Spirit calls on shareholders to reject JetBlue tender offer

Spirit has called the tender offer 'a cynical attempt' to disrupt its merger with Frontier Airlines

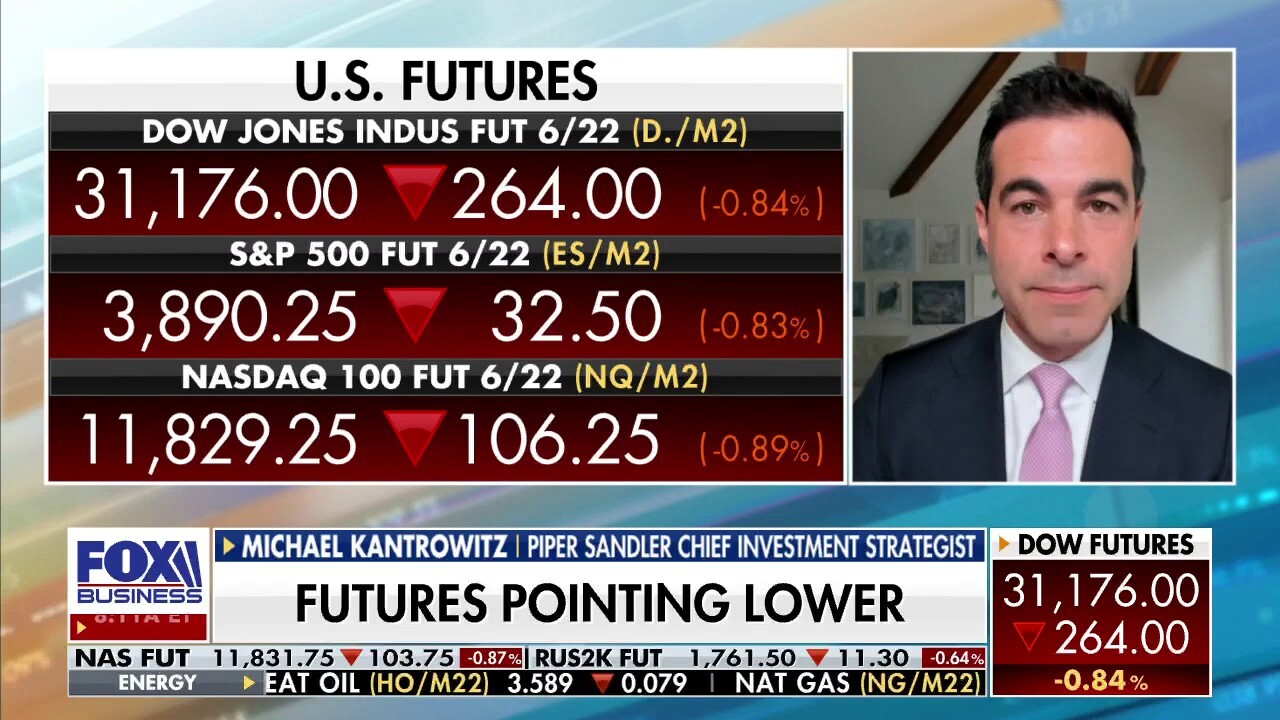

Stocks in bear market until next year’s ‘bottom’: Expert

Piper Sandler chief investment strategist Michael Kantrowitz tells investors to stay defensive, and not to call a market bottom until 2023.

Spirit Airlines' board of directors has recommended that its shareholders reject a $30 per share tender offer from JetBlue Airways, arguing the takeover bid "has not addressed the core issue of the significant completion risk and insufficient protections for Spirit stockholders."

"Based on our own research and the advice of antitrust and economic experts, our view is that the proposed combination of JetBlue and Spirit lacks any realistic likelihood of obtaining regulatory approval, while our company faces a long and bleak limbo period as we await resolution," Spirit Airlines board Chairman Mac Gardner said in a statement. "In that scenario, a $1.83 per share reverse break-up fee will not come close to adequately compensating Spirit stockholders for the significant business disruption Spirit will face during what JetBlue acknowledges will be a protracted regulatory process."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SAVE | NO DATA AVAILABLE | - | - | - |

| JBLU | JETBLUE AIRWAYS CORP. | 6.36 | +0.32 | +5.30% |

The recommendation comes after Spirit already rejected JetBlue's initial proposal to acquire the company for $33 per share.

THE BEST SUMMER TRAVEL DESTINATIONS IN 2022: REPORT

Spirit said a potential combination with JetBlue would result in a "higher-cost/higher fare airline that would eliminate a lower-cost/lower fare airline and remove about half of the ULCC capacity in the United States."

A JetBlue airliner lands past a Spirit Airlines jet on taxi way at Fort Lauderdale Hollywood International Airport on Monday, April 25, 2022. (Joe Cavaretta/Sun Sentinel/Tribune News Service via Getty Images) (Joe Cavaretta/Sun Sentinel/Tribune News Service via Getty Images / Getty Images)

It also cited concerns over JetBlue's "Northeast Alliance" with American Airlines. The Department of Justice is currently suing to block the arrangement, alleging the NEA is anticompetitive.

In addition, Spirit warned that its shareholders would be subject to "significant risk from fluctuating market conditions and stock market volatility" under JetBlue's tender offer and that the company's debt financing for a possible acquisition of Spirit "remains questionable."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Spirit argues that JetBlue's previous proposal and tender offer are "a cynical attempt" to disrupt its merger with Frontier, which it says JetBlue views as a "competitive threat."

A Frontier Airlines airplane taxis past a Spirit Airlines aircraft at Indianapolis International Airport in Indianapolis, Indiana, U.S., on Monday, Feb. 7, 2022. Photographer: Luke Sharrett/Bloomberg via Getty Images (Photographer: Luke Sharrett/Bloomberg via Getty Images / Getty Images)

Frontier and Spirit expected their combined company to produce $1 billion of consumer benefit and synergies derived from more flying on existing assets and deliver annual revenues of roughly $5.3 billion and annual run-rate operating synergies of $500 million once the merger is completed.

The combined airline would add new routes and offer more than 1,000 daily flights to over 145 destinations in 19 countries across complementary networks, according to Spirit.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ULCC | FRONTIER GROUP HOLDINGS INC | 6.52 | +0.87 | +15.40% |

"It’s no surprise that Spirit shareholders are getting more of the same from the Spirit Board," JetBlue said in a response to the Spirit board's recommendation. "The Spirit Board, driven by serious conflicts of interest, continues to ignore the best interests of its shareholders by distorting the facts to distract from their flawed process and protect their inferior deal with Frontier."

JetBlue said that Frontier's deal offers "less value, more risk, and no regulatory commitments, despite a similar regulatory profile."

"We are confident that as we continue to share the facts directly with Spirit shareholders, they will be even more perplexed than they already are about why the conflicted Spirit Board has refused to negotiate with us in good faith," the company added. "We believe that the Spirit shareholders will make their views known by voting against the Frontier offer and tendering their shares into our offer."

Spirit stockholders will vote on the Frontier merger during the company's shareholder meeting on June 10.