S&P 500 wraps worst year since 2008

Only one sector of the S&P recorded a gain in 2022

Rob Luna's headline for 2022: Don't fight the Fed and interest rates matter

Surevest CEO Rob Luna and Bokeh Capital Partners LLC founder and CIO Kim Forrest reflect on 2022's trends on 'Making Money.'

The three major U.S. stock indices are targeting their worst annual performance since 2008, with the S&P 500 skidding over 20% in 2022.

Stocks fell on Friday as growth shares dipped in the final trading session of a year marked by aggressive interest rate hikes to curb inflation, recession fears, the Russia-Ukraine war and rising concerns over COVID-19 cases in China.

"The housing market has really slowed down and the values of people's homes have declined off of the highs earlier this year," said J. Bryant Evans, investment advisor and portfolio manager at Cozad Asset Management in Champaign, Illinois.

"That, along with a slightly weakening job picture, is probably affecting ... the market right now economically. And then on the back of everyone's mind is China as they loosen up their policies toward COVID restrictions and as they open up their economy."

S&P 500

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

Of the benchmark’s 11 sectors, Dow Jones Market Data shows only energy recorded a gain year-to-date with Consumer Discretionary and Communication Services falling the furthest by around 37% and 40%, respectively.

The S&P 500 growth index was not far behind, dropping about 30.5% this year, while the value index is down 7.7%, with investors preferring high dividend-yielding sectors with steady earnings such as energy.

The data also showed the gap between the S&P’s best performer and worst performer ballooned to 94.25 percentage points in 2022 to post the largest outperformance from best to worst since 1999, while also marking for the first time in history just one sector higher on the year.

S&P ENERGY SECTOR’S RECORD 2022 PERFORMANCE ‘BUILT ON DOWNFALL OF OTHERS’

The energy sector was not only the S&P 500’s top performer of 2022 with a 58% spike year-to-date; it was also the benchmark’s only segment not saddled with a loss over the same time. (Frederic J Brown/AFP via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ESTY | NO DATA AVAILABLE | - | - | - |

| LUMN | LUMEN TECHNOLOGIES INC. (LOUISIANA) | 8.05 | +1.83 | +29.42% |

| CCI | CROWN CASTLE INC. | 80.90 | +2.51 | +3.20% |

While energy firms found gains in 2022 amid surging oil and gas prices, inflation, and global economic recession, the S&P’s bottom feeders represented a wide swath of sectors and included ecommerce seller Esty Inc., telecom Lumen Technologies, and real estate investment trust Crown Castle.

The focus now turns to the 2023 corporate earnings outlook, with growing concern about the likelihood of a recession.

Reuters contributed to this report.

CLICK HERE TO GET THE FOX BUSINESS APP

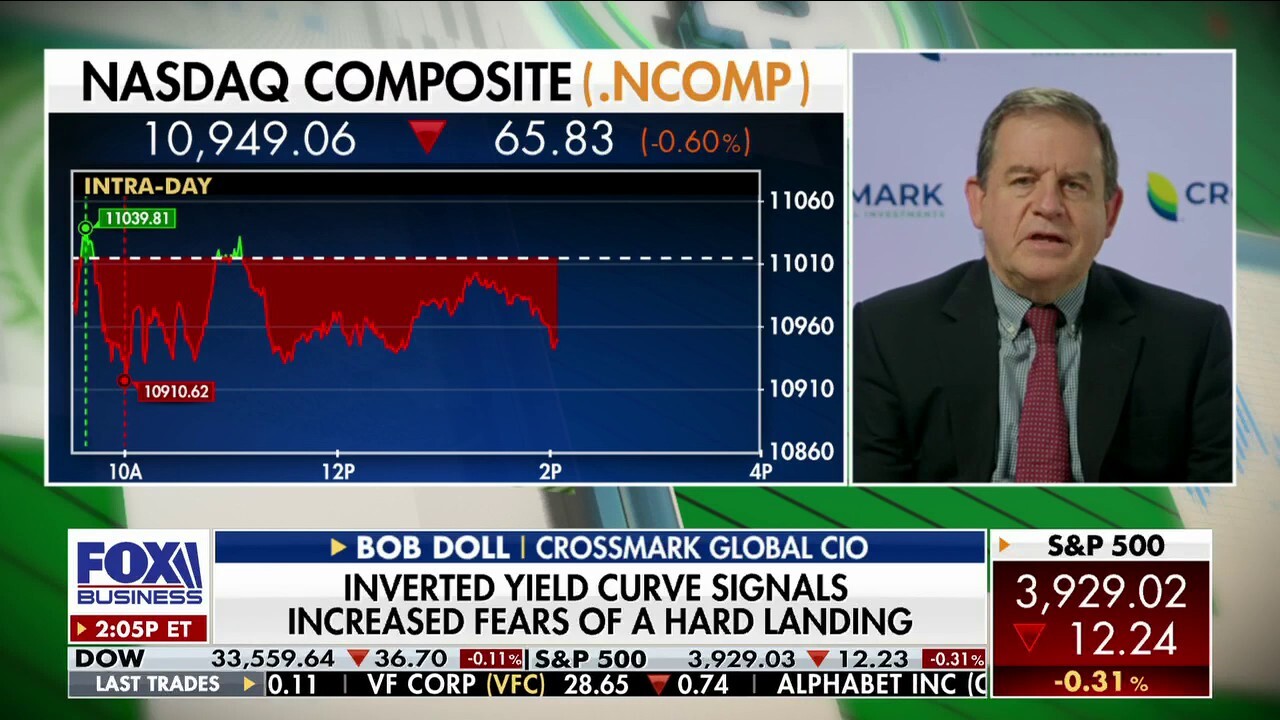

If the economy weakens it is good news for bonds, but not for stocks: Bob Doll

Crossmark Global CIO gives his take on Blackstone limiting redemptions and on what investors should watch on 'Making Money.'