Dow swoons make October most volatile month in 118 years

October, also dubbed the “jinx month” by investors, historically has always been a volatile month for stocks, largely due to the crashes of 1929 and 1987 and a general superstitious sentiment.

But if this year feels more roller coaster like, well it is.

For the Dow Jones Industrial Average, October 2018 is among the most volatile months in 118 years, based on daily percentage swings since 1900. For the S&P 500, the broadest measure of stocks, volatility is the highest in 90 years or since the modern day index rolled out in 1928, according to the Dow Jones Market Data Group. This month is close to rivaling October 2011 when the financial markets continued spiraling following Black Monday that August after the U.S. lost its pristine AAA credit rating after a rare Standard & Poor's downgrade. 2018 is also ringing up big one day drops for the Dow.

The gyrating, which continued this week, had the S&P 500 flirting with correction territory, joining the Nasdaq Composite, Russell 2000 and the Dow Transports.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

What gives? With the midterms approaching, some including White House Economic Advisor Larry Kudlow suggest investors are nervous Democrats will win control of the House and undo Trump’s historic tax plan and his cutting of regulatory red tape. While other investors raised concerns over a negative impact of tariffs. This week Caterpillar, a barometer for the global economy, warned that tariffs are driving up steel and aluminum costs.

However, market technicians are taking a more practical view and suggest volatility could be easing soon based on trading patterns. On Tuesday, by the closing bell the Dow had erased the bulk of what was nearly a 600 point midday selloff. “The ability to have rallied well up off the lows is more positive than negative and argues that the case for a low in stocks should be right around the corner and could be in place by end of week” noted Mark Newton, chief technical analyst at Newton Advisors.

Other investors, including the Trump administration, are confident the volatility will dissipate because the fundamentals of the economy are strong, as noted in statement released after the market's rubbing on Wednesday.

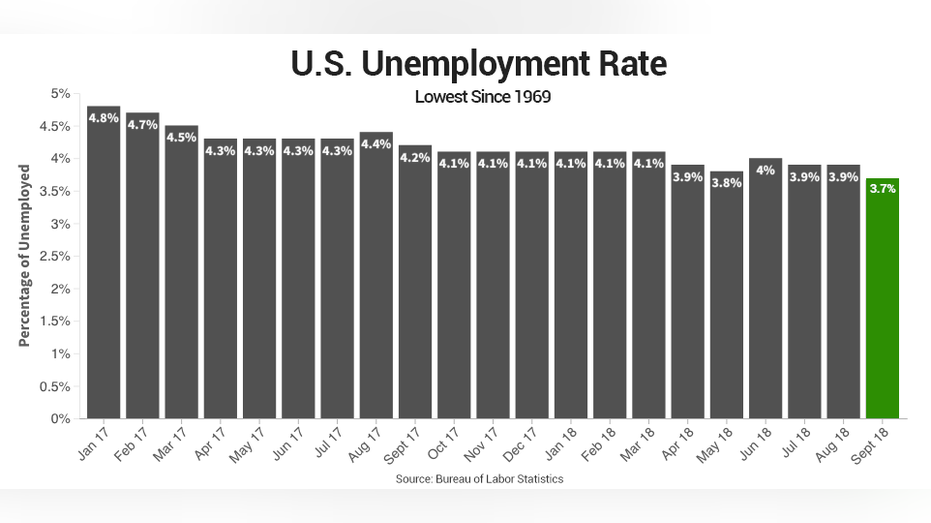

“As we’ve said before, the fundamentals and future of the U.S. economy remain incredibly strong. Unemployment is at a record low for the past half century, business and consumer confidence have hit record highs, and women and minorities are entering our workforce in droves. We remain focused on the long-term outlook of the U.S. economy and confident in our path of continued growth.”

Additionally, corporate earnings are coming in solid with more companies beating profit and sales expectations than average, as noted by John Butters, senior earnings analyst at FactSet. For example, Boeing raised its outlook for profit and sales for the year with CEO Dennis Muilenburg, on Wednesday, noting the strength of the commercial and cargo aircraft market. Shares have rallied over 18 percent this year.

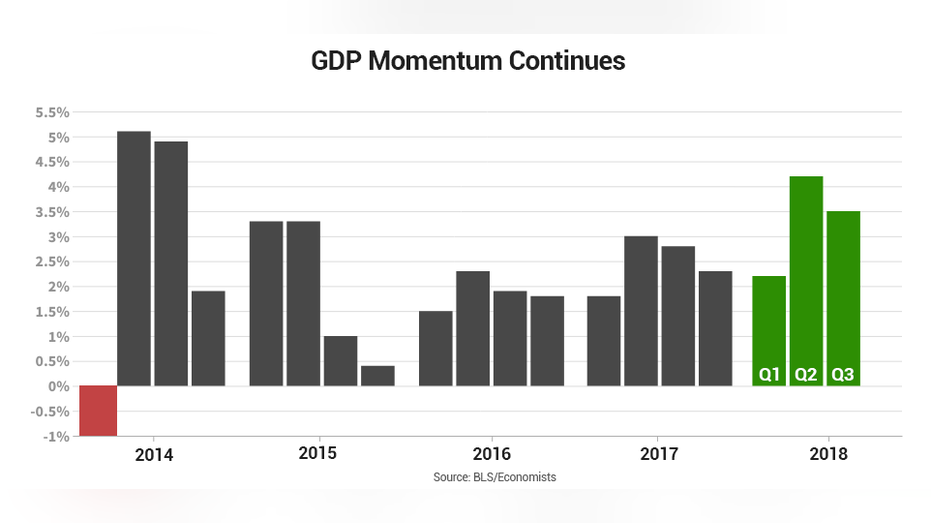

On the economic front, indicators continue to point to growth mode. On Friday, third quarter GDP rose 3.5 percent. The best back-to-back quarterly growth since 2014.

And the job market is red hot with the U.S. unemployment rate at 3.7 percent the lowest since 1969, powered by 7.1 million job openings, way more than the 6 million job seekers.

And tax reform, passed late last year, is helping Americans keep more of what they earn with President Trump promising a fresh round of tax cuts in the near-future. “We’re putting in a resolution sometime in the next week or week-and a-half, two weeks … we’re giving a middle-income tax reduction of about 10 percent – we’re doing it now – for middle-income people,” he told reporters at the White House on Monday.

Suzanne O'Halloran is Managing Editor of FOXBusiness.com and is a graduate of Boston College. Follow her on Twitter @suzohalloran

*The original story was updated to reflect Black Monday/October 2011.