Stock futures trade lower ahead of bank earnings

Investors get another report on inflation Thursday in the form of producer prices

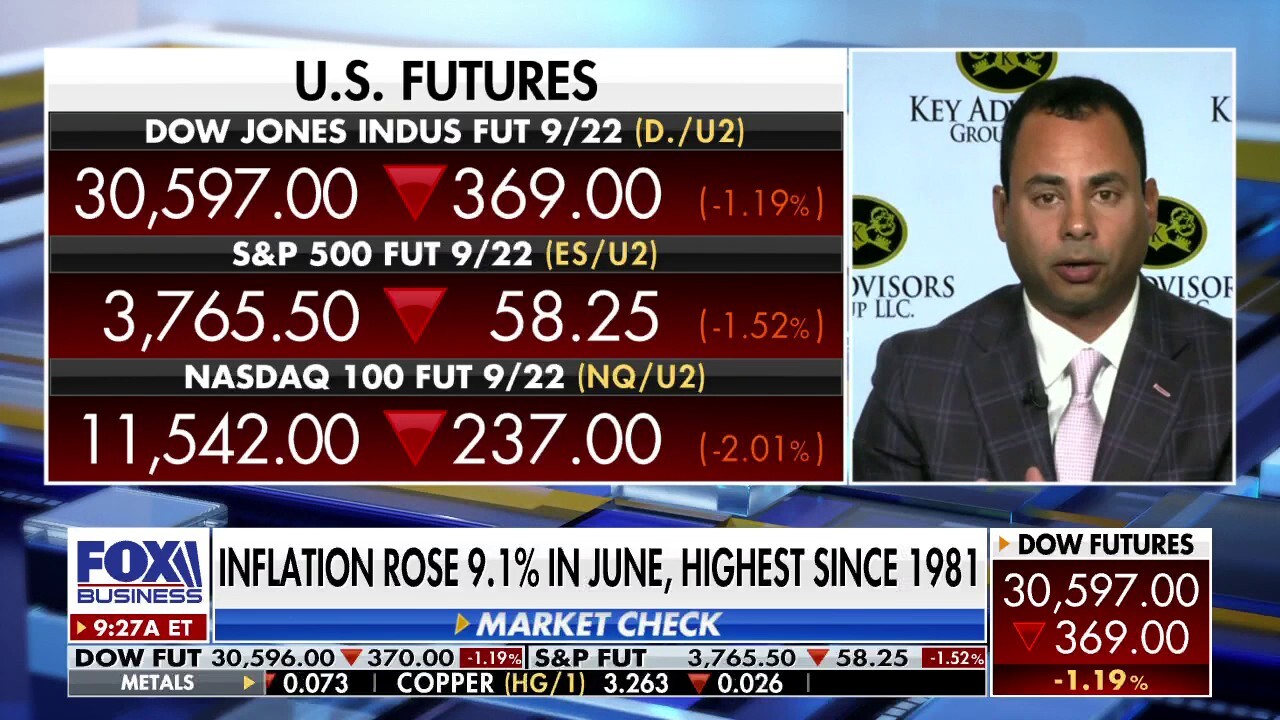

US economy’s ‘perfect storm’ coming in the near term: Expert economist

Co-founder of Key Advisors Group LLC Eddie Ghabour analyzes the U.S. markets and economy, saying that they have yet to ‘bottom out’ on ‘Varney & Co.'

U.S. equity futures were trading lower Thursday morning ahead of the release of earnings from the big banks.

The major futures indexes suggest a decline of 1% when the opening bell rings on Wall Street.

Oil prices traded lower Thursday morning as investors looked at the prospect of a large U.S. rate hike that would stem inflation and curb crude demand.

U.S. West Texas Intermediate crude was at $95 a barrel, after a small rise in the previous session.

AS BIDEN ASKS SAUDIS FOR OIL HELP, US ENERGY REPS SAY THEY'RE TIRED OF 'VILIFICATION'

An oil rig drilling a well at sunrise, owned by Parsley Energy Inc. near Midland, Texas. (REUTERS/Ernest Scheyder / Reuters Photos)

Brent crude futures traded at $99 a barrel after settling below $100 for the second straight session on Wednesday.

Second quarter earnings season kicks off unofficially this week with several of the major banks reporting starting with JPMorgan Chase and Morgan Stanley.

JAMIE DIMON WARNS OF AN ECONOMIC 'HURRICANE' COMING: 'BRACE YOURSELF'

JPMorgan Chase is expected to report an increase in revenue, but a lower profit than a year ago. The Refinitiv estimate is for $2.93 per share, down from $3.78 a year ago. The revenue estimate is for $31.97 billion, a 1.8% boost from year ago.

Traders work on the floor of the New York Stock Exchange. (REUTERS/Brendan McDermid / Reuters Photos)

Morgan Stanley's results are expected to fall short of year ago numbers. The profit estimate is for $1.53 per share, off 17% from last year's $1.73. The revenue estimate is for $13.48 billion, down more than 8% from a year ago.

A worker assembles a Boeing's 737 MAX airplane wing at the company's production facility. (AP / AP Newsroom)

On the economic calendar, traders will review another inflation report in the form of producer prices. Wholesale prices are expected to rise 0.8% month-over-month according to Refinitiv forecasts, matching May’s increase but below a record 1.6% surge in March. Year-over-year, prices paid by wholesalers are anticipated to jump 10.7% in June. core producer prices are anticipated to rise 0.5%.

NYSE SENIOR MARKET STRATEGIST ON 'BAD' INFLATION DATA AND WHAT IT MEANS FOR FUTURE FED ACTION

Investors will also look over the latest jobless figures.

Bitcoin was trading around $20,000.

In Asia, Tokyo's Nikkei 225 gained 0.6%, the Hang Seng in Hong Kong slipped 0.2% and China's Shanghai Composite Index was off 0.1%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 49395.16 | -267.50 | -0.54% |

| SP500 | S&P 500 | 6861.89 | -19.42 | -0.28% |

| I:COMP | NASDAQ COMPOSITE INDEX | 22682.729157 | -70.91 | -0.31% |

Wall Street's benchmark S&P 500 index lost 0.4% on Wednesday after data showed U.S. consumer inflation rose to 9.5% in June over a year earlier from May's 8.6%.

The Dow Jones Industrial Average fell 0.7% to 30,772.79, and the Nasdaq composite dropped 0.2% to 11,247.58.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Traders are looking ahead to the latest quarterly results from big U.S. companies in the next few weeks.

The Associated Press contributed to this report.