Stocks Cap 2016 with Double-Digit Growth, Await Uncertain New Year

With double-digit yearly gains on the broader averages, U.S. equity markets have come a long way from their worst-ever start to a new year. Despite the holiday cheer, though, analysts are uncertain what a new political paradigm means for stocks in the year ahead.

The three major averages tied up 2016 with a big green bow as they notched double-digit gains. Traders on the floor of the New York Stock Exchange celebrated with smiles and 2017 novelty glasses as they looked ahead to the promise 2017 brings. The Dow Jones Industrial Average lost 56 points on the session, notching gains of 13.4% for the year. The blue-chip index saw a burst of momentum over the final six weeks of 2016 on election-related sentiment in the wake of Donald Trump’s White-House win. Traders have high hopes for more fiscal stimulus in the form of tax cuts and infrastructure spending alongside relaxed Wall Street regulations.

The broad S&P 500 lost 10 points on Friday, registering 2016 gains of 9% helped by double-digit year-to-date gains in the energy, financial, and industrials sectors, which have jumped 25%, 20%, and 17% respectively. The tech-heavy Nasdaq Composite, meanwhile, fell 48 points Friday, gaining 7% for the year.

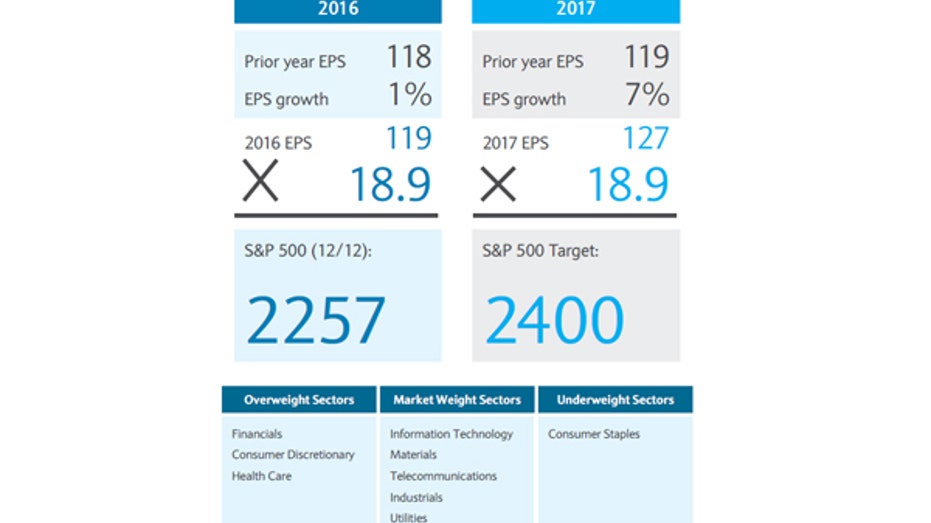

The S&P 500’s 2016 gains were mostly in line with expectations calling for a year-end target of around 2200, but the trajectory of next year’s market action is a little less clear with investment-bank forecasts roughly between 2300 and 2400.

Next year has been dubbed the “year of the rooster” and described as “an erratic bird with fat tails” by Bank of America Merrill Lynch (NYSE:BAC) head of U.S. equity and quantitative strategy, Savita Subramanian, who warned 2017 could be anything but normal.

Bulls or Bears: Take Your Pick

“Against the backdrop of elevated valuations, slow growth and limited scope for credit expansion, our target and the recent rally are reliant on policymakers’ ability to deliver growth next year,” she said, noting BAML’s year-end base-case target of 2300.

While equity markets have so far been optimistic about President-elect Donald Trump’s policy ideas, Subramanian outlined a bull and bear case for stocks under the new administration. The bull side of the spectrum prices in a 19% jump in the S&P by year end, boosted by “extra oomph” from Trump’s tax reform and fiscal stimulus in the form of infrastructure spending. The bear case, though, sees the S&P plunging 29% from current levels by next December should policymakers fail in delivering growth, and protectionist Trump policies make way for stagflation – high levels of inflation and unemployment alongside stagnant demand.

Using earnings growth as a guide, Barclays U.S. equity strategists Jonathan Gilonna and Eric Slover put their base case target at 2400, which would represent a 5% jump from current levels and a projected 7% increase in earnings growth.

“In the long run, earnings growth and the price of the S&P 500 are highly correlated. In fact, it could be argued that nothing dictates the long-term appreciation of the S&P 500 more than earnings growth,” they said, though noting that upside potential could be as high as 12% if Trump’s plans are implemented to the degree Wall Street has already discounted.

Though the Street tends to favor Trump’s business-friendly policies of lower taxes, more fiscal stimulus, and reduced regulatory burdens, those reforms could come at a cost of rapidly rising inflation and tighter financial conditions.

A U.S. dollar that continues to build on its 4.7% year-to-date gains alongside rising interest rates orchestrated by the Federal Reserve could cause investors to reassess their exposure to risk assets, putting downward pressure on the S&P 500, Gilonna and Slover warned. The Fed moved rates higher by 0.25 percentage point in December for the first time in a year, but forecasted a need to raise rates three more times in 2017.

“An unexpected pickup in inflation or inflation expectations could result in higher-than-expected interest rates and the potential for overly aggressive tightening from the Fed,” cautioned Wells Fargo Investment Institute (NYSE:WFC) global equities strategists, noting central-bank policies that change materially next year would be a ”major negative” for financial markets.