Tesla stock sinks into bear market territory

'I think it's a bubble,' market strategist says

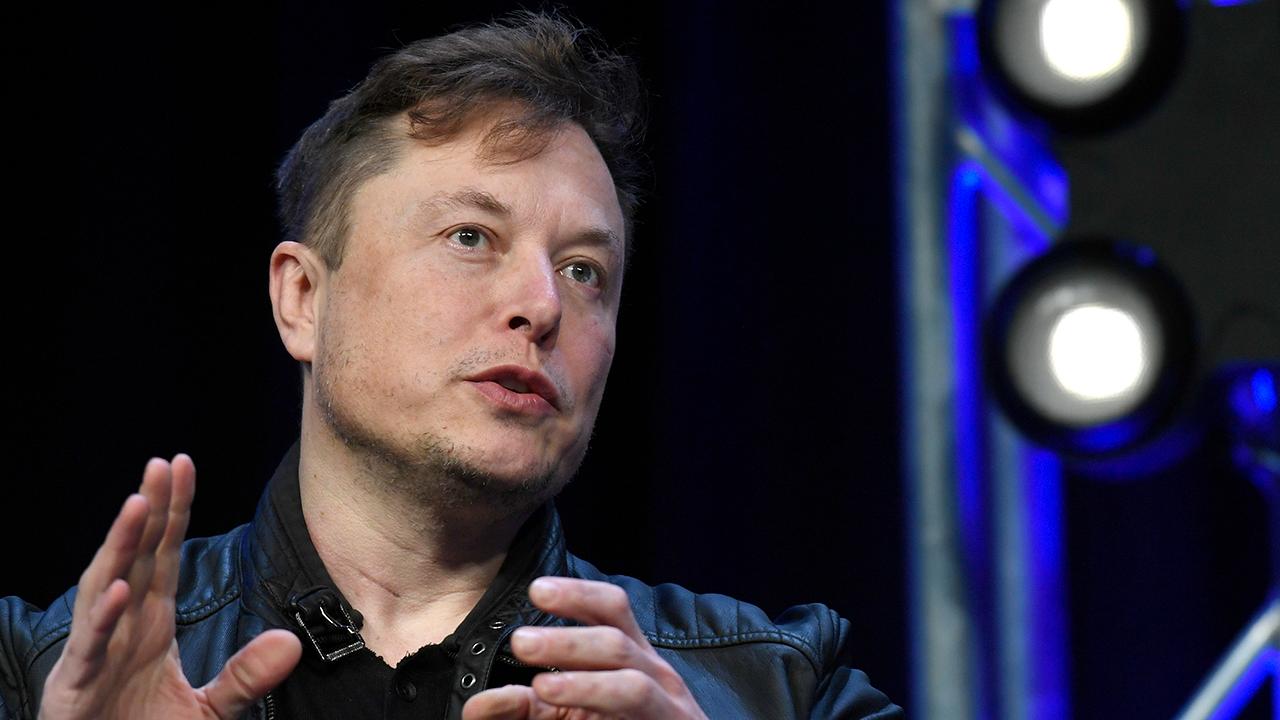

Tesla Inc. slid into bear-market territory Friday morning as a bruising post-split selloff in its shares continued for a fourth day.

Shares of the Palo Alto, Calif.-based electric-car maker fell below the $398.66 level that indicates a bear market, or drop of at least 20% from its recent peak.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 411.71 | +0.39 | +0.09% |

The selloff, while disappointing to new investors who got in at a reduced share price following the 5-for-1 split that went into effect on Aug. 31, was not unforeseen.

“It's a parabolic move,” Matt Maley, Boston-based chief market strategist at Miller Tabak & Co., told FOX Business just ahead of the stock’s 5-for-1 split on Aug. 31. “I'm sorry, but I think it's a bubble.”

The 501% rally in Tesla shares this year through Monday had boosted the company’s market capitalization to $464 billion, or $372 billion more than the $92 billion market value of Ford Motor Co., General Motors Co. and Fiat Chrysler Automobiles combined. On Friday morning, that gap had narrowed to $281 billion.

A close in bear market territory would cap off an eventful week for Tesla shareholders, who in addition to the split learned that the company is selling up to $5 billion of new stock and that Tesla's largest outside shareholder is reducing its stake.

Edinburgh-based investment management firm Baillie Gifford is trimming its holdings to less than 5%, from 6.32%, in order to meet concentration guidelines.

CLICK HERE TO READ MORE ON FOX BUSINESS

The day before, Tesla said it would sell up to $5 billion of shares over time to strengthen its balance sheet and for general purposes as it moves forward with plans to build new factories in Austin, Texas, and Germany.