Silicon Valley Bank touts Forbes 'best bank' nod days before becoming largest failure since Great Recession

SVB boasted that it made Forbes' annual ranking of 'America's Best Banks,' while underneath the surface the bank was falling apart

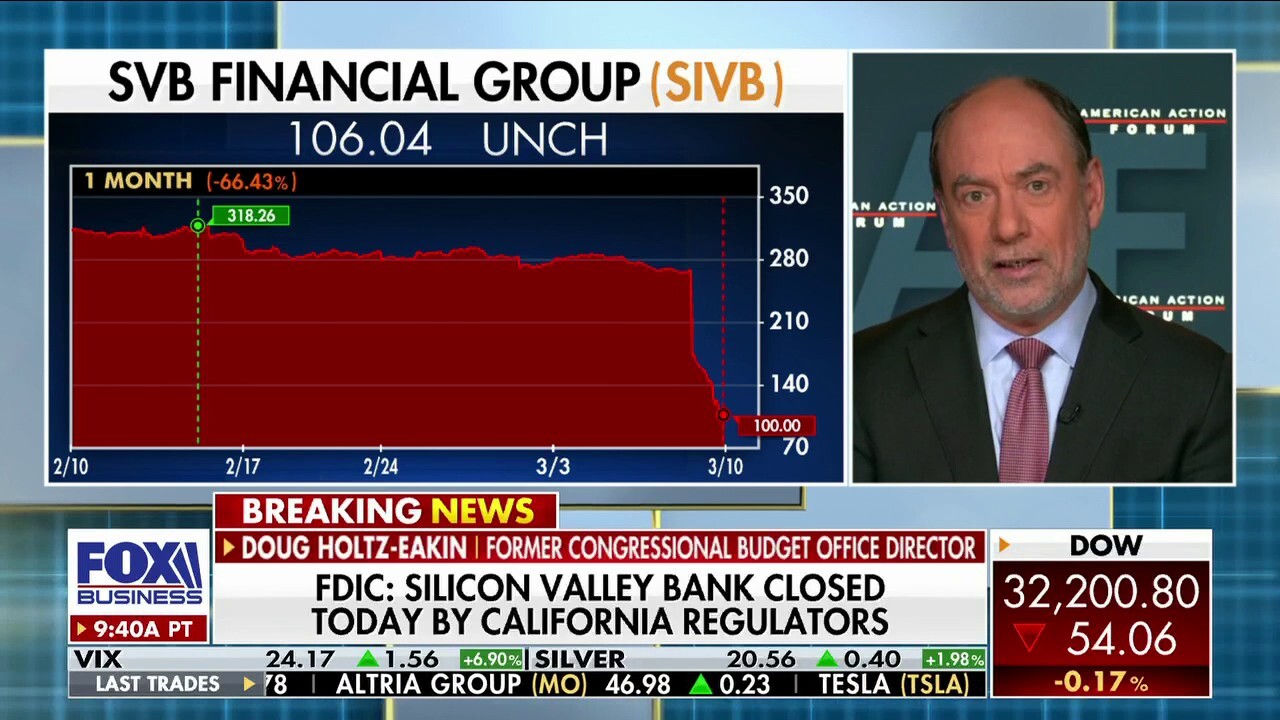

Silicon Valley Bank meltdown looks nothing like 2008 crisis: Doug Holtz-Eakin

Kaltbaum Capital Management President Gary Kaltbaum, former CBO Director Doug Holtz-Eakin and FOX Business' Susan Li discuss U.S. regulators shutting down Silicon Valley Bank on 'Cavuto: Coast to Coast.'

On Monday, Silicon Valley Bank was congratulating itself for making Forbes magazine's annual ranking of the best banks in America. By Friday, SVB imploded in the largest bank failure since Washington Mutual in 2008 and the second-largest in U.S. history.

It's a remarkable show of how fickle fortune can be, all captured in a tweet.

"Proud to be on @Forbes' annual ranking of America's Best Banks for the 5th straight year and to have also been named to the publication's inaugural Financial All-Stars list," SVB tweeted Monday.

But unbeknownst to the company's nearly 44,000 followers, that tweet would take on an ironic, even sickly meaning just five days later, when regulators seized control of the bank because it was unable to meet withdrawal demands from its depositors.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SIVB | NO DATA AVAILABLE | - | - | - |

HOW SILICON VALLEY BANK GOT BURNED

CUSTOMERS LINE UP OUTSIDE SILICON VALLEY BANK LOCATION:

Silicon Valley Bank customers line up outside California location

Silicon Valley Bank customers were seen outside a Menlo Park, California location, Friday, after the Federal Deposit Insurance Corporation seized its assets. (Cointelegraph)

Anxiety over the SVB's health triggered a run on the bank that culminated in the California Department of Financial Protection and Innovation (DFPI) taking over the bank's operations after it went insolvent. The banks assets have since been turned over to the Federal Deposit Insurance Corporation (FDIC), which will begin to return SVB customers' insured deposits on Monday.

SVB was the nation's 16th largest lender before it was shut down Friday after it lost $2 billion in a liquidity crisis. The bank's failure has sent shockwaves through the tech industry, as it was a major financier of tech startups. Hundreds of companies were affected by the shutdown, including retailer Camp and coffee company Compass Coffee, who say they have not been able to access their deposits.

Experts say the bank's collapse appears to be a management failure, rather than a sign of larger problems in the financial services industry. Higher interest rates, falling tech stocks, and industry layoffs each squeezed the bank, which had wrapped up most of its deposits in long-term treasury bonds.

SILICON VALLEY BANK COLLAPSE HITS COMPANIES SUCH AS CAMP, COMPAS COFFEE

A person from inside Silicon Valley Bank, middle rear, talks to people waiting outside of an entrance to Silicon Valley Bank in Santa Clara, California, Friday, March 10, 2023. The Federal Deposit Insurance Corporation seized the assets of the bank o (AP Photo/Jeff Chiu / AP Newsroom)

As the Federal Reserve has raised interest rates, bond prices have fallen, which reduced the market value of SVB's portfolio. Bloomberg News reported SVB had "mark-to-market losses in excess of $15 billion at the end of 2022 for securities held to maturity."

"People are used to having zero interest rates and easy money, and it’s gone. And there are people who will manage that well and people who will not," former Congressional Budget Office Director Doug Holtz-Eakin said during an interview on "Cavuto Coast-to-Coast" Friday.

Eakin, who also served on the Financial Crisis Inquiry Commission that studied the 2008 global economic crisis, blamed the bank’s executives for bad decision-making.

"This looks like a business model failure. The Silicon Valley Bank had poor management of its Tier 1 capital, heavily concentrated in one asset. And it had a very narrow client base. It's all tech companies. It’s literally just Silicon Valley. So, I think of this as a real management failure. I don’t think it’s a financial system failure."

TECH CEO WITH MILLIONS IN SILICON VALLEY BANK: ‘INNOVATION IN THE STARTUP WORLD IS BLEEDING TODAY’

Silicon Valley Bank CEO Greg Becker (Company)

Many commentators pointed out that SVB's tweet, in hindsight, looks rather foolish.

"Yikes," Donald Trump Jr. said succinctly.

CLICK HERE TO READ MORE ON FOX BUSINESS

"Going to guess they don't make it six years in a row," quipped Ryan Detrick, chief market strategist for the Carson Group, a financial consulting firm.

"Life comes at you fast," tweeted Ashley Willis, head of developer communities at Google.

Fox Business' Suzanne O'Halloran contributed to this report.