stake in Virgin Galactic

“Virgin intends to use any proceeds to support its portfolio of global leisure, holiday and travel businesses that have been affected by the unprecedented impact of Covid-19,” the company said in a press release.

CLICK HERE TO READ MORE STORIES ON FOX BUSINESS

Both of Branson's airlines have encountered severe financial headwinds from the pandemic. His Virgin Australia was sold to Boston-based Bain Capital in a deal that will see the carrier cut 3,000 jobs and end many of its international flights.

Virgin Atlantic -- which is 51% owned by the Virgin Group and 49% by Delta Air Lines -- underwent a $1.6 billion restructuring plan this summer. Since the start of the pandemic, Virgin Atlantic has cut more than 4,600 jobs from its workforce. It also shuttered its operations at London’s Gatwick Airport and eliminated 11 planes from its fleet.

GET FOX BUSINESS ON THE GO BY CLICKING HERE