Stocks vs. Bonds: Chasing income takes a twist

Investors typically buy stocks for capital appreciation and bonds for yield, but recent market conditions are blurring those lines, creating a conundrum for investors.

The yield of the 30-year Treasury bond (1.91%) this week briefly fell below the S&P 500’s dividend yield (1.95%) for the first time since 2009.

“On a valuation basis, even though equities are not cheap, they are cheaper versus bonds,” Permanent Portfolio Family of Funds President Michael Cuggino told FOX Business’ “The Claman Countdown.” “I, for the life of me, can’t explain why you’d want to buy a 10-year, a 30-year bond less than 2 percent with all the risk factors out there.”

Investors have been aggressively buying bonds over the past five weeks amid signs of a slowing U.S. economy and got another data point earlier this week.

Second-quarter GDP revised down to 2 percent on Thursday from a prior read of 2.1 percent, according to the Commerce Department.

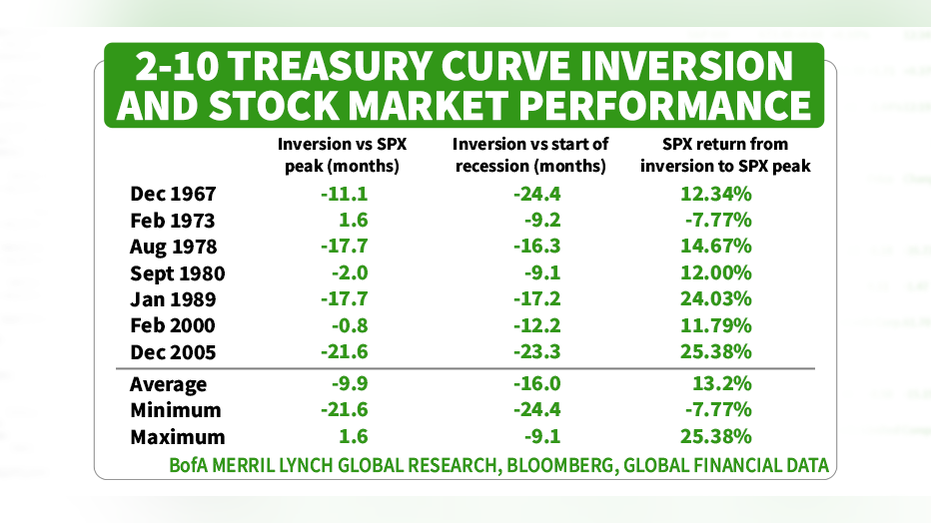

Uneven U.S. economic data, coupled with the ongoing trade war with China has whipsawed financial markets this month. The spread between the U.S. 2-year and 10-year note yields turned negative for the first time in over a decade, sparking concerns the U.S. economy is heading for a recession. Such an event has occurred ahead of the last seven recessions, spanning more than 50 years, but sometimes preceding one by as much as 24 months.

However, an inverted yield curve shouldn’t necessarily spook investors.

Keith Fitz-Gerald, chief investment strategist at the Baltimore-based Money Map Press, told FOX Business’ “Cavuto Coast to Coast” he thinks the yield curve is artificially depressed due to negative interest rates around the world and that it’s not the “harbinger of doom that everyone used to think it was.”

Even if a recession is coming, the stock market can still go higher over the near term. In fact, dating back to 1967, the S&P 500 has averaged a post-inversion gain of 13.2 percent.

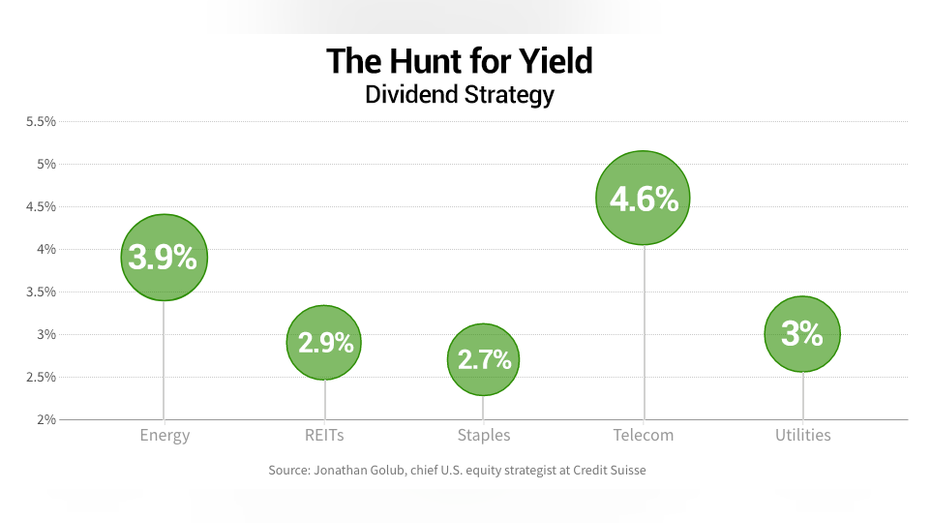

Stock-market investors who are looking for yield should consider the telecom (4.6 percent), energy (3.9 percent), utilities (3 percent), REITs (2.9 percent) and staples (2.7 percent), which are the sectors with the highest dividend yield, according to Jonathan Golub, chief U.S. equity strategist at Credit Suisse.

CLICK HERE TO READ MORE ON FOX BUSINESS

“Stocks are almost a no brainer here, David Dietze told FOX Business’ “Varney & Co.” on Friday. “You’ve got 70 percent of the S&P 500 trading with a higher yield than 10-year Treasury. That’s very rare. So now people are saying let's go into stocks for income.”