Roaring Kitty sells stake in Chewy

Meme stock investor and influencer Keith Gill, known as 'Roaring Kitty,' dissolved his entire stake in Chewy

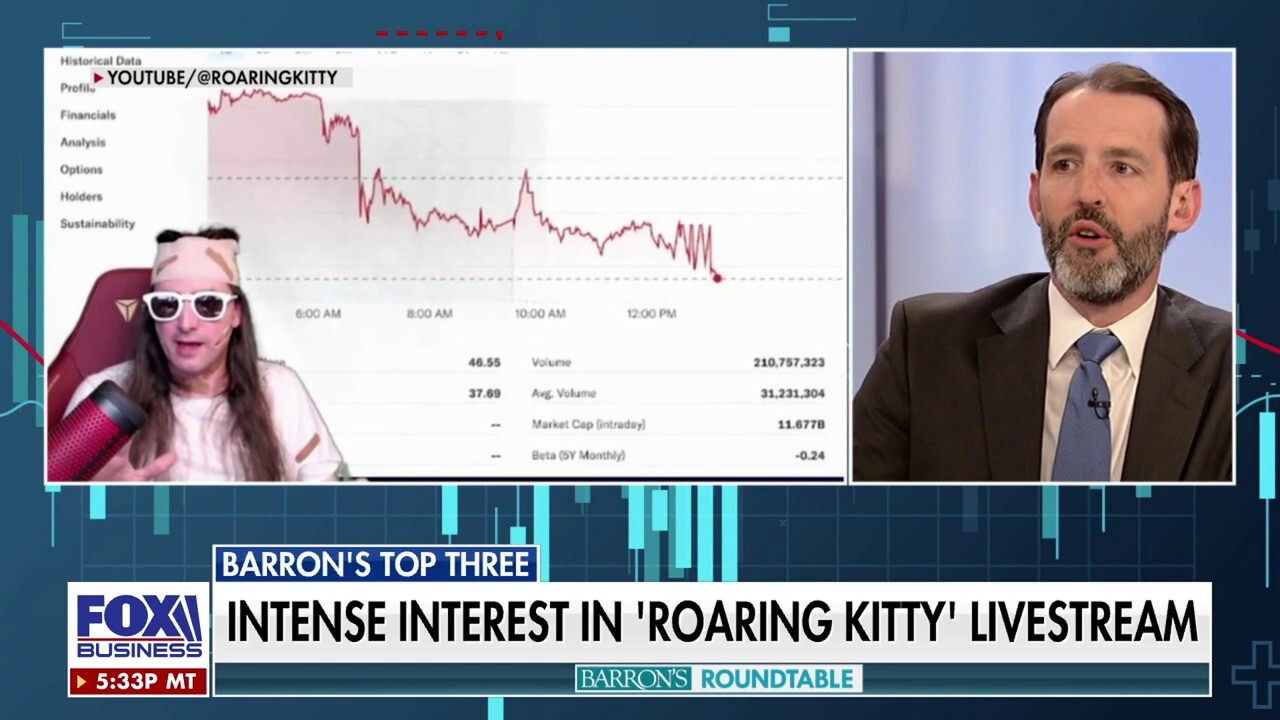

Breaking down the intense interest in Roaring Kitty livestream

Barrons Roundtable panelists offer their market outlook and discuss three things investors should be thinking about.

Keith Gill, the famed meme stock trader and influencer known as "Roaring Kitty," no longer owns any shares of Chewy after taking a 6.6% stake in the company over the summer, according to a Tuesday filing with the Securities and Exchange Commission.

Shares of Chewy were volatile on Tuesday, and down slightly as of mid-morning on Wednesday at $26.54 per share. The stock is up 18.47% year to date.

Roaring Kitty has dissolved his entire stake in Chewy, an SEC filing showed Tuesday. (Gabby Jones/Bloomberg via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CHWY | CHEWY INC. | 25.86 | +1.69 | +6.99% |

Chewy Inc.

In July, Gill purchased just over 9 million shares of the online pet retail site. The stake was valued at more than $230 million at the time.

The Chewy stake is Gill's first known investment beyond GameStop, and there is a link between his investments.

‘ROARING KITTY’: WHAT TO KNOW ABOUT THE MEME STOCK INVESTOR

Ryan Cohen, the billionaire founder of Chewy, who sold it in 2017, is now CEO of GameStop. Gill previously praised Cohen in his social media posts.

Keith Gill, a Reddit user credited with inspiring GameStop's rally, during a YouTube livestream. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

Once an office worker, Gill shot to fame after his cat memes and exuberant YouTube streams, in which he frequently wore a bright red pirate bandana, drew thousands of copycat bets on GameStop, crushing hedge funds that had bet against the stock.

MAGNIFICENT SEVEN STOCKS ARE ‘SOMEWHAT OVERVALUED’: RYAN PAYNE

Gill's investment had raised concerns among Chewy's top brass about asset managers, who are shareholders, potentially being put off by the ensuing volatility in the stock fueled by Gill's army of individual investors, a person familiar with the company's thinking told Reuters in July, when Gill disclosed his stake.

Keith Gill, known on Reddit under the pseudonym Roaring Kitty, first gained fame through his involvement in the GameStop stock saga of 2021. (Pavlo Gonchar/SOPA Images/LightRocket via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP CORP. | 23.91 | +0.01 | +0.06% |

GameStop Corp.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Roaring Kitty sent GameStop shares soaring in 2021 with a series of social media posts that drew a flood of retail money into the company. He won notoriety and a cult-like following among some investors.

FOX Business' Daniella Genovese and Reuters contributed to this report.