Texas man with less than $1 in account offers $200M to bail out space company: SEC

Matthew Brown Companies, LLC reportedly said the complaint is filled with 'egregious error, fabrications and biased allegations'

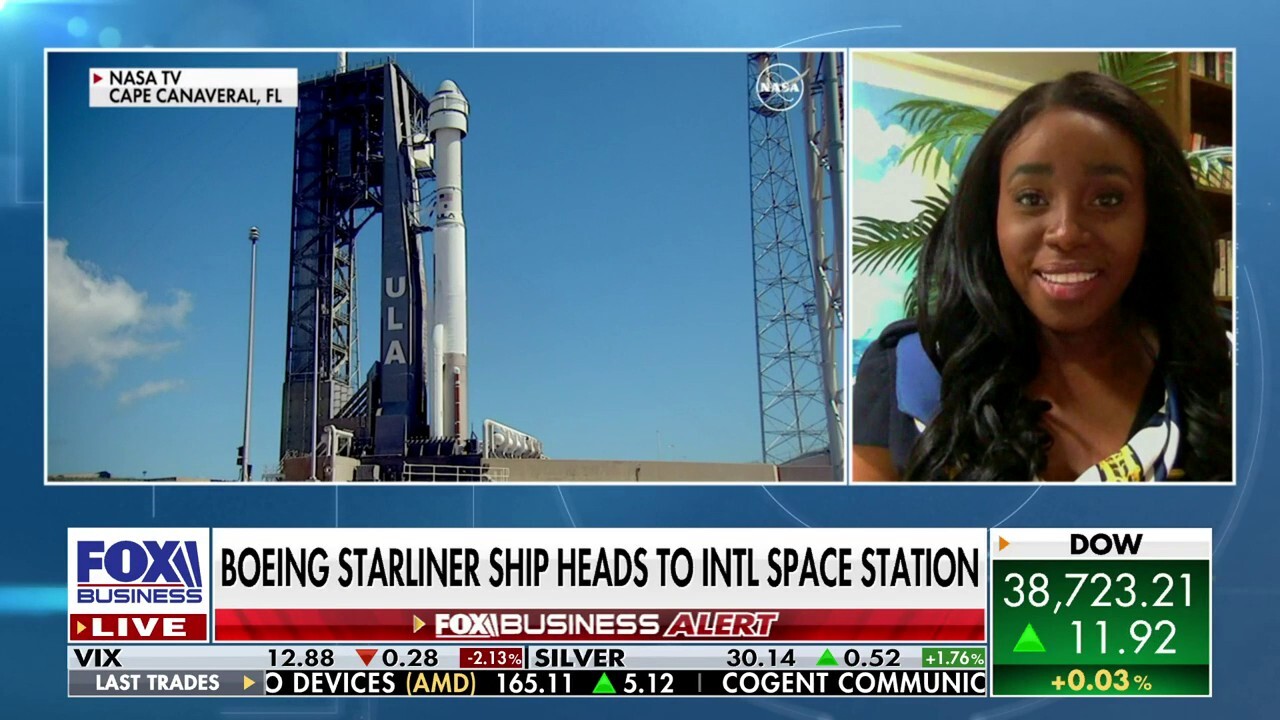

We are in a 'very exciting and emerging time' for private sector in space: Ezinne Uzo-Okoro

Former NASA executive Ezinne Uzo-Okoro reacts to the launch of the Boeing Starliner and weighs in on the growth of private space sector.

A Fort Worth, Texas, native faces serious accusations after the Securities and Exchange Commission (SEC) announced plans to sue him for allegedly submitting a "bogus offer" of $200 million to purchase the now-defunct space company, Virgin Orbit.

The SEC claims Matthew Brown and his company, Matthew Brown Companies, LLC, engaged in a fraudulent scheme to submit a bogus offer to invest $200 million in Virgin Orbit Holdings, Inc, which was once listed on NASDAQ under the ticker symbol VORB.

The complaint alleges that on March 19, 2023, Brown submitted the unsolicited offer as Virgin Orbit was close to filing for bankruptcy.

Brown reportedly told the company’s CEO he had invested hundreds of millions of dollars of his "personal capital" in space companies, and to prove his offer was legitimate, he allegedly sent Virgin Orbit a "fabricated screenshot" of his company’s bank account, which showed a balance of more than $182 million.

SEC SIGNALS POSSIBLE APPROVAL OF ANTICIPATED ETHEREUM SPOT ETFS

The SEC filed a criminal complaint against Matthew Brown and his company, Matthew Brown Companies, LLC, after he allegedly proposed bailing Virgin Orbit out for $200 million, despite having less than $1 in his company's account. (Rafael Henrique/SOPA Images/LightRocket via Getty Images / Getty Images)

But in reality, the SEC claims, the bank account contained less than $1.

The SEC also alleges Brown told the space company he held a law degree from Southern Methodist University in Dallas, though he never graduated from college.

Still, the offer was leaked to the media and Virgin Orbit’s stock price increased 33.1%.

Brown allegedly signed a non-disclosure agreement with Virgin Orbit about the deal, yet later appeared on CNBC on March 23, 2023, to talk about the offer and promote himself and his company as venture capitalists with "positions in over 13 space companies."

TIM SCOTT TO INTRODUCE MEASURE TO OVERTURN CONTROVERSIAL SEC CLIMATE RULE

The SEC claims that at the time, Brown had a negative net worth and did not have any holdings, past or present, in the space industry.

The commission also alleges Brown refused to put any funds in escrow. He also reportedly refused to respond to Virgin Orbit’s due diligence inquiries, and negotiations broke down.

On April 4, 2023, Virgin Orbit filed for bankruptcy, and on May 2, 2023, the company was taken off the NASDAQ.

VIRGIN ORBIT PAUSE OPERATIONS, LAYS OFF MAJORITY OF WORKFORCE

The headquarters of the US Securities and Exchange Commission (SEC) is seen in Washington, D.C., on Jan. 28, 2021. (SAUL LOEB/AFP via Getty Images / Getty Images)

The SEC is seeking permanent injunctions, a civil penalty, and an officer-and-director bar against Brown, prohibiting him from holding such positions within companies.

Brown tells FOX Business his company plans to file a response within 21 days from the day he received the complaint.

Matthew Brown Companies, LLC released a statement in response to the SEC’s lawsuit, denying the allegations and claiming the complaint is filled with "egregious errors, fabrications and biased allegations."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"In 2023, we were approached by a representative of Virgin Orbit to invest. We engaged in commercial conversations, and during our evaluations, a non-binding letter of intent was produced by Virgin Orbit. However, during our due diligence, we decided not to invest," the statement read. "The SEC's complaint is filled with egregious errors, fabrications and biased allegations that undeniably favor the true culprit, Virgin Orbit's management. Mr. Brown is an esteemed businessman, community member and philanthropist. This matter concerns a single potential transaction, specifically a non-binding indicative term sheet, unrelated to Mr. Brown's core businesses and is the first to draw fictitious, inaccurate and exaggerated claims by the SEC, despite Mr. Brown's extensive involvement in the investment community.

"We are steadfast in our commitment to thoroughly contest these issues, if they arise, through the trial process. We have the utmost respect for our judicial system, and our stance in this civil lawsuit is firm: We will not settle until we are vindicated by the rule of law," the company added.