Texas fears losing oil-rich lands in Chinese takeover of weakened energy companies

'It's a national security concern to allow unfriendly foreign countries to come in and buy land and oil'

Plunging prices have wreaked havoc on Texas oil companies struggling to avoid a wave of bankruptcies that has ravished the industry during the past five years, leaving them ripe takeover targets for rivals from China and elsewhere.

Ninety-eight exploration and production companies in Texas with $75.7 billion of debt filed for bankruptcy from 2015 through 2020, according to the international law firm Haynes and Boone.

That number is expected to grow even larger after West Texas Intermediate crude oil prices plunged 52 percent this year as stay-at-home orders designed to slow the spread of COVID-19 wiped out 30 million barrels per day of demand while Saudi Arabia and Russia ramped up production amid a price war.

The companies’ vulnerability to foreign buyers raises the risk that the U.S. might lose control over valuable oil-producing lands in the Permian Basin, a swath of land in western Texas and southeastern New Mexico that helped the country become the world's largest crude producer amid a shale boom.

“We have discovered this volume of natural gas and oil that is more than any time in history,” said Wayne Christian, commissioner of the Texas Railroad Commission -- the agency that regulates the state's oil and gas industries.

“I believe it's a national security concern to allow unfriendly foreign countries to come in and buy land and oil in Texas and the United States," he told FOX Business.

OIL-RICH ALASKA WARY OF SAUDI POWER PLAY IN BATTERED CRUDE MARKET

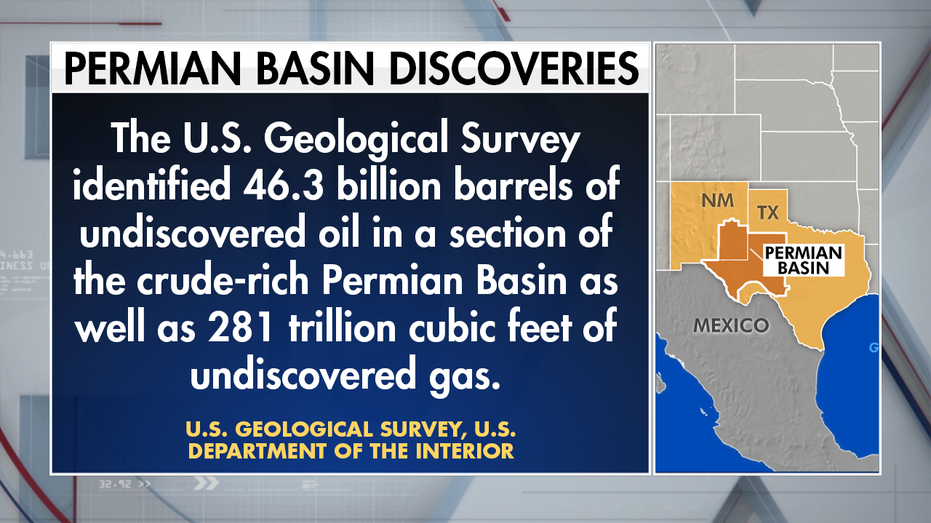

A 2018 oil discovery in the Permian uncovered 46.3 billion barrels of crude, 281 trillion cubic feet of gas, and 20 billion barrels of natural gas liquids, according to an assessment by the U.S. Geological Survey.

The discovery effectively doubled America’s oil and gas reserves and puts the country on a path for years of energy independence. A separate estimate from RS Energy Group found the discovery could be as large as 230 billion barrels.

The oil industry is critical for the Texas economy, accounting for $16.3 billion of revenue in 2019 and about 10 percent of the state’s labor force. An oil worker makes about $132,000 a year, 1.6 times the state’s average wage.

Exxon Mobil, Chevron, and BP are the major players in the industry, but there are also hundreds of companies that produce less than 1,000 barrels of oil per day.

Stocks In This Article:

The scope of the industry reaches far beyond the oil and gas producers, also including midstream companies that operate pipelines, service rigs and more.

To help smaller companies navigate the industry's crisis, Christian said Texas is working on measures that include cutting regulations and permit costs.

When the industry is prospering, such firms get bought out at a premium by the big international companies such as Exxon Mobil, leaving money in Texas and giving workers bonuses, Christian said.

When markets sour, however, the firms can be snapped up at fire-sale prices.

“The federal government should watch very carefully and raise their standards on who can buy,” Christian said.

China and other countries are already “starting to look for deals,” said Malcolm McNeil, international practice co-leader at the law firm Arent Fox.

$1.6T IN CENTURY-OLD CHINESE BONDS OFFER TRUMP UNIQUE LEVERAGE AGAINST BEIJING

He said that while recent volatility in oil prices has left some Chinese companies "cash poor," those that have money are “going to be seeking bargains.”

The uncertainty surrounding the outcome of the 2020 election will cause Chinese firms to “explore deals now, but wait to bargain-hunt until companies are really hurting” and there is more clarity on the political front, he added.

Should President Trump win re-election, prospective acquisitions might be less appealing to Chinese buyers, given his administration's prickly relationship with Beijing and efforts to limit Chinese control of vital U.S. resources.

Any oil deal, unless it’s rudimentary, will likely involve the Committee on Foreign Investment in the United States (CFIUS), which would require arduous reviews. U.S. law prohibits foreign companies from directly holding many oil, gas and mineral leases, but does allow them to form U.S. corporations to make purchases.

Chinese acquisitions of U.S. oil and gas companies have faced increased scrutiny since China National Offshore Oil Corporation in 2005 attempted a takeover of the El Segundo, California-based explorer Unocal, now a subsidiary of Chevron, causing public uproar.

PLUNGING OIL PRICES, CORONAVIRUS FUEL BUDGET CRISIS IN PETROLEUM-RICH ALASKA

While that deal was blocked, the Chinese firm Yantai Xinchao Industry Co. in 2015 received CFIUS approval to forge ahead with a $1.3 billion purchase of oil assets in the Permian Basin owned by Tall City Exploration and Plymouth Petroleum.

Stewart Glickman, an energy analyst at New York-based CFRA Research, told FOX Business that barring a “rapid V-shaped recovery in oil prices,” there are going to be a “fair number of new Chapter 11 filings.”

While Texas is an attractive investment destination for companies from China and elsewhere, it’s difficult for them to “swoop in” and start acquiring acreage “like a vulture feasting on a carcass,” he said.

Though companies from China, Saudi Arabia and elsewhere may have experience in oil and gas, shale is a “U.S. phenomenon,” Glickman noted.

A more plausible way for foreign companies to gain access to the rock, according to Glickman, is to enter a joint venture that gives them financial exposure but not operational exposure. He added that such a route would also be the way to go for those seeking to gain access through midstream and downstream businesses.

But while the tactic might help eager overseas buyers reach lucrative deals, such developments are precisely what Christian, the Texas railroad commissioner, hopes to avoid.

CLICK HERE TO READ MORE ON FOX BUSINESS

“I don’t want to wind up five years from now with, all of a sudden, some foreign country shutting down production in Texas because they own it, and prefer buying from their own reserves overseas,” Christian said. “I think that would be inefficient use, and I would think it would threaten national security.”