Tesla deliveries expected to slump on China competition, weak demand

Tesla is expected to announce a sales slowdown amid increasing competition from China as well as weak demand due to high interest rates

Why are investors frustrated with Tesla stock?

Barrons Roundtable discusses the stocks shrinking margins amid stiff auto competition.

Electric vehicle maker Tesla is expected to release first-quarter delivery figures next week that show a sales slowdown amid increasing competition in the EV market and a waning boost from price cuts.

The world's most valuable automaker has seen years of rapid sales growth but is bracing for a slowdown in 2024. Tesla is projected to deliver 458,500 vehicles in the quarter ending March 31, according to analysts polled by Visible Alpha.

That amount is up from the 422,875 vehicles sold in the first quarter a year ago, but would represent a 5% decline from the preceding fourth quarter of 2023.

Tesla CEO Elon Musk has aggressively cut prices for its most popular models since late 2022 in an effort to boost sales amid the high interest rate environment, which has increased the cost of car payments for customers.

SENATOR WARREN URGES SEC TO INVESTIGATE TESLA OVER BOARD INDEPENDENCE

Tesla is expected to announce first-quarter delivery figures that show a sales slowdown as the EV-maker faces headwinds. (John Paraskevas/Newsday RM via / Getty Images)

Musk has said the price cuts are needed to maintain demand for Tesla's vehicles and to keep its production facilities humming, and he has blamed winter and high borrowing costs for the slowdown in demand.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 411.11 | +13.90 | +3.50% |

The company temporarily cut prices for its Model Y rear-wheel drive and long-range variants by $1,000 each in February, though those cuts ended at the beginning of March.

"This is the essential quandary of manufacturing: factories need continuous production for efficiency, but consumer demand is seasonal," Musk said last month when responding to a post from Tesla on X, formerly Twitter, that indicated prices would tick back up in March.

ELON MUSK PROVIDES UPDATE ON TESLA ROADSTER TIMELINE

Sales of Teslas made in China at its Shanghai Gigafactory have slowed amid a price war with Chinese EV-makers like BYD. (VCG/VCG via / Getty Images)

Tesla is currently offering $7,680 discounts on some of the new Model Y vehicles for U.S. customers. The discounts have frustrated some Tesla customers who have seen the value of their vehicles decline due to the price cuts.

"Teslas have the dubious honor of being the fastest-depreciating vehicles in the U.S.," HSBC said in a report last week. "We can see how cheaper works for consumables, but we are less convinced it works for consumer durables for which residuals are part of the cost equation."

TESLA CEO ELON MUSK VISITS GIGA BERLIN AS PRODUCTION RESUMES FOLLOWING ARSON ATTACK

Tesla is focusing its production on its next-generation EV, code-named "Redwood." (Smith Collection/Gado / Getty Images)

In January, the company warned of "notably lower" sales growth in 2024 as it focuses its production on its next-generation EV, which is code-named "Redwood."

It also faces the loss of access to $7,500 per car federal tax credits on its Model 3 compact sedans, which no longer qualify for the credit due to non-compliance with newly-implemented eligibility restrictions for battery materials sourced from China.

Mounting competition from cheap EVs made by Chinese automakers like BYD, which surpassed Tesla as the world's top-selling EV maker in the fourth quarter of last year amid a fierce price battle, is also creating headwinds for Tesla's bottom line..

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In the first two months of this year, Tesla delivered 131,812 vehicles made in China, down 6.2% from a year ago.

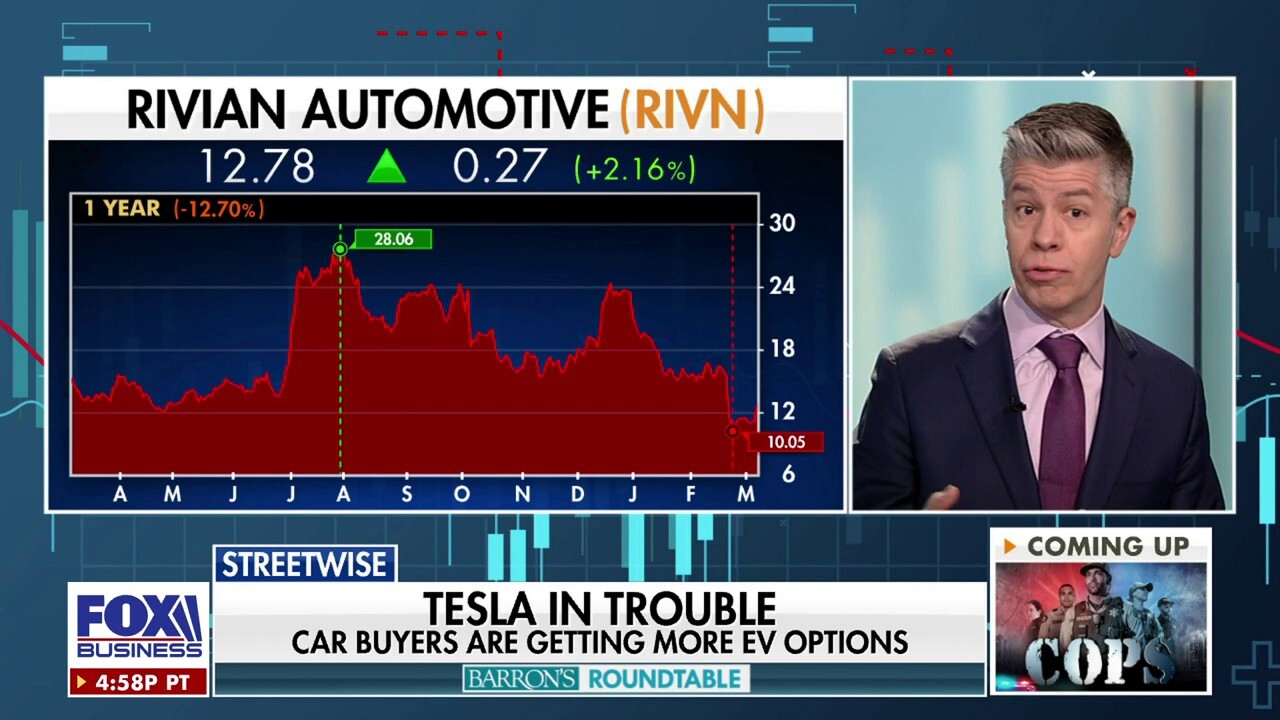

Tesla's stock is down over 28% year to date and more than 6% over the last year.

Reuters contributed to this report.