Roku's Latest Move Could Supercharge Its Platform Business

Roku (NASDAQ: ROKU) introduced the Roku Channel in late 2017. The app offers free ad-supported streaming video content to Roku users. It quickly became a top-five app on the Roku platform, and the company made moves to expand to Samsung smart TVs, the web, and smartphones.

The Roku Channel has become a pillar of Roku's growing platform business.

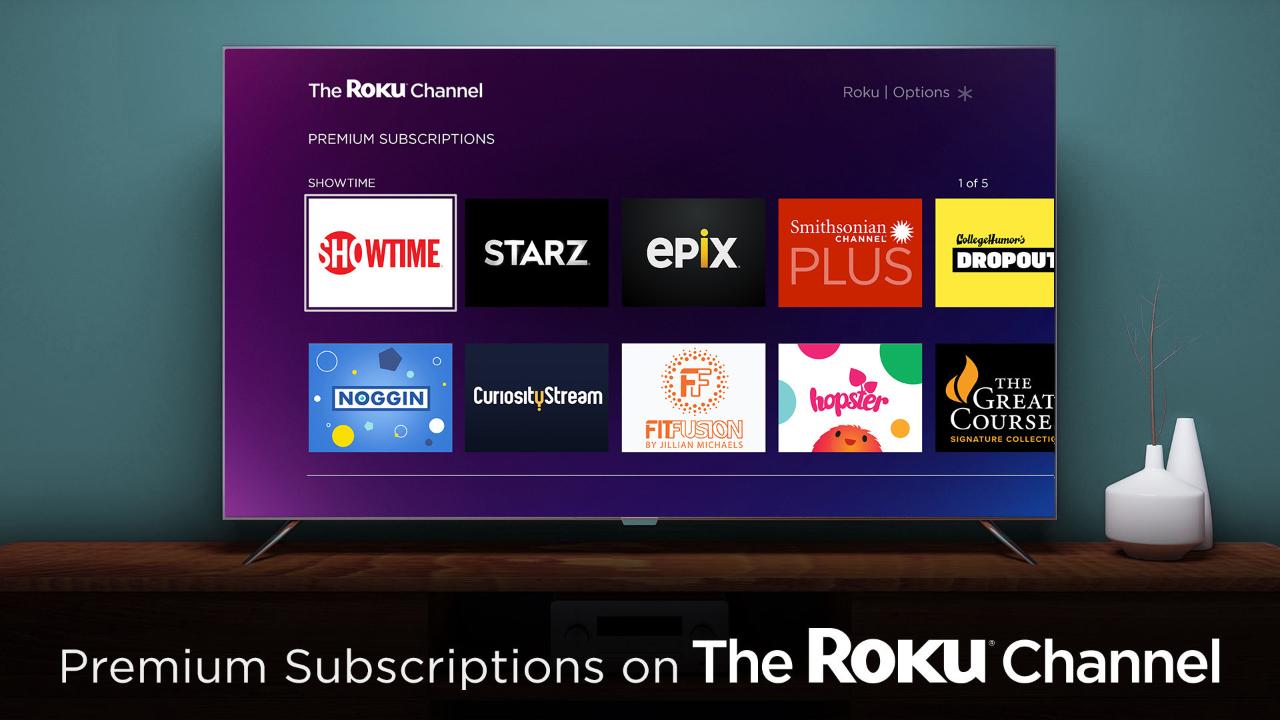

To start off 2019, management has taken the step to add premium content to the Roku Channel, partnering with CBS's Showtime, Lions Gate's Starz, and MGM's Epix to offer subscriptions via the Roku Channel. While Roku users can already subscribe to those services with their stand-alone apps, the Roku Channel will aggregate content across channels with a content-first user interface. The new product is similar to Amazon's (NASDAQ: AMZN) Channels, which has been a huge success since its launch in 2015.

More content, more data

"We're focused on making it easy to find great entertainment of all types," Roku VP of programming and engagement Rob Holmes said in a press release. Incorporating free trials and subscription sales into the Roku app, an app Roku users already use heavily, is one of the easiest ways to do that.

Offering subscriptions in the Roku Channel gives Roku a greater ability to promote the content available through premium streaming services. Roku's endemic advertising already has a big focus on specific content -- films or TV series -- available through certain channels. But being able to show paywalled content alongside free content in the Roku Channel could lead to higher conversions.

On top of better advertising real estate, the new agreements will give Roku better viewership data. Right now, Roku might know how much time its users spend streaming content in the Showtime channel, for example, but it usually doesn't receive data on what users are actually watching. Gaining access to those data can help Roku provide better recommendations to users, further improve conversions for premium subscriptions in the Roku Channel, and improve its other advertising as well.

A multibillion-dollar opportunity

As mentioned, Roku's forthcoming subscription option is similar to Amazon's Channels, available to Prime subscribers. Channels puts content from over 150 premium streaming partners alongside the streaming video Amazon provides to Prime members.

Amazon generated $1.7 billion in revenue from Channels, according to a BMO Capital Markets estimate. The analysts expect that to climb to $3.6 billion in 2020. Amazon keeps a percentage of that revenue, typically 15% to 30%, for itself. So, Amazon likely generated net revenue between $250 million and $500 million from Channels in 2018. For reference, Roku's platform business generated $351 million in revenue over the last four quarters.

Amazon Channels accounts for a significant portion of over-the-top subscriptions for Showtime, Starz, and HBO. Channels accounts for over 70% of Showtime and Starz OTT subscribers, according to estimates from The Diffusion Group.

Amazon says it has over 100 million Prime members globally, way more than Roku's 23.8 million active accounts. But only a small percentage of Prime member actively use Prime Instant Video. Leaked documents from 2017 indicate only about 26 million Prime households stream content. That makes Roku's user base much more comparable in size.

It's worth noting that Prime households, by their nature, have greater than average disposable income. The average Prime member might be more inclined to sign up for a premium video subscription than the average Roku user.

Still, the opportunity for Roku to grow its platform business through premium subscriptions in the Roku Channel is absolutely massive for a company of its size. If Amazon's results are any indication of the ability to convert streamers into subscribers, Roku could see another year of rapid growth in its high-margin platform business.

10 stocks we like better than Roku, Inc When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Roku, Inc wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of November 14, 2018

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adam Levy owns shares of Amazon. The Motley Fool owns shares of and recommends Amazon and Lions Gate Entertainment Class A. The Motley Fool has a disclosure policy.