Risk of delayed, disputed election results looms over market rally

The Brookings Institution gave 19 states a “C” grade for their mail-in ballot readiness; 11 received a "D" or "F"

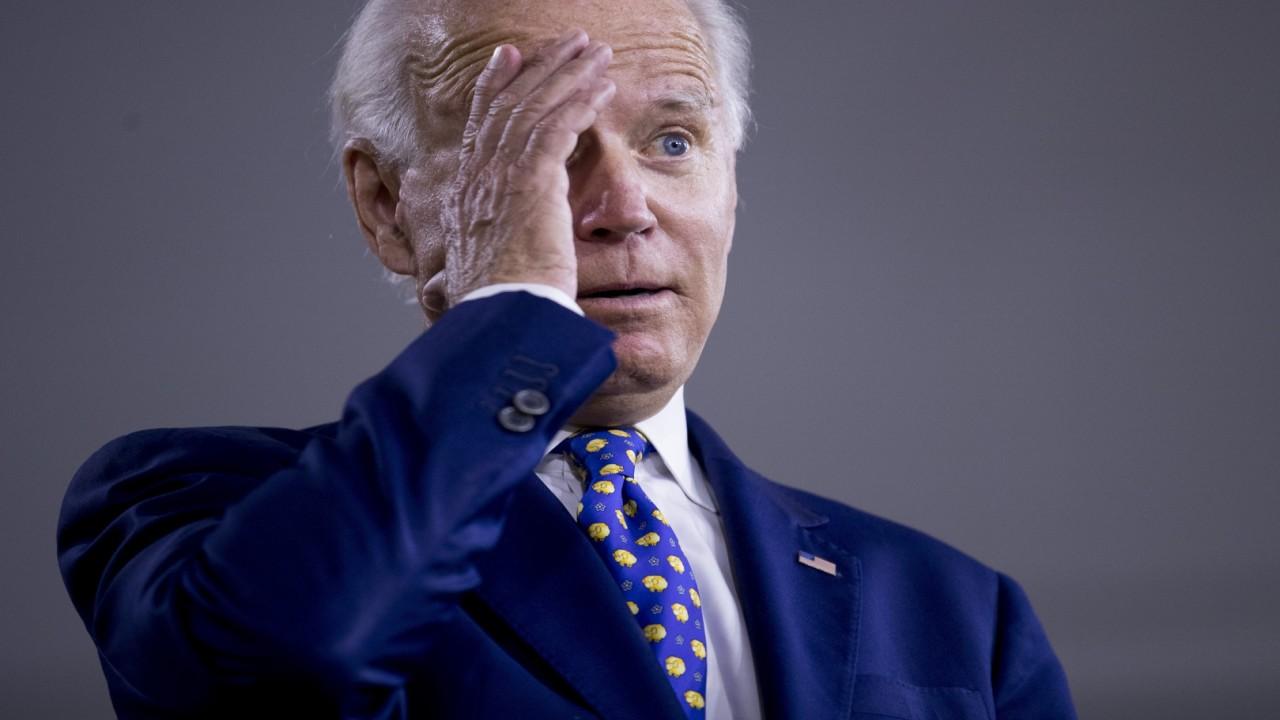

President Trump linked his controversial suggestion last week to delay the 2020 election to his repeated warning that mail-in voting would yield "the most fraudulent and inaccurate election in history."

But that possibility, which many experts have dismissed, isn't the only risk.

The volume of mailed ballots this year, pushed up by people avoiding crowded polling places and the resulting higher chances of COVID-19 infection, means vote-counting may take significantly longer than normal, with results not known for days.

In such an instance, the uncertainty would almost surely cause tremors in the stock market.

And a disputed election is another “wild card you can’t rule out,” Greg Valliere, chief U.S. policy strategist at Ontario, Canada-based AGF Investment, told FOX Business in July. Trump has already declined to commit to accepting the results.

The potential for election upheaval arrives amid a pandemic that has infected more than 4.5 million people in the U.S., the most of any country in the world, and is expected to prompt more Americans than ever before to cast ballots by mail.

At least 77 percent of American voters, including those who use absentee ballots, will have the opportunity to do so, the Washington Post reported.

Trump and other critics have warned not only of the possibility of fraud and the potential for a lenghty vote tabulation process because of that, but the possibility of vote leakage and other problems.

There is also concern that states are not prepared to deal with the influx of mail-in votes and that a beleaguered Postal Service can't handle the volume efficiently, especially with pandemic-related service reductions.

A recent report from the Brookings Institution gave 19 states a “C” grade for their readiness, compared with 21 states that received an “A” or a “B.” The remainder received a “D” or an “F.”

Such challenges might lead not only to confusion about the outcome in the immediate aftermath but the second contested election in 20 years. Translation: Uncertainty.

And if there's anything the stock market loathes, it's uncertainty.

The results of the 2000 election between former President George W. Bush and former Vice President Al Gore hung in the balance for five weeks amid a battle over vote-counting in Florida. It wasn’t until Gore conceded defeat on December 13, a day after the U.S. Supreme Court blocked a Sunshine State recount, that the winner was known.

The confusion contributed to a 12 percent drop in the S&P 500 from Election Day through December 20, according to Lori Calvisina, head of U.S. equity strategy at RBC Capital Markets, who also noted investor confidence was low following the collapse of the dotcom bubble.

Two decades later, the market has been roiled by the worst economic downturn since the Great Depression, which might compound the fallout of an uncertain or contested outcome.

CLICK HERE TO READ MORE ON FOX BUSINESS

While Valliere said he “isn’t predicting” a contested election, he believes the chances of that happening “are not zero.”